Asana's (NYSE:ASAN) Q1 Sales Beat Estimates, Stock Soars

Work management software maker Asana (NYSE: ASAN) announced better-than-expected results in Q1 CY2024, with revenue up 13.1% year on year to $172.4 million. The company expects next quarter's revenue to be around $177.5 million, in line with analysts' estimates. It made a non-GAAP loss of $0.06 per share, improving from its loss of $0.28 per share in the same quarter last year.

Is now the time to buy Asana? Find out in our full research report.

Asana (ASAN) Q1 CY2024 Highlights:

Revenue: $172.4 million vs analyst estimates of $168.8 million (2.2% beat)

EPS (non-GAAP): -$0.06 vs analyst estimates of -$0.08

Revenue Guidance for Q2 CY2024 is $177.5 million at the midpoint, roughly in line with what analysts were expecting

The company reconfirmed its revenue guidance for the full year of $721.5 million at the midpoint

Gross Margin (GAAP): 89.7%, in line with the same quarter last year

Free Cash Flow was -$4.28 million compared to -$16.95 million in the previous quarter

Net Revenue Retention Rate: 100%, in line with the previous quarter

Billings: $198.3 million at quarter end, up 8.5% year on year

Market Capitalization: $3.15 billion

“AI is transforming how we work, and Asana is delivering the ideal platform for this new era where people and AI collaborate to reach new levels of productivity and innovation," said Dustin Moskovitz, co-founder and chief executive officer of Asana.

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE:ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

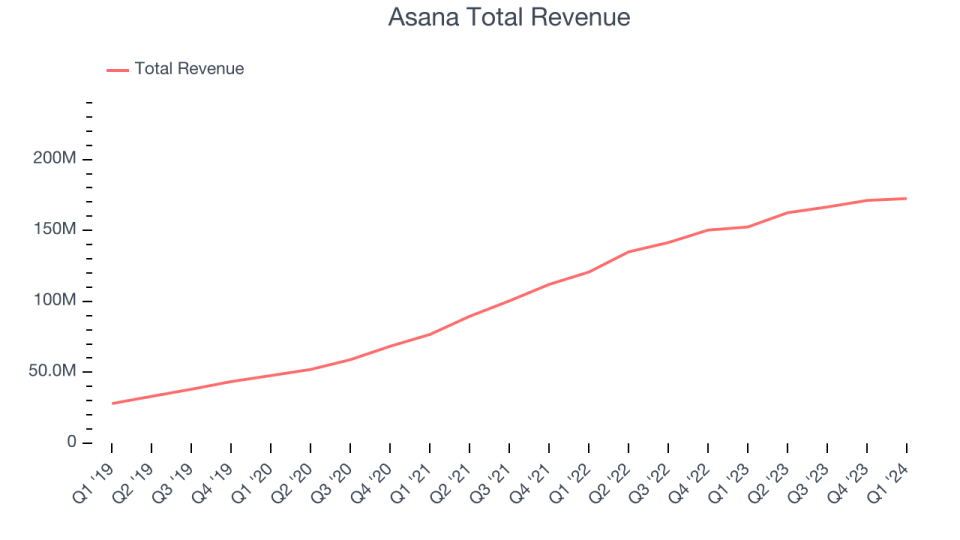

Sales Growth

As you can see below, Asana's revenue growth has been very strong over the last three years, growing from $76.67 million in Q1 2022 to $172.4 million this quarter.

This quarter, Asana's quarterly revenue was once again up 13.1% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $1.31 million in Q1 compared to $4.63 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Asana is expecting revenue to grow 9.3% year on year to $177.5 million, slowing down from the 20.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 10.7% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

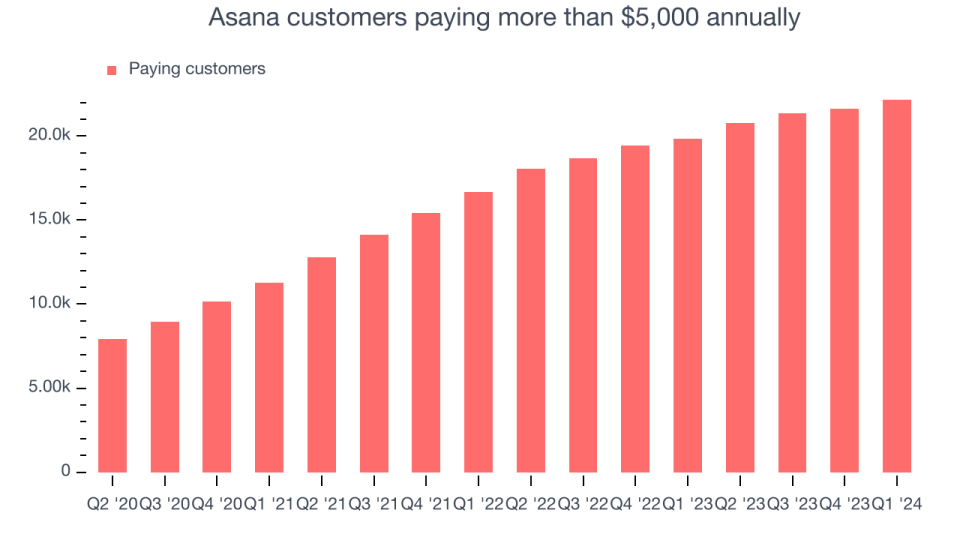

Large Customers Growth

This quarter, Asana reported 22,162 enterprise customers paying more than $5,000 annually, an increase of 516 from the previous quarter. That's quite a bit more contract wins than last quarter but also quite a bit below what we've typically observed over the last year, suggesting that the company may be reinvigorating growth.

Key Takeaways from Asana's Q1 Results

It was good to see Asana beat analysts' billings expectations this quarter. We were also glad both its revenue and operating profit outperformed Wall Street's estimates. Zooming out, we think this was a decent quarter, showing that the company is staying on target. The stock is up 6.1% after reporting and currently trades at $13.92 per share.

So should you invest in Asana right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance