Assurant (AIZ) Beats Earnings and Revenue Estimates in Q2

Assurant, Inc. AIZ reported second-quarter 2019 net operating income of $2.34 per share, which beat the Zacks Consensus Estimate by 9.9%. The bottom line increased 10.9% from the year-ago quarter.

The quarter benefited from contributions from The Warranty Group (TWG) and Global Lifestyle’s strong mobile growth as new client partnerships and program expansions continued to gain traction.

Total revenues surged 38% year over year to $2.5 billion, mainly attributable to higher premiums earned (up 51.9%) and net investment income (up 13.7%). Moreover, the top line exceeded the Zacks Consensus Estimate by 7.7%.

Total benefits, loss and expenses escalated 34.7% to $2.4 billion, mainly on account of an increase in policyholder benefits, selling, underwriting, general and administrative expenses plus interest expense.

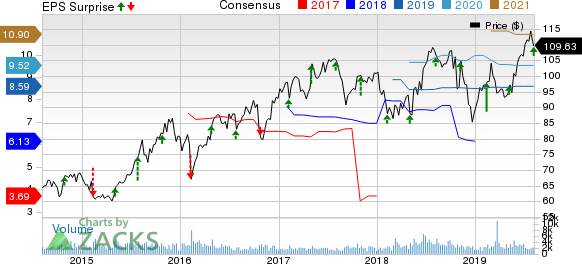

Assurant, Inc. Price, Consensus and EPS Surprise

Assurant, Inc. price-consensus-eps-surprise-chart | Assurant, Inc. Quote

Segmental Performance

Net earned premiums, fees and others at Global Housing declined 6% year over year to $510.1 million, primarily due to the sale of mortgage solutions.

Net operating income of $71.5 million improved 2% year over year.

Net earned premiums, fees and others at Global Lifestyle soared 64% year over year to $1.8 billion. This upside was primarily driven by TWG revenues.

Net operating income of $109.3 million skyrocketed 60% year over year, driven by TWG acquisition and organic growth in Connected Living.

Net earned premiums, fees and others at Global Preneed rose 6% year over year to $49.6 million, primarily owing to growth in prefunded funeral policies in the United States as well as prior period sales of the Final Need product.

Net operating income jumped 15% year over year to $16.9 million, mainly on the back of higher investment income.

Net operating loss at Corporate & Other was $24.4 million, wider than the year-ago quarter’s net operating loss of $17.5 million, attributable to lower investment income.

Financial Position

Liquidity was $386 million as of Jun 30, 2019, about $161 million above the company’s current targeted minimum level of $225 million.

Total assets increased nearly 5% from 2018 end to $43.1 billion as of Jun 30, 2019.

Total shareholders’ equity came in at $5.7 billion, up 12.1% year over year.

Share Repurchase and Dividend Update

In the second quarter, the company bought back 0.5 million shares for $50 million. From Jul 1 through Aug 2, the company repurchased additional 0.2 million shares for $19 million. It now has $642 million remaining under its current share buyback authorization.

The company’s total dividends amounted to $43 million in the quarter.

2019 Guidance

Assurant estimates net operating income (excluding reportable catastrophe loss) to grow between 6% and 10% from 2018 driven by profitability achieved in Global Lifestyle and Global Housing along with share buybacks. This growth rate includes full-year impact of the 10.4 million shares issued for the Warranty Group buyout.

Consolidated effective tax rate is projected between 23% and 25%.

Double-digit earnings growth is likely to reflect full-year contributions from the Warranty Group that will include $25-$30 million after tax of additional synergy realization, modest organic growth across Connected Living, Global Automotive and multifamily housing, along with ongoing expense management efforts. Given a moderate decline in revenues, lender-placed insurance excluding reportable catastrophe loss and incremental reinsurance costs, is projected to be around 2018-levels. However, persistent declines in Global Financial Services might partially offset earnings growth.

Assurant expects full-year net operating loss to hover around 2018-levels at Corporate & Other. Additionally, interest expense is projected in the range of $83-$85 million and preferred dividends are anticipated to be around $20 million. Both these estimates take into account full-year financing costs associated with the buyout of Warranty Group.

Assurant now estimates Global Housing net operating income, excluding catastrophe losses, to modestly decline from 2018 due to elevated severity and frequency of claims in small commercial products found within the Global Housing Specialty and Other offerings. The company has implemented a plan to exit these products, which is expected to lower 2019 Specialty and other revenue growth in the second half of the year.

Dividends from the units namely Global Housing, Global Lifestyle and Global Preneed are likely to approximate segment net operating income (including catastrophe loss).

The company plans to deploy capital, mainly to fund business growth, finance other investments and return capital to shareholders via buybacks and dividends.

Zacks Rank

Assurant currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Second-quarter earnings of Torchmark TMK and MGIC Investment MTG beat the respective Zacks Consensus Estimate while that of Reinsurance Group of America RGA missed expectations.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Torchmark Corporation (TMK) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance