Atlantic Power (AT) Q3 Earnings Top Estimates, Revenues Up Y/Y

Atlantic Power Corporation AT delivered third-quarter 2019 operating earnings of 10 cents per share, which beat the Zacks Consensus Estimate of 5 cents by 100%. The company incurred a loss of 3 cents in the year ago quarter.

Total Revenues

Total revenues in the third quarter amounted to $71.1 million, up 8.7% from $65.4 million in the year-ago quarter.

Project revenues increased due to the acquisition of Allendale and Dorchester in July 2019, higher water flows at Curtis Palmer as well as lower depreciation and amortization expenses.

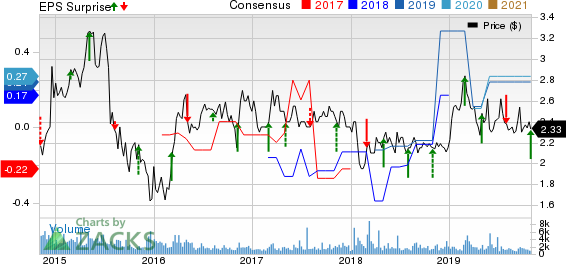

Atlantic Power Corporation Price, Consensus and EPS Surprise

Atlantic Power Corporation price-consensus-eps-surprise-chart | Atlantic Power Corporation Quote

Highlights of the Release

The company completed the acquisition of the Allendale and Dorchester contracted biomass plants for $12.6 million. It also acquired the equity interests in the Craven County and Grayling contracted biomass plants for $18.7 million.

In the third quarter, project expenses amounted to $55.1million compared with the prior-year quarter’s figure of $55.7 million.

Project income amounted to $27.9 million, up 6.5% year over year.

The company incurred interest expenses of $10.9 million, down from $14.6 million in the prior-year quarter.

Financial Highlights

As of Sep 30, 2019, ONEOK had cash and cash equivalents of $58.1 million compared with $68.3 million as of Dec 31, 2018.

Long-term debt, net of unamortized discount and deferred financing costs, amounted to $457.3 million as of Sep 30 compared with $540.7 million as of Sep 30, 2018.

The company’s net cash provided by operating activities in the first nine months of 2019 was $104.5 million compared with net cash provided by operating activities of $97.8 million in the year-ago period.

Guidance

The company now expects its 2019 Project Adjusted EBITDA in the range of $185-$195 million. The previous range was $175- $190 million.

Zacks Rank

Atlantic Power carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

NextEra Energy, Inc NEE reported third-quarter 2019 adjusted earnings of $2.39 per share, beating the Zacks Consensus Estimate of $2.27 by 5.3%.

Xcel Energy Inc XEL posted third-quarter 2019 operating earnings of $1.01 per share, which lagged the Zacks Consensus Estimate of $1.05 by 3.8%.

American Electric Power Co., Inc AEP reported third-quarter 2019 adjusted earnings of $1.46 per share, which surpassed the Zacks Consensus Estimate of $1.30 by 12.3%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atlantic Power Corporation (AT) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance