ASX to rise as PM mulls major leave change

Good morning.

Here’s Yahoo Finance’s Thursday morning wrap.

ASX: The ASX is expected to rise early on Thursday morning, with the Australian SPI 200 futures contract 54.0 points higher at 7:00am AEST.

Investors in Australia will today be keeping an eye out for the June building approvals data and Macquarie Group’s annual meeting.

Wall Street: Wall Street rose on Wednesday night after the US Federal Reserve promised more support. Wall Street’s major indexes were already flying high on anticipated earnings reports from the big tech companies, Facebook, Apple, Google and Amazon.

The Dow Jones Industrial Average rose 160.29 points, or 0.61 per cent, to 26,539.57, the S&P 500 gained 40 points, or 1.24 per cent, to 3,258.44 and the Nasdaq Composite added 140.85 points, or 1.35 per cent, to 10,542.94.

US Federal Reserve: The US Federal Reserve kept interest rates on hold as the pandemic continues to pose gargantuan challenges for the US economy. The Fed said it would also increase its holdings of mortgage-backed securities and Treasury bills.

"The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term," it added.

Acceptable gambling: The pandemic has seen hordes of amateur investors pour into the stock market in the hopes of making a quick buck. The only problem? They’re not very good, warns Stockspot’s Chris Brycki.

“Though they mightn’t know it, for most people who try, share trading is just a socially acceptable form of gambling.”

Extra super: Treasurer Josh Frydenberg has defended the Government’s early release of superannuation scheme amid concerns the nation’s pool of retirement funds was being drained too quickly.

"The government believes that Australians in financial hardship as a result of the coronavirus should be given the opportunity to access their own money in superannuation to help them get to the other side of the crisis,” Frydenberg said.

Property prices: Australia’s median house price is slowly declining but if you’re wondering if it’s heading for a steeper cliff, there’s one “tell-tale sign” you should keep an eye out for, according to the experts.

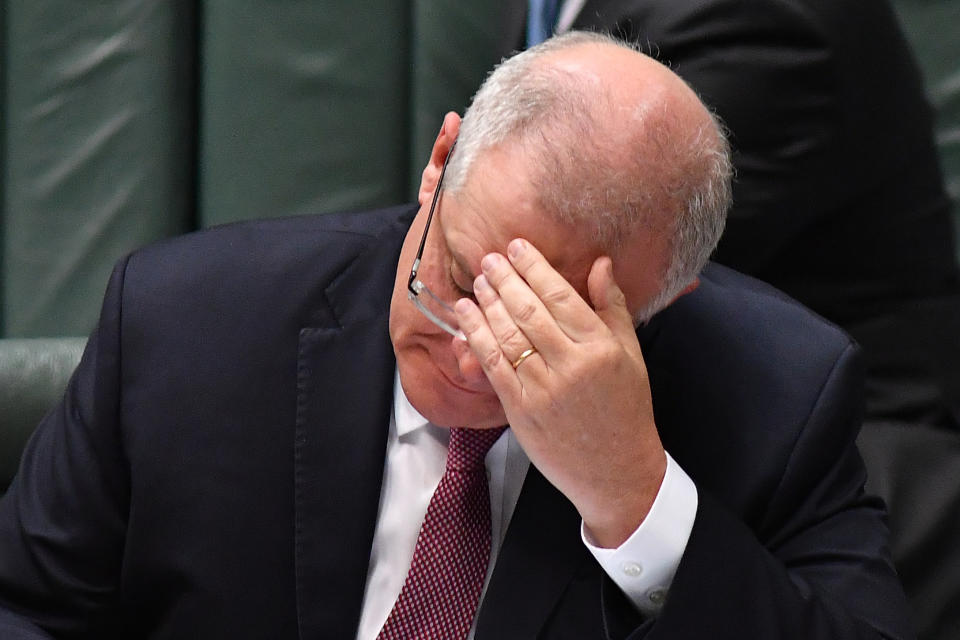

Paid pandemic leave: And the Morrison Government is mulling paid pandemic leave after a major push from the unions. The issue will be discussed by unions, employers and the Government this week. Morrison said the topic was part of “ongoing discussions” on Wednesday, while Attorney-General Christian Porter said he was now looking for evidence that the scheme would work and was required.

"This includes working with the Australian Council of Trade Unions to identify data and evidence illustrating where circumstances may arise where a lack of financial support for a workplace absence could manifest as a contributing cause of workplace transmission of COVID-19, particularly in Victoria," Mr Porter said.

ACTU secretary Sally McManus described the leave as an “essential public health measure”.

Have a great day.

Want to take control of your finances and your future? Join the Women’s Money Movement on LinkedIn and follow Yahoo Finance Australia on Facebook, Twitter and Instagram.

Yahoo Finance

Yahoo Finance