The Ashland Global Holdings (NYSE:ASH) Share Price Has Gained 18% And Shareholders Are Hoping For More

Low-cost index funds make it easy to achieve average market returns. But if you invest in individual stocks, some are likely to underperform. For example, the Ashland Global Holdings Inc. (NYSE:ASH) share price return of 18% over three years lags the market return in the same period. Zooming in, the stock is up a respectable 17% in the last year.

Check out our latest analysis for Ashland Global Holdings

Ashland Global Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years Ashland Global Holdings saw its revenue shrink by 6.5% per year. The modest share price gain of 6% per year suggests holders are sanguine about the falling revenue. Profit focussed investors would generally avoid a company with falling revenue and zero profits, since it's hard to imagine when profit might come.

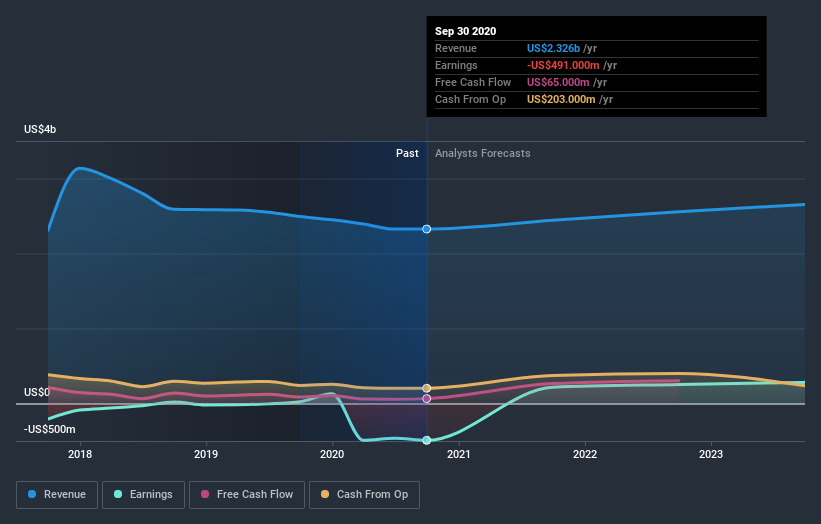

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Ashland Global Holdings will earn in the future (free profit forecasts).

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Ashland Global Holdings' TSR for the last 3 years was 23%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Ashland Global Holdings provided a TSR of 19% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 14% per year over five year. This suggests the company might be improving over time. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance