Astec (ASTE) Q1 Earnings Top Estimates, Revenues Rise Y/Y

Astec Industries, Inc. ASTE reported first-quarter 2023 adjusted earnings per share of 90 cents, surpassing the Zacks Consensus Estimate of 59 cents. The bottom line also marked a 119.5% improvement from earnings per share of 41 cents reported in the prior-year quarter.

Favorable net volume, pricing and mix helped negate the impact of inflation, manufacturing inefficiencies, increased selling, general and administrative expenses and restructuring charges, leading to the better-than-expected earnings.

Including one-time items, the company’s earnings of 53 cents per share in the quarter under review compared with earnings of 18 cents per share in the year-ago quarter.

Astec Industries, Inc. Price, Consensus and EPS Surprise

Astec Industries, Inc. price-consensus-eps-surprise-chart | Astec Industries, Inc. Quote

Revenues & Backlog

Astec’s revenues increased 19.5% year over year to $348 million in the quarter under review driven by changes in volume, pricing and mix of sales that generated increases in equipment sales, service and equipment installation, parts and component sales and freight revenue. The top line beat the Zacks Consensus Estimate of $336 million. Domestic sales were up 20% year over year and International sales were up 17.5%.

Given the strong demand, Astec reported a backlog of $800 million in the first quarter of 2023, marking a year-over-year decline of 4%. Domestic backlog slipped 3% year over year to $686 million, while international backlog was down 10.3% to $114 million.

Operating Performance

The cost of sales rose 14% year over year to $259 million in the first quarter. The gross profit was $89 million, compared with the year-ago quarter’s $65 million. The adjusted gross margin was 25.6% compared with the year-ago quarter’s 22.2%.

Selling, general, administrative and engineering expenses increased 13.7% year over year to around $68 million. The company reported an adjusted operating income of $28.5 million, a notable increase from $10.9 million in the prior year. The adjusted operating margin was 6.2%, compared with 3.7% in the prior-year quarter.

Adjusted EBITDA was $35.2 million in the reported quarter, up from the year-ago quarter’s $18.8 million. The adjusted EBITDA margin was 10.1%, compared with 6.5% in the previous year’s comparable quarter.

Segment Performance

Revenues in the Infrastructure Solutions segment were up 16% to $230 million from the year-ago quarter. The segment’s adjusted EBITDA was $27.3 million, compared with the prior-year quarter’s $16.4 million.

The Materials Solutions segment’s total revenues were $114 million in the quarter under review, marking a year-over-year increase of 22%. The segment’s adjusted EBITDA was $15.3 million, up 25.4% year over year.

Financial Position

Astec ended the first quarter of 2023 with cash and cash equivalents of $42.5 million, compared with $66 million at the end of fiscal 2022. At the end of the first quarter, the company’s long-term debt was $65 million, compared with $78 million at the end of 2022. The company used $19.2 million of cash in operating activities as it carried additional inventories to satisfy customer demand. This compared with an outflow of $9.6 million in the prior year quarter.

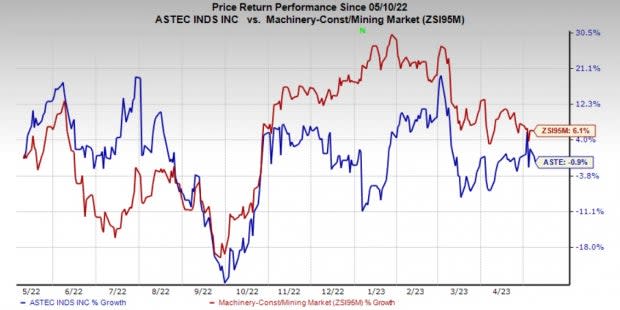

Price Performance

Image Source: Zacks Investment Research

Astec’s shares have lost 0.9% in the past year against the industry's 6.1% growth.

Zacks Rank & Other Stocks to Consider

Astec currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Industrial Products sector are Worthington Industries, Inc. WOR, AptarGroup, Inc. ATR, and OI Glass Inc. OI. WOR and ATR sport a Zacks Rank #1 (Strong Buy) at present, and OI has a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Worthington Industries has an average trailing four-quarter earnings surprise of 27.5%. The Zacks Consensus Estimate for WOR’s fiscal 2023 earnings is pegged at $4.93 per share. The consensus estimate for 2023 earnings has moved north by 17.7% in the past 60 days. Its shares gained 32.5% in the last year.

AptarGroup has an average trailing four-quarter earnings surprise of 6.4%. The Zacks Consensus Estimate for ATR’s 2023 earnings is pegged at $4.04 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days. ATR’s shares gained 15% in the last year.

The Zacks Consensus Estimate for OI Glass’ 2023 earnings per share is pegged at $2.59. The consensus estimate for 2023 earnings rose 0.8% in the last 60 days. OI has a trailing four-quarter average earnings surprise of 16.5%. Its shares soared 65% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

O-I Glass, Inc. (OI) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance