ASX closes in a sea of blood, spooked by US dole queues

Australia’s share market was a sea of blood on Friday, as coronavirus fears and cashing in April winnings resulted in a massive sell-off.

The benchmark ASX200 lost a painful 5.01 per cent at the close of trade, to sink to 5,245.90 points. The All Ordinaries index bled 4.87 per cent of value, leaving the bloodbath at 5,325 as investors headed into the weekend.

The finance and mining industries saw huge drops in share prices, with many in retail also hemorrhaging value. But all sectors were down for the day.

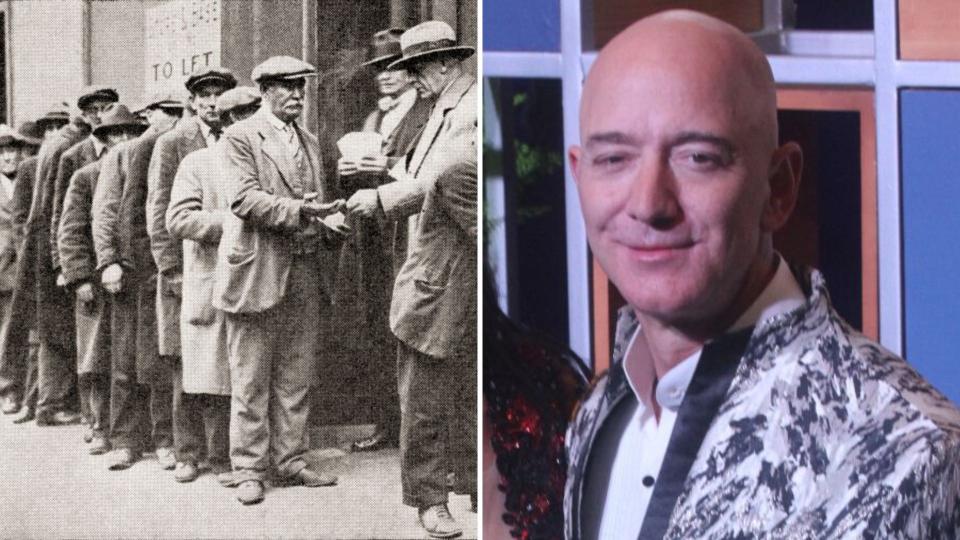

The dark trading day started after eye-opening data about the length of unemployment queues were released in the US overnight, as well as some soft earnings from big overseas retailers like Amazon.

What happened at lunchtime?

Australian shares are hurtling downhill on Friday, losing close to 4 per cent by lunchtime.

The ASX200 index had tumbled a massive 3.85 per cent as of 12:01pm AEST to hit 5,309.80 points. The All Ordinaries didn’t fare much better, losing 3.79 per cent in value to sink to 5,385.80 points.

Energy (down more than 6 per cent) and banking stocks led the downfall, according to AAP, although all sectors were in the red.

Cracks appeared from the very start of trade Friday morning after unflattering statistics out of the US overnight spooked Australian investors.

There may also be an element of investors cashing in after a massive April that saw it crowned the best-performing month on the ASX in 32 years.

What happened this morning?

The Australian stock market sunk lower upon opening on Friday morning.

The benchmark ASX200 index took a 2.56 per cent hit in the first 10 minutes of trade, while the broader All Ordinaries sunk 2.5 per cent.

The dip comes after the ASX just completed an April that was the best-performing month since 1988, according to AAP.

The downward pressure to start May came overnight from Wall Street, where pessimistic economic data and corporate results made for a gloomy trading session.

What happened overnight?

On Thursday night Australian time, US unemployment benefits claims hit an astounding 30 million while Amazon's financial results underwhelmed.

Amazon, as a dominant online retailer, was expected to have performed better while consumers were locked in their homes due to the coronavirus epidemic.

The S&P500, which also had a stunning April that was the best month since 1987, sunk 0.9 per cent in overnight trade.

That prompted the SPI200 futures to dip 2.22 per cent as of 8am AEST, forecasting an unpleasant Friday morning in the Australian market.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance