Applied Materials (AMAT) Q4 Earnings & Sales Top Estimates

Applied Materials Inc. AMAT reported fiscal fourth-quarter 2019 non-GAAP earnings of 80 cents per share, which beat the Zacks Consensus Estimate by 4 cents and improved 8.1% sequentially. However, the figure declined 5.9% year over year.

Net sales of $3.75 billion surpassed the Zacks Consensus Estimate by 1.9% and were within management’s guided range of $3.535-$3.835 billion. The figure improved 5.3% from the fiscal third quarter but marginally decreased 0.1% from the year-ago period.

The company witnessed solid momentum in key geographies namely United States, China and Taiwan. Additionally, strong investments by foundry logic customers and acceleration of the 5G roadmap drovefiscal fourth-quarter results.

Following strong fiscal fourth-quarter results, its shares were up 4% in after-hours trading. Encouragingly, the company provided strong guidance for first-quarter fiscal 2020.

Let’s delve deeper into the numbers.

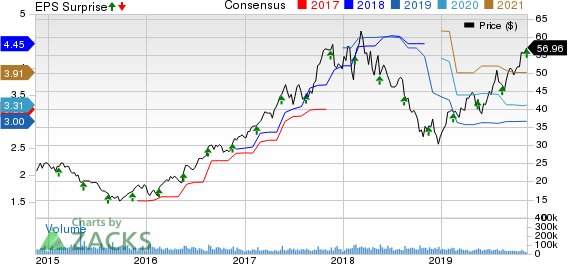

Applied Materials, Inc. Price, Consensus and EPS Surprise

Applied Materials, Inc. price-consensus-eps-surprise-chart | Applied Materials, Inc. Quote

Segments in Detail

The Semiconductor Systems Group generated $2.3 billion sales in the reported quarter (contributing 61% to its net sales), reflecting an increase of 2.5% year over year.

Applied Global Services reported sales of $977 million (26% of net sales), which increased 0.1% from the prior-year quarter.

Sales from the Display and Adjacent Markets came in at $457 million (13% of net sales), down 12.1% from the year-ago level.

Revenues by Geography

United States, Europe, Japan, Korea, Taiwan, Southeast Asia and China generated sales of $412 million, $147 million, $471 million, $471 million, $919 million, $135 million and $1.20 billion, contributing 11%, 4%, 13%, 13%, 24%, 3% and 32% to net sales, respectively.

We note that sales in United States, Taiwan and China were up 17.7%, 55.5%and 5.5% year over year, respectively. However, Applied Materials’ sales in Europe, Japan, Korea and Southeast Asia declined 39%, 33.8%, 11.5% and 31.5%, respectively.

Operating Results

Non-GAAP gross margin was 43.8%, contracting 150 basis points (bps) from the year-ago quarter.

Applied Materials’ adjusted operating expenses, as a percentage of net sales, contracted 10 bps on a year-over-year basis to 20.5%.

Further, non-GAAP operating margin of 23.7% in the reported quarter contracted 140 bps from the prior-year quarter.

Balance Sheet & Cash Flow

At the end of the fiscal fourth quarter, cash and cash equivalent balance was $3.13 billion compared with $3.01 billion at the end of fiscal third quarter.

Inventories were $3.47 billion compared with $3.54 billion in the fiscal third quarter. Accounts receivables increased to $2.53 billion from $2.37 billion in the fiscal third quarter.

The company returned $500 million and $194 million through stock repurchases and cash dividends, respectively.

Notably, Applied Materials generated cash flow of $826 million, up from $787 million in the fiscal third quarter.

Guidance

For first-quarter fiscal 2020, Applied Materials expects net sales to be approximately $4.10 (+/-$150 million). The Zacks Consensus Estimate for the same is pegged at $3.70 billion.

Non-GAAP EPS is expected in the range of 87-95 cents. The corresponding Zacks Consensus Estimate is pegged at 72 cents per share.

Bottom Line

Management remains optimistic about the price elasticity of NAND, which is expected to bolster NAND customer spending in the near term. The demand for foundry logic is improving, thanks to rising need for specialty nodes in automotive, power, IoT, communications and image sensor markets.

Also, ongoing inventory correction in DRAM is a tailwind for the near term. The company expects more clients to upgrade their equipment ahead of the 5G rollout in key markets, which will help it to expand top-line growth.

The company’s expanding etch footprint bodes well for the semiconductor portfolio. Moreover, its strengthening momentum in conductor etch is aiding it to gain traction in DRAM and NAND. Additionally, the company remains confident about its relentless focus on research and development activities to develop new products.

Zacks Rank & Stocks to Consider

Applied Materials currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Stamps.com Inc. STMP, Advantest Corp. ATEYY and AMETEK, Inc. AME. While Stamps.com and Advantest sport a Zacks Rank #1 (Strong Buy), AMETEK carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Stamps.com, Advantest and AMETEK is currently projected at 15%, 15.5% and 10.9%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stamps.com Inc. (STMP) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Advantest Corp. (ATEYY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance