ASX stages show-stopping turnaround

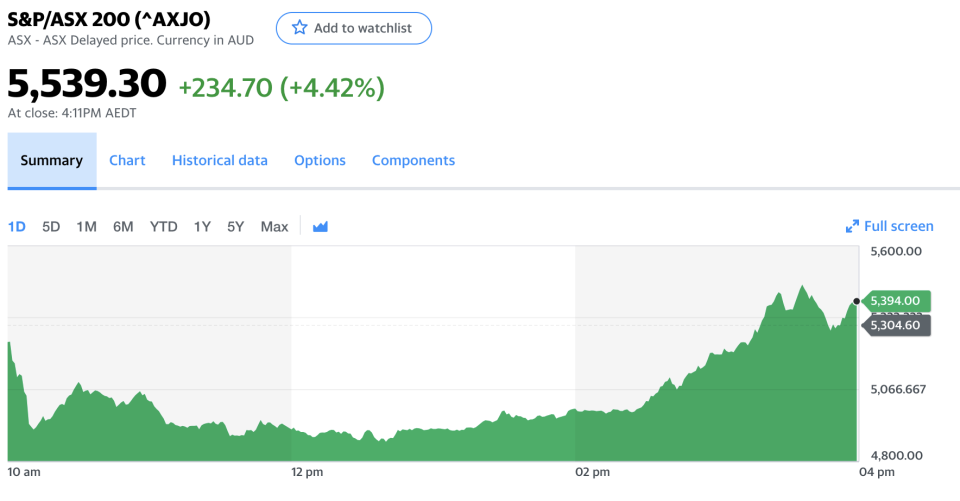

The benchmark S&P/ASX200 has staged a dramatic turnaround on Friday afternoon

After tumbling by 8.1 per cent, the index began rallying around midday before climbing to finish 4.4 per cent higher. The 655 point swing saw the benchmark close at 5,539.3 points after the 13.7 per cent recovery.

But will this be enough? After one of the worst weeks in global markets history, Australian economists aren’t convinced.

What happened this morning?

Australian shares dove 6.5 per cent in early trade on Friday after the Dow Jones saw its worst day since the 1987 ‘Black Monday’ sell-off.

$18 billion rescue package: Here’s what it means for you

‘Cruelly exposed’: Casual workers ‘abandoned’ in rescue package

UPDATING: All the companies paying casual staff amid Covid-19 crisis

To put that in context, Australia's top 200 companies have now lost 30 per cent in value since the peak on February 20.

The benchmark S&P/ASX200 was 348 points, or 6.56 per cent, down at 4,956.6 points at 1015 AEDT on Thursday, with falls across the board.

The broader All Ordinaries index dived 349.2 points, or 6.5 per cent, to 5021.7.

Energy, materials, industrials and consumer discretionary stocks were down more than seven per cent.

Health care, financials, info tech and property trusts were down more than six per cent after 15 minutes of trading.

Global markets plunged in the wake of a US travel ban for Europe with European markets closing down about 12 per cent while the US tanked 10 per cent.

By the close on Thursday, the ASX200 had lost 20.4 per cent of its value in just 14-and-a-half trading sessions and had sunk to its lowest level since January 8, 2019 amid concerns about the economic impact of the coronavirus on economies.

The Australian dollar was buying 62.82 US cents at 1015 AEDT on Friday down from 65.05 at the market closed on Thursday.

We’re going on a bear hunt

The Australian sharemarket has careened into a bear market with the benchmark S&P/ASX200 shedding 26.5 per cent from peak to trough. The total market has lost $608 billion in value in the days between 20 February and 12 March.

Okay, what’s a bear market?

A bear market is a market trend that occurs after major stock indexes lose at least 20 per cent or more following a recent high, and gains remain suppressed for a few months.

With the S&P/ASX200 losing 26.5 per cent since February - and counting - Australian trade is in bear territory.

‘Biggest of them all’

Independent economist Stephen Koukoulas likened this week’s lurching movements to the 1987 stock crash, the early 1990s recession, the 2000s dot-com crash and the Global Financial Crisis, in terms of fear and reaction. However, he said this may also be the most significant of all those crashes.

“This is staggering,” he told Yahoo Finance.

“It is a different crisis. It impacts social interaction. Australia's economy is three-quarters services which means going out and doing things. The fact this will be curtailed in coming days, weeks and maybe months suggests this is the biggest of them all.”

While it’s too early to say, he said the closure of sports and broader leisure and recreational activities will have a “huge” economic effect.

“The government will need to follow up its first package with several more if an economic hard landing is to be averted.”

Recession looms

And AMP Capital, BIS Oxford Economics and Bloomberg Economics all predict Australia will enter a recession in 2020, or at the very least see a major financial shock.

AMP Capital chief economist Shane Oliver said there are three scenarios for how the rout plays out, the worst of which is a downturn that triggers GDP falls in the March and June quarters, “resulting in a global recession to be then followed by a rebound as life returns to normal led by China.”

He said AMP Capital’s base prediction is a recession.

“[It’s] just really more of the same on the ASX,” he told Yahoo Finance.

“Until we get confidence that the virus is coming under control, or its economic impact will be limited such that we can look forward to a recovery, then markets will remain under pressure.”

However, he said the crossing into a bear market “doesn’t really change things”, given AMP Capital had concluded Australia would fall into recession in its market update last week.

“The share market is factoring that in. I think markets and the economy will rebound on a 12-month view once the virus runs its course and things bounce back to normal helped by policy stimulus but that doesn’t mean markets can’t remain under pressure on the short term,” he said.

“The key issue lately has been a lack of decisive policy stimulus in the US from President Trump and Congress - they will need to do more.”

Recession by June: S&P

S&P also predicts Australia will move into a recession by June 2020 and have annual GDP growth of 1.2 per cent.

“This is the weakest economic outlook in 20 years and means the COVID-19 outbreak would be a greater economic shock to Australia than the global financial crisis, when growth fell to 1.6 per cent in 2008,” the ratings agency said this week.

“With our forecast that China's GDP growth will slow to 4.8 per cent in 2020, we don't expect Chinese demand to provide the same level of support to the Australian economy as it did in 2008.”

‘Once in a generation sell-off’

Markets commentator and Yahoo Finance contributor David Taylor described this week’s movements as a “once in a generation market sell-off”.

“From a technical perspective the market is cheap, but the problem is, based on fundamentals, no one has any clue how much the coronavirus will hurt the economy,” he added.

“That means we look over the financial markets cliff, and all we see is a very dark chasm.”

He said the market will rebound, although it’s unclear when that will happen.

With AAP.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance