The Arrowhead Pharmaceuticals (NASDAQ:ARWR) Share Price Is Up 557% And Shareholders Are Delighted

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. You won't get it right every time, but when you do, the returns can be truly splendid. One such superstar is Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR), which saw its share price soar 557% in three years. And in the last month, the share price has gained 7.2%.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Arrowhead Pharmaceuticals

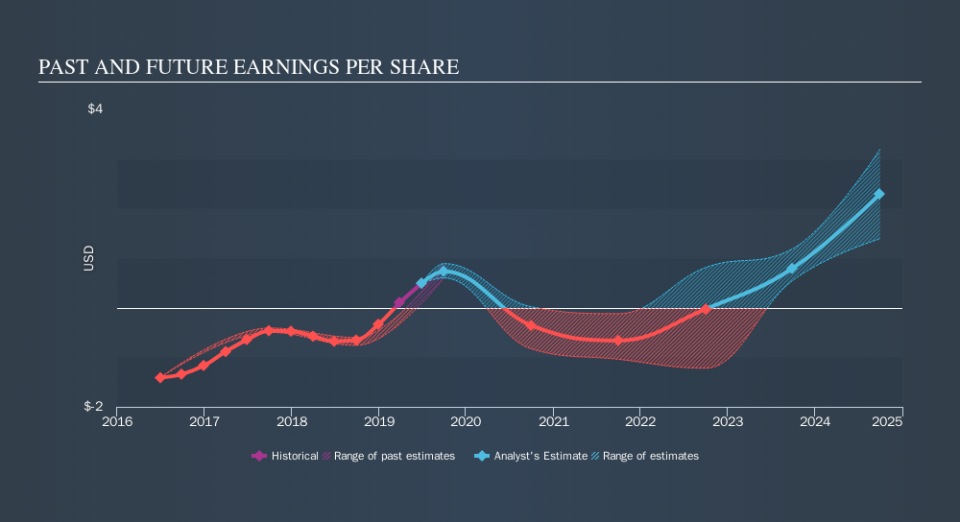

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Arrowhead Pharmaceuticals became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Arrowhead Pharmaceuticals has rewarded shareholders with a total shareholder return of 205% in the last twelve months. That's better than the annualised return of 43% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance