Aspen Technology (AZPN) Q3 Earnings & Revenues Miss Estimates

Aspen Technology AZPN reported third-quarter fiscal 2023 non-GAAP earnings of $1.06 per share, missing the Zacks Consensus Estimate of $1.66. The company reported non-GAAP earnings of 40 cents per share in the year-ago quarter.

The company reported revenues of $229.9 million, missing the Zacks Consensus Estimate by 19.1%. The company had reported revenues of $84.6 million in the year-ago quarter. The year-over-year top-line performance was driven by solid momentum across all business segments.

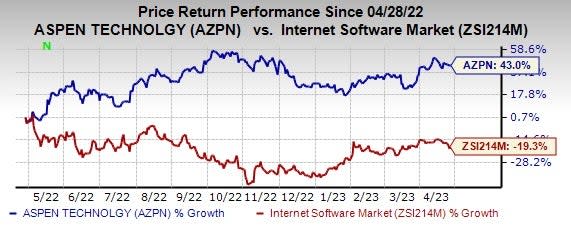

Following the announcement, shares of the company were down 15.9% in pre-market trading on Apr 27. In the past year, shares of the company have gained 43% against the sub-industry’s decline of 19.3%.

Image Source: Zacks Investment Research

Quarter in Detail

License’s revenues (59.3% of revenues) were up 168.3% year over year to $136.3 million.

Maintenance’s revenues (33.6% of revenues) rose 183.2% year over year to $77.3 million.

Revenues from Services and other (7.1% of revenues) rose 150.8% from the year-ago quarter’s figure to $16.3 million.

As of Mar 31, 2023, the annual spend (which Aspen Technology defines as the annualized value of all term license and maintenance contracts at the end of the quarter other than Open Systems International [OSI] and Subsurface Science and Engineering [SSE]) amounted to $712 million, up 8.6% year over year and 2.1% quarter over quarter.

Margins

Gross profit increased to $136.1 million from the year-ago quarter’s figure of $40.8 million. As a percentage of total revenues, the figure reached 59.2% from 48.2% reported in the prior-year quarter.

Total operating expenses amounted to $214.5 million from the year-ago quarter’s figure of $43.5 million due to higher selling, marketing, and research and development costs.

Non-GAAP operating income totaled $56.8 million compared with $102.5 million reported in the prior-year quarter.

Balance Sheet & Cash Flow

As of Mar 31, 2023, cash and cash equivalents were $286.7 million compared with $446.1 million as of Dec 31, 2022.

The company generated $66.8 million in cash from operations compared with $20.1 million reported in the previous quarter. Non-GAAP free cash flow was $129.3 million in the fiscal third quarter.

Aspen Technology, Inc. Price, Consensus and EPS Surprise

Aspen Technology, Inc. price-consensus-eps-surprise-chart | Aspen Technology, Inc. Quote

Fiscal 2023 View

For fiscal 2023, Aspen now expects revenues in the range of $1.04-$1.06 billion compared with the previous guidance of $1.14-$1.20 billion. The company has lowered its guidance primarily due to ongoing integration and transformation factors related to the OSI and SSE businesses. The Zacks Consensus Estimate for revenues is pegged at $1.17 billion.

Non-GAAP net income is now anticipated to be $5.63-$5.83 per share compared with the earlier guided range of $6.83-$7.43 per share. The Zacks Consensus Estimate for earnings is pegged at $7.10 per share.

Management projects Annual Contract Value growth of 11-12% year over year compared with the earlier guided range of 10.5-13.5%. The company stated that the adjustment for the high end of guidance was mainly due a declining chemical customer software spending

Total bookings are projected in the range of $1.03-$1.06 billion compared with earlier guided range of $1.07-$1.17 billion.

Management projects non-GAAP operating income in the range of $398-$413 million compared with the earlier guided range of $503-$555 million. Non-GAAP total expenses are projected to be between $642 million and $647 million.

The free cash flow is projected to be at least $315 million.

Zacks Rank & Stocks to Consider

Currently, Aspen carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Arista Networks ANET, Asure Software ASUR and Salesforce CRM. Asure Software and Salesforce currently sport a Zacks Rank #1 (Strong Buy), whereas Arista Networks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2023 earnings has increased 1.2% in the past 60 days to $5.83 per share. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 29% in the past year.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings has increased 25% in the past 60 days to 35 cents per share. The long-term earnings growth rate is anticipated to be 25%.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 445.8%. Shares of ASUR have increased 122.4% in the past year.

The Zacks Consensus Estimate for Salesforce’s 2023 earnings has increased 21.5% in the past 60 days to $7.11 per share. The long-term earnings growth rate is anticipated to be 16.8%.

Salesforce’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 15.6%. Shares of the company have increased 3.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance