Apple Can Bounce Back

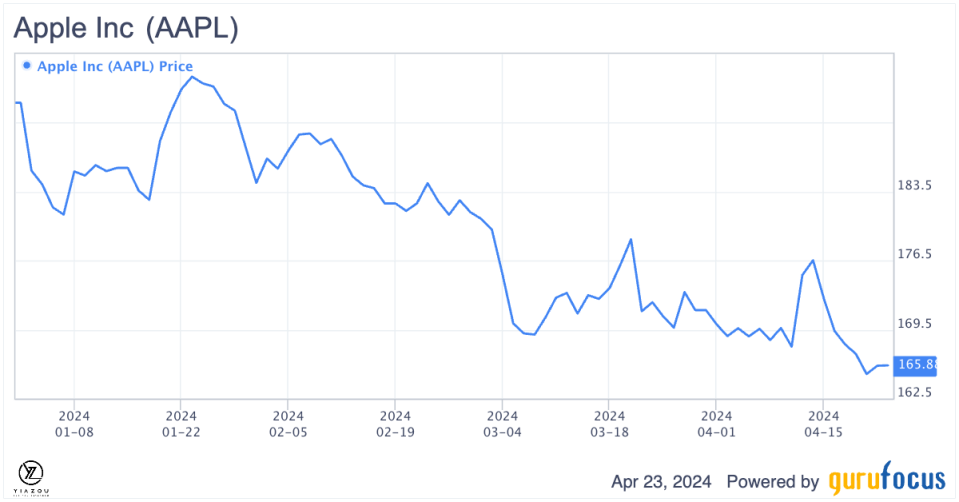

Apple Inc. (NASDAQ:AAPL) finds itself at a pivotal crossroads, nestled within the $160 to $168 price range that forms a critical demand zone. This strategic position could either serve as a springboard for resurgence or a potential pitfall if the stock dips below this support level.

Investors and market watchers alike are keenly observing whether Apple can leverage its robust cash flows and innovative prowess to bounce back from recent setbacks and continue its legacy of growth and value creation.

Apple at key demand zone

The $160 to $168 area is a crucial support level where the stock remains well supported for a potential bounce back. The stock has a higher chance of edging higher if it does not plummet below this demand zone. On the other hand, a sell-off followed by a close below this level could open the door for short sellers to push the stock lower.

Nevertheless, Apple could bounce back given that it is in a critical demand zone whereby buyers on the fence could be enticed. Likewise, the Moving Average Convergence and Divergence Indicators have already started showing signs of bouncing back even as they remain below the zero line.

Lastly, the pullback has made Apple relatively cheap compared to its peers trading at a premium valuation. The company's boasts of solid cash flows, buybacks, and a reputation for generating long-term value should continue to fuel optimism of a potential bounce back after the recent slide from 52-week highs.

AAPL Data by GuruFocus

Navigating antitrust probes, stagnant iPhone sales and global tensions

There is no denying that Apple is in a difficult period as it deals with a high-profile antitrust probe over claims it blocks rivals from accessing hardware and software features in its devices. Yet, in the case of Microsoft (NASDAQ:MSFT), history offers some guidance that the market reaction in the very early going of such regulatory pressures may be worse than the ultimate effects. Apple has been leading efforts to meet these concerns with various compromises, including changes to its payment system and adopting right-to-repair policies, which may open up new business opportunities.

Next, the growing concerns over slowing iPhone sales in China and other key markets have rattled the stock's sentiment on Wall Street. Even though the iPhone remains the company's flagship product, its lack of significant upgrades and updates from previous versions has made it difficult to ship more products as expected. With customers opting to hold on to their older-generation iPhones rather than upgrading, Apple has yet to generate as much revenue as it would have expected.

Apple's amazing return on equity and return on invested capital have effectively placed a target on its back in the fiercely competitive technological scene. The most recent reports of smartphone sales have seen Apple just beaten by Samsung (XKRX:005930), marking the beginning of heightened competition within the smartphone sector.

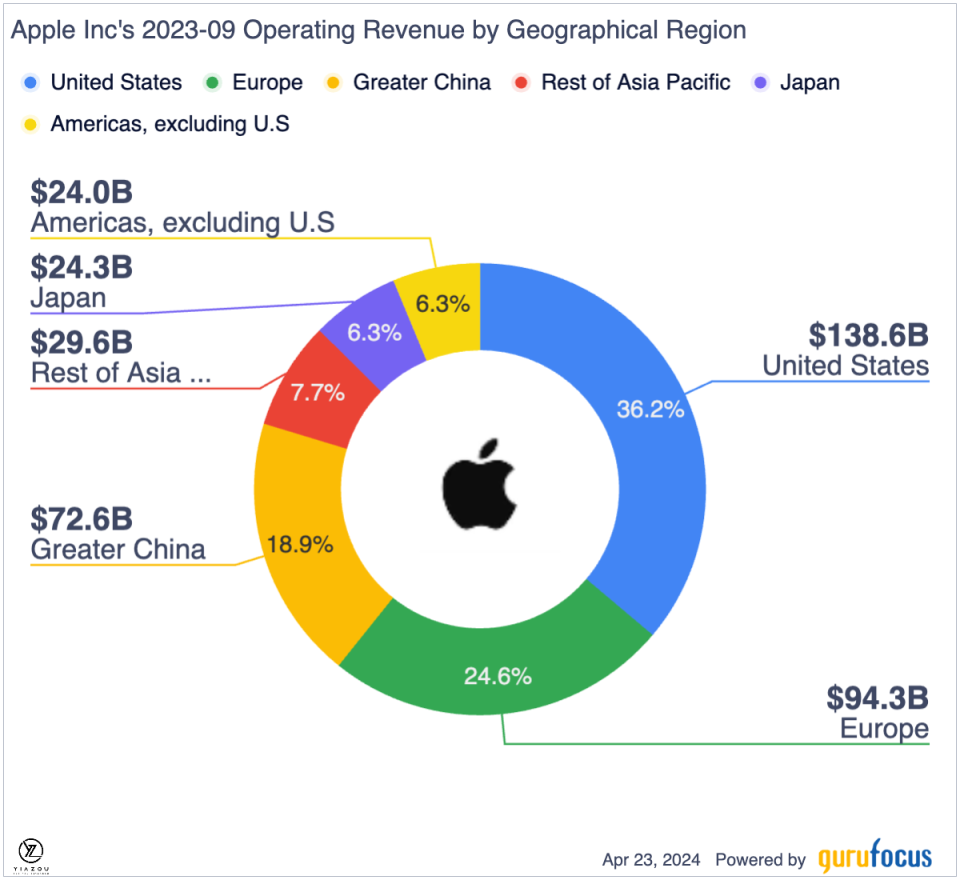

The current state of tensions around the world and threats of hardware and software bans could ripple across tech giants such as Apple, which relies on international markets. Chinese companies are taking an ever-greater share, partly due to nationalistic preferences at the expense of foreign companies, and this is likely to impact Apple's sales in this all-important market.

However, CEO Tim Cook has managed a tightrope of strategic relations with China, forging ahead with diversification in manufacturing to other Asian nations such as India, Indonesia and Vietnam to spread out risk and open up new growth opportunities.

Finally, despite these risks, Apple is in very healthy financial condition. It has the highest rating from every major credit agency, a "wide moat" status. Therefore, its financial health underlines the company's ability to weather market volatility and invest in innovation.

New frontiers in robotics and solid financial growth

With new products such as the Vision Pro, which was recently launched and not well-accepted, the company is sticking to its guns on an innovation drive. Exiting from the car project definitely means gearing the company's efforts toward new and high-potential profit markets, such as home robotics, where its technological advantage of vision recognition and voice command can really shine.

Additionally, as per former software engineer and tech expert Vance Tran, mature businesses can leverage Apple's innovative spirit and new product ventures to access new markets and revenue streams. Specifically, companies in the automotive supply chain and software development sectors stand to benefit significantly from the Apple Car and the increasing demand for apps and services within Apple's ecosystem.

Indeed, the company's first-quarter earnings registered an upsurge of 16%, with solid contributions to revenue from the Americas and Europe, while performance was weaker in China. The company's strategy in emerging markets could offset these challenges, where a rapidly increasing middle class with a huge appetite for quality consumer tech can offset an overly competitive landscape.

Additionally, Apple plans to continue growing earnings per share by 10% or better annually with constant product enhancements, its highly efficient operations and a strong brand that can command premium pricing. Together, these things enable Apple to be well-positioned for long-term, sustained growth.

A possible increase in the dividend accompanying the second-quarter earnings and a conservative dividend policy maintained by Apple alongside the robust business model ensure that shareholder returns can indeed be grown, mostly regarding capital gains. The fact that peers against which comparison is made, including Microsoft and Samsung, are priced appropriately with respect to Apple means that there is good investment potential here, mostly based on the potential to earn from the company and its robust market position.

Lastly, with a persistent forecast for long-term earnings growth, Apple makes a strong case for investors looking for sustained returns from this global leader in technology. Therefore, with an earnings per share estimate of $6.57 in 2024 and a price-earnings multiple of 30, the stock can easily get back on track and reach $197 by year's end.

Bold $77 billion bet: Boosting shareholder value amidst iPhone challenges

As Apple continues exploring new growth areas to offset losses on its iPhone product line, it still generates optimum shareholder value. The company already has a $77 billion buyback program, the biggest in the industry, which underlines its robust financial health and management confidence about its prospects.

While Apple has yet to detail the number of shares it intends to repurchase, any buyback should result in a reduction in shares in circulation, in return increasing earnings per share, all else equal. The same earnings shared among small shares will always be worth more. By reducing the share count by 2% to 3% a year, the company should increase shareholders' return by a comparable amount annually.

If the management team had not been confident about long-term prospects amid the iPhone headwinds, the buyback program could have been cut and the amount redirected to other projects. Therefore, the $77 billion buyback program underscores the company's stability and growth potential.

Over the past decade, the company has spent nearly $658 billion on buybacks. Yet it continues to finance its research and development operations as one of the ways of staying ahead of the pack with unique products and services. In contrast, Alphabet (NASDAQ:GOOG) has spent nearly $240 billion on buybacks, opting to dedicate a good chunk of its cash flows toward research and development investments.

Given that Apple has been able to maintain its edge while offering one of the most sought-after smartphones and growing its software offering, this affirms the company's commitment to innovation.

Takeaway

Amid fluctuations in its iconic iPhone line and challenging market conditions, Apple stands resilient, backed by strategic shifts toward high-potential markets like home robotics and sustained financial maneuvers, including a $77 billion buyback program.

As Apple adapts to changing consumer trends and regulatory landscapes, it continues to drive shareholder value through innovative products and a robust business model aimed at long-term growth. Thus, investors should watch closely as Apple navigates these waters, bolstering its position with solid cash flows and a legacy of strategic foresight.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance