Arch Capital (ACGL) Q1 Earnings Miss, Revenues Rise Y/Y

Arch Capital Group Ltd. ACGL reported first-quarter 2020 operating income per share of 46 cents, which missed the Zacks Consensus Estimate by 14.8%. Moreover, the bottom line deteriorated 31.3% year over year.

The quarter benefited from improving premiums across Insurance, Reinsurance and Mortgage segments, offset by higher expenses.

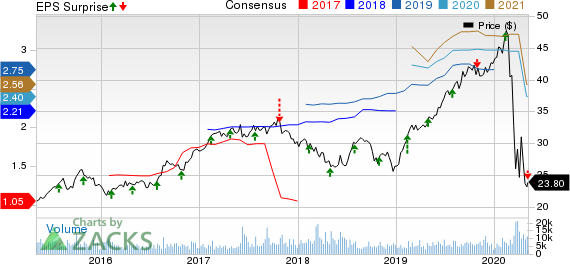

Arch Capital Group Ltd. Price, Consensus and EPS Surprise

Arch Capital Group Ltd. price-consensus-eps-surprise-chart | Arch Capital Group Ltd. Quote

Q1 in Detail

Gross premiums written increased 36.3% year over year to $2.8 billion, largely fueled by higher premiums written across the Insurance, Reinsurance and Mortgage segments.

Net investment income declined 6.8% to $113 million due to reinvestment of fixed income securities at lower yields available in the financial market.

Operating revenues of $1.9 billion improved 24.3% year over year on the back of higher premiums earned.

Interest expenses were $25.2 million, up 7.5% year over year.

Total expenses of $1.6 billion increased 35% year over year on higher losses and loss adjustment expenses, acquisition expenses, other operating expenses, corporate expenses and interest expenses.

Arch Capital’s underwriting income came in at $154 million, down 40.8% year over year. Combined ratio deteriorated 980 basis points (bps) to 91.5%.

Segment Results

Insurance: Gross premiums written grew 28.2% year over year to $1.2 billion, driven by increases in most lines of business, primarily due to new business opportunities, rate increases and growth in existing accounts.

Underwriting loss came in at $28.2 million against the underwriting profit of $0.6 million year over year. Combined ratio deteriorated 400 bps to 103.9%.

Reinsurance: Gross premiums written rose 64.4% year over year to $1.1 billion, driven by increases in most lines of businesses, primarily due to growth in existing accounts, new businesses, including premiums written through Barbican acquired in fourth-quarter 2019, and rate increases.

Underwriting loss came in at $9.4 million against the underwriting profit of $20.9 million. Combined ratio deteriorated 680 bps year over year to 102%.

Mortgage: Gross premiums written increased 3.6% year over year to $368.9 million on the back of an increase in monthly premium business due to growth in insurance in force and lower ceded premiums. Underwriting income decreased 19% to $197.6 million. Combined ratio deteriorated 1850 bps year over year to 44.1%. Arch MI U.S. generated $16.8 billion of new insurance written compared with $11.2 billion in the year-ago quarter, driven by higher mortgage refinance activity.

Financial Update

Arch Capital exited the quarter with cash of $882.3 million, up 39.3% year over year. Debt was $1.8 billion, up 0.03% year over year.

As of Mar 31, 2020, book value per share was $26.10, up 12.9% year over year.

Operating return on equity was 7.1% in the first quarter, down 520 basis points.

Net cash provided by operating activities was $585.9 million, up 254.2% year over year.

Zacks Rank

Arch Capital currently has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other insurance industry players who have reported first-quarter results so far, earnings of The Progressive Corporation PGR and The Travelers Companies, Inc. TRV missed the Zacks Consensus Estimate, while that of Globe Life Inc. GL matched the same.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Globe Life Inc. (GL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance