ArcelorMittal Starts 3D Printing Ventilators & Face Shields

ArcelorMittal MT said that it began 3D printing ventilators and face shields to combat the coronavirus outbreak.

The company is working with leading Spanish experts and medical practitioners to ramp up efforts to find solutions for the treatment of coronavirus.

Notably, the ventilators have been developed using 3D printing and it took a week to design. The ventilators are presently undergoing health checks and inspections, and will be subject to regulatory approval. Upon approval, patients with acute respiratory problems may be supported.

ArcelorMittal is also developing 3D printed face shields for health professionals. Notably, in two days, it designed and created two types of face shields — the ones attached to the head and the ones attached to the helmet.

Reportedly, the company is presently collaborating with a number of external partners to allow such face shields to be manufactured on a large scale.

ArcelorMittal’s shares have lost 53.9% in the past year compared with a 47.7% decline of the industry.

On its fourth-quarter earnings call, the company expected apparent steel consumption (“ASC”) in the core markets to grow in 2020.

For 2020, ArcelorMittal expects global ASC growth of 1-2%, whereas it reported 1.1% in 2019.

In the United States, the company projects ASC of flat-to-1% growth for 2020. ASC growth in flat products is expected to offset the anticipated decline for long products.

In Europe, the company expects the end of destocking to support improved ASC for flat products amid anticipated weakness in automotive. Similarly, it expects the end of destocking to offset the impacts of the slowdown in construction activity on long product ASC. The net effect of the factors is expected to support ASC growth of 1-2% for 2020 in the region.

ASC is expected to rise 4-5% in Brazil, following an expected growth in construction activity.

In China, the company expects overall demand growth to be flat to 1% for 2020 compared with an estimated growth of 3.2% in 2019. This is likely to be driven by strong real estate activity. The company also expects the coronavirus outbreak to have a short-term negative impact on steel demand in China.

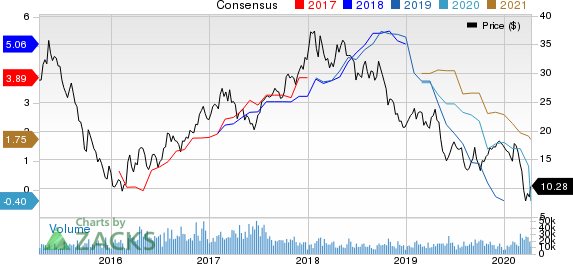

ArcelorMittal Price and Consensus

ArcelorMittal price-consensus-chart | ArcelorMittal Quote

Zacks Rank & Stocks to Consider

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Novagold Resources Inc. NG, Franco-Nevada Corporation FNV and Barrick Gold Corporation GOLD.

Novagold has a projected earnings growth rate of 11.1% for 2020. The company’s shares have surged 113% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has a projected earnings growth rate of 17.6% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have rallied 40.6% in a year.

Barrick Gold currently has a Zacks Rank #2 and a projected earnings growth rate of 41.2% for 2020. The company’s shares have gained 50.2% in a year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Novagold Resources Inc. (NG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance