Here's the maths to figure out how much the Tesla of China may be worth in the future

Nio, known as the Tesla of China, debuted for trading in the US on Wednesday.

Shares surged 75% Thursday, despite Bernstein analyst Robin Zhu giving shares an "underperform" rating.

Nio's current $US12 billion market cap could double in five years, according to Evercore ISI.

Nio, known as the Tesla of China, could be worth double its current valuation in five years, according to analysts from Evercore ISI.

The stock had a disappointing debut on Wednesday. Nio priced shares at $US6.26 apiece, the low end of its range, raising $US1 billion. The electric-car maker had hoped to raise $US1.8 billion.

And while shares fell 10% in their first day of trading, they soared 75% on Thursday - despite Bernstein analyst Robin Zhu assigning an "underperform" rating and saying he thanks a capital raise is coming in the next 12 to 18 months.

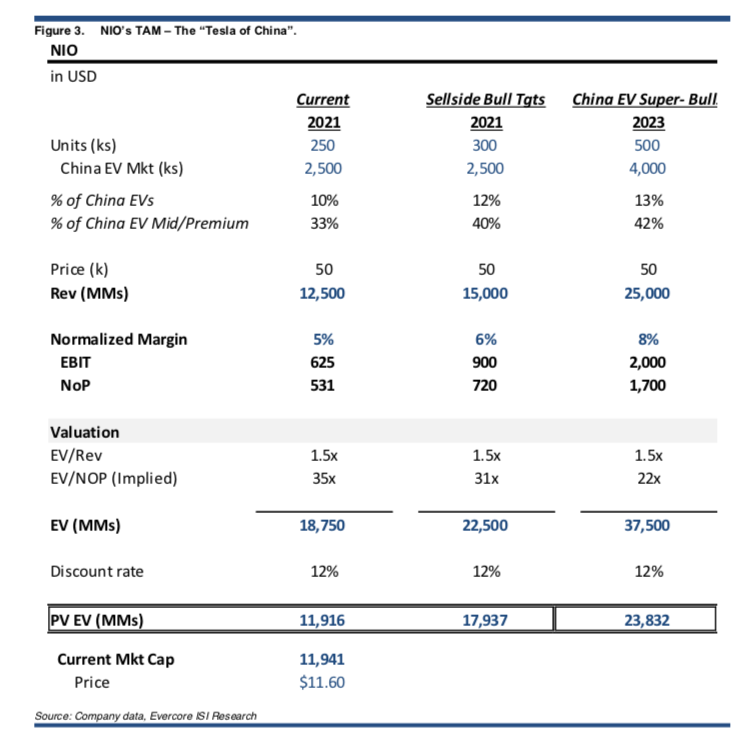

Those gains propelled Nio's valuation to $US12 billion. Wth investors looking further into Nio's future and expecting the company to run Tesla's playbook in China, Evercore ISI analysts did the maths to see just how much room there is for the car maker to grow.

The research team says China could have 4 million electric vehicles in 2023 with Nio will likely grabbing around 13% of total market share and 42% of mid- and premium- electric vehicles. And the Tesla of China's current $US12 billion valuation could double by that time.

"Enterprise-Value/Revenue multiples for tech companies are 1-3x EV/Rev (TSLA traded 1.4-3.7x EV/fwd 3yr Rev between 2012 and 2015)," the team of Evercore ISI analysts led by Arndt Ellinghorst wrote in a note sent out to clients on Friday.

"The current $US12 Billion valuation is likely discounting 250k cars sold in 2021, at~$US50k/car, at 1.5x EV/Rev," they added.

Now read:

Yahoo Finance

Yahoo Finance