Arista (ANET) Offers Improved, Modernized WAN Routing System

In a concerted effort to simplify and modernize customer wide area network, Arista Networks, Inc. ANET recently launched the Arista WAN Routing System by integrating three new network offerings. These include enterprise-class routing platforms, carrier/cloud-neutral Internet transit capabilities and the CloudVision Pathfinder Service.

The solution is based on Arista’s EOS (Extensible Operating System) routing and CloudVision management capabilities. While EOS is core to the company’s cloud networking solutions for next-generation data centers and cloud networks, CloudVision is a network-wide approach for workload orchestration, workflow automation and real-time telemetry as a turnkey solution for cloud networking.

It enables customers to deploy a consistent networking architecture across all enterprise network domains from the client to campus to the data center to multi-cloud, offering an ideal solution across a blend of edge, campus, data center, cloud and SaaS environments. This software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience is likely to fuel its growth in data-driven cloud networking business with proactive platforms and predictive operations.

Arista continues benefiting from the expanding cloud networking market, driven by strong demand for scalable infrastructure. In addition to high capacity and easy availability, its cloud networking solutions promise predictable performance and programmability, enabling integration with third-party applications for network management, automation and orchestration. It offers one of the broadest product lines of datacenter and campus Ethernet switches and routers in the industry. Arista provides routing and switching platforms with industry-leading capacity, low latency, port density and power efficiency. The company also innovates in areas such as deep packet buffers, embedded optics and reversible cooling.

The company holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. It is increasingly gaining market traction in 200- and 400-gig high-performance switching products. It remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

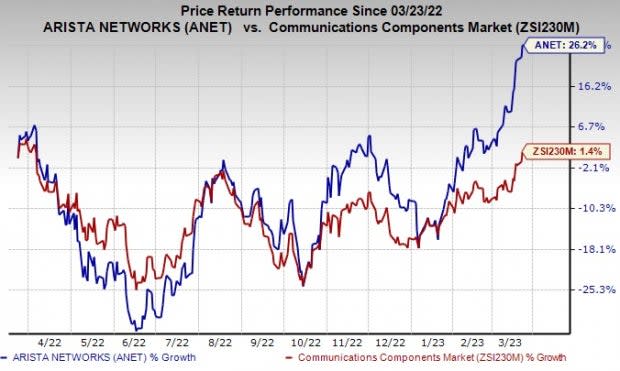

The stock has gained 26.2% over the past year compared with the industry’s rise of 1.4%.

Image Source: Zacks Investment Research

We remain impressed with the inherent growth potential of this Zacks Rank #1 (Strong Buy) stock. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Key Picks

Juniper Networks, Inc. JNPR carries a Zacks Rank #2 (Buy). It has a long-term earnings growth expectation of 7% and delivered an earnings surprise of 1.6%, on average, in the trailing four quarters.

Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence.

Ubiquiti Inc. UI, carrying a Zacks Rank #2, offers a comprehensive portfolio of networking products and solutions for service providers and enterprises. Ubiquiti’s excellent global business model, which is flexible and adaptable to evolving changes in markets, helps it to beat challenges and maximize growth.

Ubiquiti boasts a proprietary network communication platform that is well equipped to meet end-market customer needs. In addition, the company is committed toward reducing its operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

Deutsche Telekom AG DTEGY, sporting a Zacks Rank #1, is likely to benefit from the accretive post-merger integration of T-Mobile US Inc. and Sprite in the United States, in which it owns about 43% stake. The removal of forced cable TV access in multiple dwelling units in Germany through telecom legislation is likely to help Deutsche Telekom expand its broadband market.

Moreover, an aggressive fiber rollout strategy across the country is expected to augment its domestic market hold. The Zacks Consensus Estimate for current-year earnings for Deutsche Telekom has been revised 21.8% upward over the past year. It has a VGM Score of B and a long-term earnings growth expectation of 15.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Deutsche Telekom AG (DTEGY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance