AstraZeneca's (AZN) Imfinzi Gets FDA Nod in Expanded Use

AstraZeneca AZN announced that the FDA has approved its blockbuster cancer drug Imfinzi (durvalumab) plus chemotherapy, followed by Imfinzi monotherapy for the treatment of adult patients with mismatch repair deficient (dMMR) advanced or recurrent endometrial cancer.

The approval for expanded use of Imfinzi was based on data from a prespecified exploratory subgroup analysis by MMR status in the phase III DUO-E study.

Data from the study showed that treatment with Imfinzi in combination with carboplatin and paclitaxel (chemotherapy), followed by Imfinzi monotherapy reduced the risk of disease progression or death by 58% in patients with dMMR endometrial cancer compared with chemotherapy alone.

Treatment with Imfinzi and chemotherapy was generally well tolerated and manageable with no new safety concerns being observed.

The three-arm DUO-E study is also evaluating Imfinzi plus chemotherapy followed by Imfinzi plus Lynparza as maintenance therapy in advanced or recurrent endometrial cancer. The Lynparza plus Imfinzi arm of the study has also met the primary endpoint of progression-free survival (PFS). The study continues to assess overall survival as a key secondary endpoint for both arms.

Regulatory application seeking approval for both Imfinzi as well as Imfinzi plus Lynparza regimens are currently under review in the Europe, Japan and other countries to include data from the DUO-E study on Imfinzi’s label.

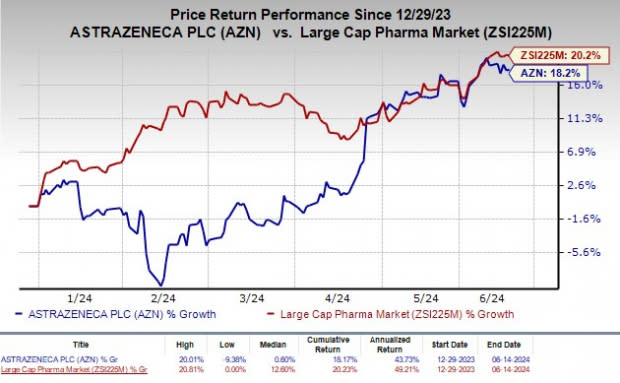

Shares of AstraZeneca have gained 18.2% so far this year compared with the industry’s rally of 20.2%.

Image Source: Zacks Investment Research

Imfinzi is the global standard of care in the curative-intent setting of unresectable, stage III non-small cell lung cancer (NSCLC) in patients whose disease has not progressed after chemoradiotherapy. It is also approved for extensive-stage- small cell lung cancer (ES-SCLC), locally advanced or metastatic biliary tract cancer and in combination with Imjudo in unresectable hepatocellular carcinoma in some countries.

Imfinzi is being studied for multiple cancer indications, either alone or in combination with other regimens, including phase III studies in earlier settings in NSCLC and SCLC, early-stage gastric and gastroesophageal junction cancer and liver cancer, among others.

Imfinzi is a key revenue driver for AZN’s oncology portfolio. The drug generated sales worth $1.11 billion in the first quarter of 2024, up 33% year over year at constant exchange rates, driven by increased use in recent launches like biliary tract and hepatocellular carcinoma cancers and rising patient demand across SCLC and Stage IV NSCLC indications.

Zacks Rank & Stocks to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Acrivon Therapeutics, Inc. ACRV, Aligos Therapeutics, Inc. ALGS and RAPT Therapeutics, Inc. RAPT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Acrivon Therapeutics’ 2024 loss per share have narrowed from $3.42 to $2.47. Loss per share estimates for 2025 have narrowed from $3.36 to $2.55. Year to date, shares of ACRV have surged 47.4%.

ACRV’s earnings beat estimates in three of the trailing four quarters and missed the same on the remaining one occasion, the average surprise being 3.56%.

In the past 60 days, estimates for Aligos Therapeutics’ 2024 loss per share have narrowed from 84 cents to 73 cents, while loss per share estimates for 2025 have narrowed from 82 cents to 71 cents. Year to date, shares of ALGS have declined 24.7%.

ALGS’ earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 60 days, estimates for RAPT Therapeutics’ 2024 loss per share have narrowed from $3.19 to $2.93. Loss per share estimates for 2025 have narrowed from $2.40 to $2.05. Year to date, shares of RAPT have plunged 86.6%.

RAPT’s earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average surprise being 3.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Rapt Therapeutics (RAPT) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Acrivon Therapeutics, Inc. (ACRV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance