Asian Markets Mixed as China Eases Restrictions on Foreign Investment

Investing.com – Asian stocks were mixed in morning trade on Friday. A move to ease foreign investment curbs in China were cited as tailwind for regional equities, although trade concerns continued to weigh on market sentiment.

China’s National Development and Reform Commission published a new version of the so called “negative list” on Thursday. The new rules, which would take effect on July 28, list curbs on sectors including banking, automotive, heavy industry and agriculture.

On top of removing ownership limits on insurance companies and auto makers within the next three to five years, which China already announced earlier this year, it would also ease ownership caps on business including ship and aircraft manufacturing and power grids.

The Shanghai Composite and the Shenzhen Component were 0.4% and 0.2% higher by 10:10PM ET (02:10 GMT). Hong Kong’s Hang Seng Index climbed 0.5%.

The People’s Bank of China said in a statement on Thursday that it would monitor domestic and global economic development and use comprehensive policy tools to stabilize market expectations when necessary.

The central bank is expected to lower the reserve ratios for some banks next Thursday.

Meanwhile, ZTE Corp (HK:0763), which ceased major operations in April after the U.S. Commerce Department said the company violated U.S. sanctions against Iran and North Korea, is still waiting for details necessary for lifting the ban to buy U.S.-origin goods. A spokesman of the U.S. Department of Commerce said last week that the final steps would be taken in a “couple of days.”

"The department continues to work with ZTE," the Commerce spokesman said. He declined to comment on the cause of the delay, according to reports.

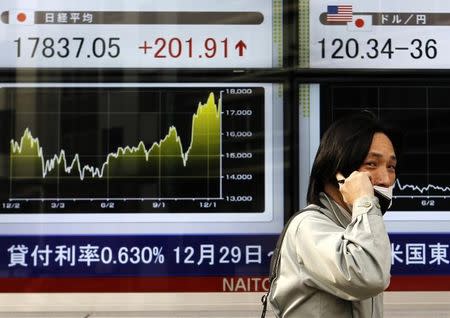

Elsewhere, Japan’s Nikkei 225 slipped 0.3%. Electronics maker Sharp Corp (T:6753)’s share jumped as much as 15% on Friday after the company cancelled plans to raise 200 billion yen in a public share sale. Citing market instability fuelled by recent trade tensions as the reason for the cancellation, the company also retracted a full-year report related to the sale, it said in a statement Friday.

Down under, Australia’s S&P/ASX 200 fell 0.2%.

Related Articles

Trump says SoftBank's Son increasing U.S. investment

Asian shares stay near nine-month lows as trade frictions weigh

Lawsuit claims U.S. pork companies conspired to inflate prices

Yahoo Finance

Yahoo Finance