‘Unexpected error’: ATO website crashes

The Australian Tax Office (ATO) portal appears to have crashed on Wednesday morning, the first day of the new financial year.

Wednesday 1 July marks the first day Australians in need can access the second batch of early superannuation, meaning they can apply to withdraw another $10,000 from their nest egg.

Also read: Sex toys, face masks: Surprising things you can claim on tax

Also read: ATO ‘conducting checks’ on dodgy JobKeeper claims

Also read: 2 million Aussies at risk of $12k fine

According to outage tracking website, Down Detector, MyGov - which is the login service for access to taxpayers’ personal ATO account - has been experiencing outages all morning but began to increase in severity around 8am AEST.

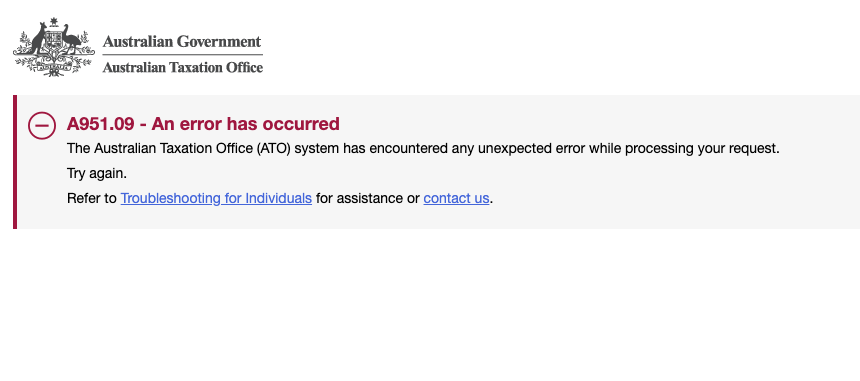

Yahoo Finance attempted to log on but was also met with a system error.

“An error has occurred,” the website reads.

“The Australian Taxation Office (ATO) system has encountered any unexpected error while processing your request.”

Other users reported an error sign explaining the ATO was experiencing a “high volume of traffic”.

OK NOW AT LEAST I AM GETTING SAME MESSAGE pic.twitter.com/74yB2zYwTW

— STIVETTE BROWNHOLLOW (@Stivette) June 30, 2020

Australians took to Twitter to complain of the outage, with one person saying they had been “trying for hours”.

And the ATO has crashed pic.twitter.com/X725WKoJK8

— Mitch (@bornin1998) June 30, 2020

In a statement to Yahoo Finance, an ATO spokesperson said the office is aware of issues with its systems.

“We are investigating this as a priority, and our technicians are working to resolve the issue. If you are experiencing issues, there's no need to call and report it.

We appreciate your patience at this time.

Super controversy

More than 2 million Australians raided their super earlier this year as the government opened up early access eligibility to those suffering financial hardship.

However the ATO has warned that those who accessed their super without meeting the eligibility rules face paying tax on the amount and even copping $12,600 fines.

“If you are unable to demonstrate your eligibility when we ask for evidence, we may revoke the determination that we issued in respect to your application. This means the amount paid to you under Covid-19 early release of super will become assessable income [and]need to be included in your tax return and you will pay tax on the released amount,” the ATO said in June.

The ATO has also warned Australians against lodging their tax returns too early as incomplete information can hamper and delay the process.

“We often see people too eager to get a tax refund making obvious mistakes, which can either delay processing the tax return or result in a bill later on,” ATO assistant commissioner Karen Foat said.

“It’s important to check that your employer has finalised the information in your income statement and it is marked as ‘tax ready’ before you lodge.”

Join the Women’s Money Movement on LinkedIn and follow Yahoo Finance Australia on Facebook, Twitter and Instagram.

Yahoo Finance

Yahoo Finance