Aspen's (AZPN) Solutions Adopted by China National BlueStar

Aspen Technology AZPN recently announced that its Mtell and ProMV asset performance management (APM) solutions have been selected by chemical company China National BlueStar, also known as BlueStar, for its digital transformations goals.

Notably, Aspen Mtell leverages AI and machine learning to help customers identify asset failure symptoms in real time, determine the cause, predict future failures and provide valuable feedback to prevent such problems. Meanwhile, Aspen ProMV applies multivariate analysis to create models that aid companies analyze and interpret complex data. Thus, plants are able to determine the exact variables that could lead to quality issues.

These solutions will aid BlueStar improve product quality by predicting process deviations and prevent unplanned delays by applying predictive analytics on all critical assets. Further, they will aid BlueStar to enhance asset performance management strategy and speed up its digital transformation process.

The BlueStar deal win is expected to boost Aspen’s revenues in the upcoming quarters.

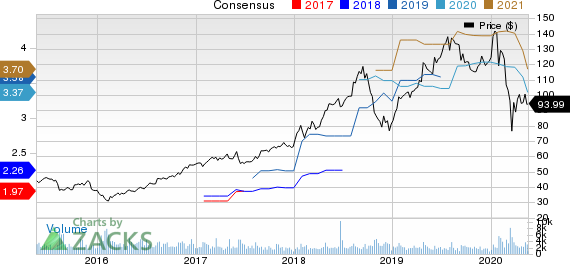

Aspen Technology, Inc. Price and Consensus

Aspen Technology, Inc. price-consensus-chart | Aspen Technology, Inc. Quote

Solid Traction for Solutions to Drive Growth

Aspen has been witnessing robust momentum for its asset optimizations solutions in recent times.

Notably, the company’s DMC3 software has been adopted by Messer Group GmbH to improve operating efficiency and margins, while reducing energy consumptions and emissions. Moreover, Aspen’s Advanced Process Control (APC) solution will increase levels of automation throughout Messer’s business.

China HuanQiu Contracting and Engineering Corp. also selected Aspen’s HYSYS Dynamics software to accelerate digital transformation across the business and maximize safety, throughput and profitability at the design phase of critical systems.

The growing clout of Aspen’s solutions bodes well for its growth prospects. Moreover, Aspen is well poised to expand its position in the APM market, which is expected to witness a CAGR of 15.1% between 2020 and 2025, per Markets and Markets data.

Persistent Risks

Nonetheless, Aspen is facing stiff competition in the APM space from major players like SAP SAP, IBM IBM and Oracle ORCL.

Notably, similar offerings from these companies, which include Maximo from IBM, Oracle Enterprise Asset Management solution and SAP Enterprise Asset Management (EAM) suite, have heated up competition in the space. This is likely to create pricing pressure to maintain market share, which could impact the company’s margins.

Further, COVID-19 induced uncertainties prevailing in the market are likely to dampen Aspen’s performance in the days ahead. Notably, the company is witnessing a decline in demand from customer’s in the oil industry due to the pandemic related drop in oil prices. Moreover, Aspen is witnessing an overall slowdown in customer payments owing to the outbreak.

Zacks Rank

Aspen currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance