AUD/JPY to Threaten Key Support Ahead of RBA

DailyFX.com -

Talking Points

AUD/JPYapproaching confluence support ahead of RBA

Updated targets & invalidation levels

Looking for more trade ideas? Review DailyFX’s 2017 Trading Guides. Join Michael for Live Weekly Trading Webinars on Mondays at 13:30GMT (8:30ET)

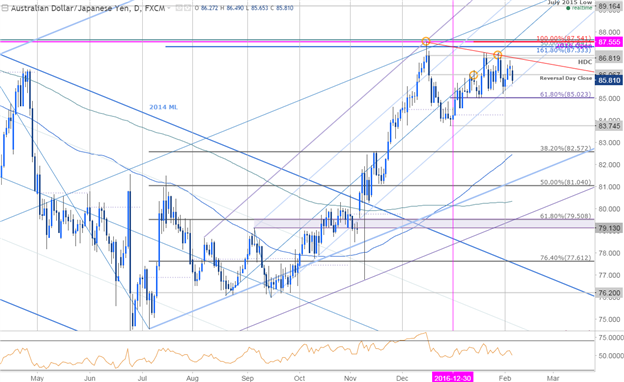

AUD/JPY Daily

AUD/JPY120min

Technical Outlook: AUDJPY is approaching support at the lower median-line parallel extending off the July low with price action continuing to respect this near-term descending slope off the recent highs. We discussed this setup at length in today’s webinar and to start the week the focus is on this support zone at 85.55 where the 61.8% extension of the late-January decline and the February open converge on the lower parallels.

Look for interim resistance at 86.02 backed by 86.30 with bearish invalidation set to 85.52. From a trading standpoint, I’ll favor selling rallies while within this formation with a break/close below confluence support at the 85-handle needed to validate a more significant reversal in the pair- such a scenario would target subsequent support objectives at 84.83 and the 78.6% retracement / lower median-line parallel at 84.46.

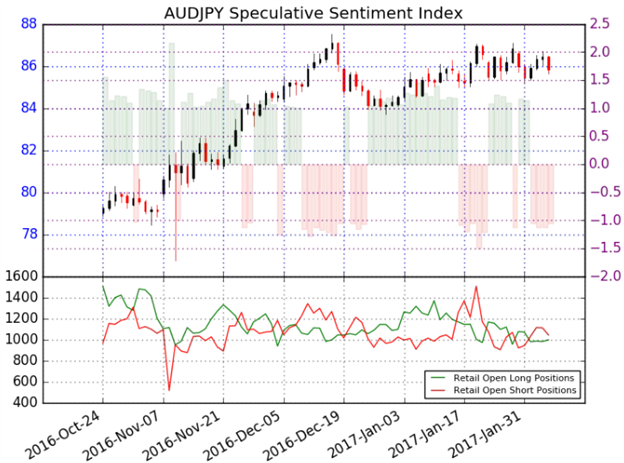

A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are short AUDJPY- the ratio stands at -1.05 (49% of traders are long)- neutral reading

Long positions are 4.7% higher than yesterday and 3.5% above levels seen last week

Short positions are 0.9% lower than yesterday but 4.6% above levels seen last week

Open interest is 1.8% higher than yesterday but 6.7% below its monthly average

While the current SSI profile continues to offer a mixed outlook for the pair, it’s worth noting that the recent increase in long-positioning on building open interest leaves the long-side vulnerable near-term.

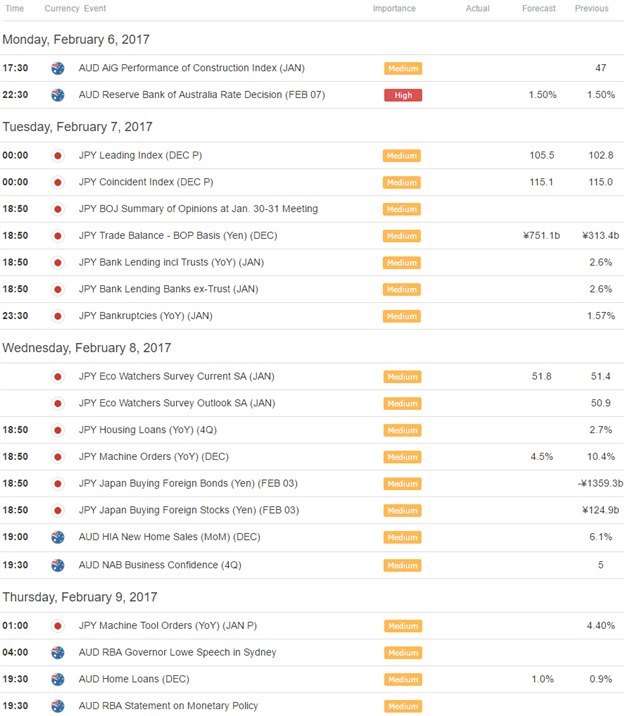

Relevant Data Releases

Looking for trade ideas? Review DailyFX’s 2017 1Q Projections

Other Setups in Play:

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance