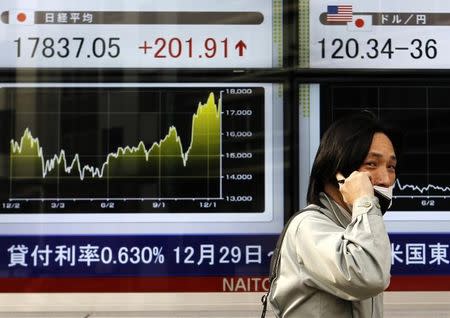

Asian Stocks Mixed; MSCI Announces 234 China Stocks to Be Added to Indexes

Investing.com – Asian equities were mixed in morning trade on Tuesday. MSCI on Tuesday unveiled the list of 234 China A shares to be added to its relevant global and regional indexes in June.

The index giant added 11 companies and removed nine from its MSCI China A inclusion index, according to a statement.

Overnight, U.S. stocks pared early gains on Monday, while technology companies were supported by President Donald Trump’s easing of tension in a trade spat with China.

In Asia, China’s Shanghai Composite and the Shenzhen Component both opened 0.1% higher by 9:35PM ET (01:35AM GMT), while Hong Kong’s Hang Seng Index slipped 0.4%.

Reports on Monday suggested that China and the U.S. were close to agreeing a deal that would lift the ban on ZTE (HK:0763) Corp (SZ:000063). In return, the U.S. requested China to remove tariffs on billions of dollars of agricultural products.

Meanwhile, China’s top economic official Liu He has arrived in Washington on Tuesday for trade talks with U.S. Treasury Secretary Steven Mnuchin that would run until Saturday. Reports suggested that Liu might be ready to offer U.S. companies easier access to Chinese markets.

The news came after the U.S.’s request of a more precise timetable on when and how China would open up its markets, as U.S. Ambassador to China Terry Branstad said on Tuesday that the two countries are still "very far apart" on resolving trade frictions.

"The Chinese have said 'we want to see the specifics.' We gave them all the specifics in terms of trade issues. So they can't say they don't know what we're asking for," he said.

"We're still very far apart," Branstad said, saying that China has not met pledges to open up its insurance and financial services area, as well as reduce auto tariffs.

"There are many areas where China has promised to do but haven't. We want to see a timetable. We want to see these things happen sooner or later," he said at a conference in Tokyo.

Elsewhere, Australia’s S&P/ASX 200 was down 0.2%, Japan’s Nikkei 225 climbed 0.1% and South Korea’s KOSPI fell 0.3%.

Looking ahead, Investors’ attention will likely turn to China’s industrial output and retail sales data due later in the day.

Related Articles

Seattle passes scaled-back tax on Amazon, big companies

Despite gun debate, Sturm Ruger board faced little opposition

Yahoo Finance

Yahoo Finance