Associated Banc-Corp (ASB) Q2 Earnings Beat, Revenues Down

Associated Banc-Corp’s ASB second-quarter 2019 adjusted earnings of 51 cents per share outpaced the Zacks Consensus Estimate of 49 cents. The figure compares favorably with 50 cents reported in the prior-year quarter. Earnings (in the reported quarter) excluded acquisition-related costs in connection to the Bank Mutual deal.

Results benefited primarily from lower expenses, rise in non-interest income and growth in loans. However, decline in net interest income and considerable rise in credit costs were the undermining factors.

Net income available to common shareholders (GAAP basis) was $80.9 million, down 7% year over year.

Revenues & Expenses Down

Net revenues were $309.5 million, down 3% year over year. Also, the figure lagged the Zacks Consensus Estimate of $315.8 million.

Net interest income was $213.6 million, a fall of 6% from the year-ago quarter. Net interest margin (NIM) was 2.87%, down 15 basis points (bps).

Non-interest income totaled $95.8 million, up 3% year over year. Higher mortgage banking income (up 51%) primarily drove the rise.

Non-interest expenses were $197.8 million, down 6% from the year-ago quarter. The decline was attributable to fall in all cost components except loan costs, technology expenses and other intangible amortization.

Efficiency ratio (fully tax-equivalent basis) decreased to 61.13% from 64.45% in the prior-year quarter. Fall in efficiency ratio indicates higher profitability.

As of Jun 30, 2019, net loans were $23.2 billion, up slightly on a sequential basis. Total deposits decreased 1% from the prior quarter to $25.2 billion.

Credit Quality: A Mixed Bag

As of Jun 30, 2019, total non-performing assets were $185.1 million, down 22% year over year. Further, total non-accrual loans were $166.7 million, down 18%.

However, the company reported provision for credit losses of $8 million, up 100% year over year. Moreover, the ratio of net charge-offs to annualized average loans was 0.18% in the second quarter, up 2 bps.

Strong Capital & Profitability Ratios

As of Jun 30, 2019, Tier 1 risk-based capital ratio was 11.18%, up from 11.17% as of Jun 30, 2018. In addition, common equity Tier 1 capital ratio was 10.13% compared with 10.51% at the end of the prior-year quarter.

Annualized return on average assets was 1.01%, down from 1.07%. Moreover, return on average tangible common equity was 13.81% compared with 14.98% a year ago.

Share Repurchases

During the reported quarter, Associated Banc-Corp repurchased nearly 2 million shares for $40 million.

Associated Banc-Corp to Acquire First Staunton Bancshares

Concurrent with the earnings release, Associated Banc-Corp announced an agreement to acquire Staunton, IL-based First Staunton Bancshares, Inc. The all-cash deal, valued at $76.3 million, is expected to close in first-quarter 2020.

Moreover, First Staunton’s subsidiary, The First National Bank in Staunton, will merge with Associated Banc-Corp’s subsidiary, Associated Bank, N.A. The transaction, approved by the board of directors of both the companies, is still subject to regulatory consents and customary closing conditions.

Associated Banc-Corp president and CEO Philip B. Flynn said, “This acquisition provides the opportunity to increase our Illinois presence and improve the scale of our operations. This ultimately positions us to make further investments in the St. Louis metro market and deliver increased network value to our customers and shareholders.”

Additionally, Associated Banc-Corp projects the deal to be accretive to its earnings in 2020 (excluding one-time charges). Further, the transaction is expected to produce strong returns on capital. The company anticipates to realize nearly 35% cost savings from back office and frontline branch operating efficiencies.

2019 Outlook

Associated Banc-Corp expects to achieve 3-6% average loan growth. Also, it expects to maintain loan to deposit ratio under 100%, with some seasonality.

Further, the company projects NIM to be nearly 2.90%, based on assumption of two Fed rate cuts this year.

It anticipates non-interest income between $360 million and $375 million.

The company projects non-interest expenses to be in the range of $790-$795 million, down from prior guidance of approximately $800 million. Adjusted efficiency ratio is expected to improve by 100-200 bps.

Further, it forecasts the effective tax rate to be roughly 21%.

Our Take

Associated Banc-Corp is well positioned to benefit from growth in loans and improving economy. Also, the company’s inorganic growth strategy (including the announced First Staunton Bancshares deal) will support profitability in the quarters ahead. However, elevated expenses are likely to hurt bottom-line growth to some extent.

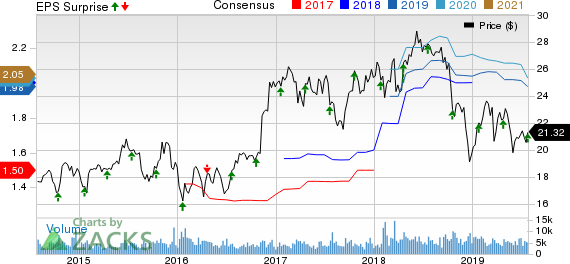

Associated Banc-Corp Price, Consensus and EPS Surprise

Associated Banc-Corp price-consensus-eps-surprise-chart | Associated Banc-Corp Quote

Associated Banc-Corp currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Hancock Whitney Corporation’s HWC second-quarter 2019 operating earnings per share of $1.01 were in line with the Zacks Consensus Estimate. The bottom line was 5.2% higher than the year-ago quarter figure.

East West Bancorp’s EWBC second-quarter 2019 adjusted earnings per share of $1.24 were in line with the Zacks Consensus Estimate. Also, the figure was up 5.1% from the prior-year quarter.

Prosperity Bancshares Inc. PB reported second-quarter 2019 earnings of $1.18 per share, which were in line with the Zacks Consensus Estimate. The figure improved nearly 1% on a year-over-year basis.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB) : Free Stock Analysis Report

East West Bancorp, Inc. (EWBC) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance