ArcelorMittal Up 42% in a Year: What's Behind the Rally?

Shares of ArcelorMittal MT have rallied 41.8% over a year, outperforming the industry’s gain of roughly 26.6%.

The steel behemoth has a market cap of roughly $31.9 billion and average volume of shares traded in the last three months is around 3,656.4K. The company has an expected long-term earnings per share growth rate of 13.4%.

Let’s take a look into the factors that are driving this Zacks Rank #1 (Strong Buy) stock.

Driving Factors

Better-than-expected fourth-quarter 2017 earnings performance, upbeat 2018 view and the company’s internal initiatives are contributing to a rally in ArcelorMittal’s shares. The company is also gaining from its efforts to reduce debt, lower costs, improve efficiency and expand capacity.

ArcelorMittal recorded a nearly three-fold year-over-year rise in its profits in the fourth quarter, while adjusted earnings of 90 cents per share topped the Zacks Consensus Estimate of 80 cents. Moreover, the company has outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering a positive average earnings surprise of around 39.4%.

ArcelorMittal noted during its fourth-quarter earnings call that the market conditions are favorable and demand environment remains positive along with healthy steel spreads. It expects global apparent steel consumption (ASC) to grow in the range of 1.5-2.5% in 2018.

In the United States, the company expects ASC growth of 1.5-2.5% in the year, considering higher construction and machinery demand. It also anticipates 1-2% growth in ASC in Europe. Moreover, ASC is forecasted to rise around 6.5-7.5% in Brazil as the economy is expected to turn around with improved consumer confidence as construction recovers.

Notably, ASC in China increased 3.5% in 2017 and is expected to remain close to this level in 2018 as weakness in the real estate sector is likely to be partly offset by strong infrastructure and automotive end markets.

ArcelorMittal remains focused on implementing strategic measures under its Action 2020 plan to drive profitability. The plan is a strategic roadmap for each of the company’s key segments, which targets a structural EBITDA improvement of about $3 billion. The program contributed $0.6 billion to EBITDA in 2017 with cumulative benefit of $1.5 billion.

The company also remains on track with its cost-reduction actions under the program and is focused on deleveraging its balance sheet. Sustained commitment to reduce debt is leading to lower net interest expenses.

ArcelorMittal is also expanding its global portfolio of automotive steels by launching a new generation of advanced high strength steels, in line with the Action 2020 program.

The company has also announced a three-year investment program of roughly $1 billion at its Mexican operations, which is geared toward improving the quality and efficiency of operations. It will allow ArcelorMittal Mexico to produce 2.5 million tons of flat rolled steel that will be supplied to customers of domestic non-auto and general industry.

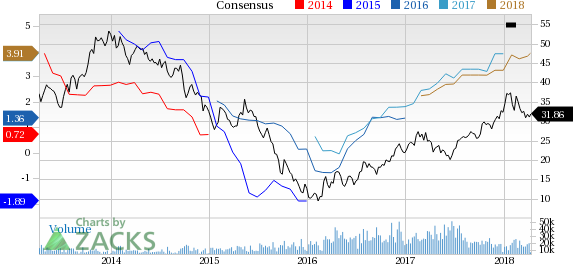

ArcelorMittal Price and Consensus

ArcelorMittal Price and Consensus | ArcelorMittal Quote

Other Stocks to Consider

Some other stocks worth considering in the basic materials space are Steel Dynamics, Inc. STLD, United States Steel Corporation X and CF Industries Holdings, Inc. CF, each sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics has an expected long-term earnings growth rate of 12%. Its shares have rallied 33.6% over a year.

U.S. Steel has an expected long-term earnings growth rate of 8%. Its shares have soared 26.9% over the past six months.

CF Industries has an expected long-term earnings growth rate of 6%. Its shares have gained 30.2% over a year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

ArcelorMittal (MT) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance