Atmos Energy (ATO) Q1 Earnings Lag Estimates, Sales Drop Y/Y

Atmos Energy Corporation ATO posted first-quarter fiscal 2020 earnings of $1.47 per share, which lagged the Zacks Consensus Estimate of $1.49 by 1.3%.

However, the reported earnings improved 6.5% from the prior-year figure. The year-over-year improvement in earnings was due to positive rate outcomes.

Total Revenues

Total revenues of $875.6 million decreased 0.3% from the year-ago figure of $877.8 million. The year-over-year decline in revenues was due to lower contribution from the distribution segment.

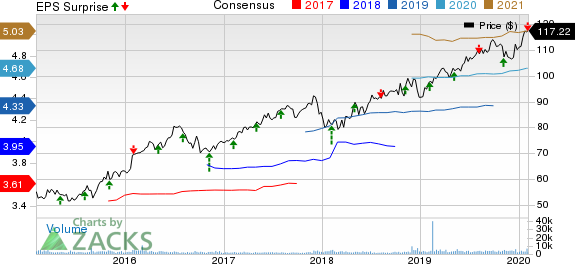

Atmos Energy Corporation Price, Consensus and EPS Surprise

Atmos Energy Corporation price-consensus-eps-surprise-chart | Atmos Energy Corporation Quote

Segment Revenues

Distribution: Revenues from the segment decreased 1.2% to $828.5 million from $838.8 million in the prior-year quarter.

Pipeline and Storage: Revenues from the segment increased 10.2% to $148.2 million from $134.5 million in the year-ago quarter. The improvement was driven by increase in rates, marginally offset by increase in operation and maintenance expenses.

Quarterly Highlights

Total expenses in the reported quarter decreased 2.9% from the year-ago level to $622.8 million due to lower purchased gas cost, offset by higher operation and maintenance expenses, as well as depreciation and amortization costs.

Operating income in the reported quarter was up 6.9% year over year to $252.8 million.

The company incurred interest expenses of $27.3 million, down 2.2% from the year-ago period.

Financial Highlights

As of Dec 31, 2019, Atmos Energy had cash and cash equivalents of $189.3 million compared with $24.6 million on Sep 30, 2019.

Long-term debt was $4.3 billion as of Dec 31, 2019, up from $3.53 billion on Sep 30, 2019.

The company’s cash flow from operating activities in first-quarter fiscal 2020 was $172.5 million, up from $164.7 million recorded in the year-ago period.

It invested $529.2 million in fiscal first-quarter 2020 compared with $414.4 million in fiscal first-quarter 2019. The increase in capital spending was due to continued spending for infrastructure replacements and enhancements.

Guidance

Atmos Energy reiterated its fiscal 2020 earnings guidance in the range of $4.58-$4.73 per share. The Zacks Consensus Estimate for fiscal 2020 earnings is $4.68 per share. Capital expenditure is expected in the range of $1.85-$1.95 billion for fiscal 2020.

Zacks Rank

Atmos Energy currently has a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

National Fuel Gas Company NFG posted first-quarter fiscal 2020 operating earnings of $1.01 per share, beating the Zacks Consensus Estimate of 95 cents by 6.3%.

Plains All American Pipeline PAA posted fourth-quarter 2019 operating earnings of 63 cents per unit, beating the Zacks Consensus Estimate of 49 cents by 28.6%.

MDU Resources Group Inc. MDU reported fourth-quarter 2019 earnings of 47 cents per share, which improved from the year-ago figure by 20.5%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

Plains All American Pipeline, L.P. (PAA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance