Announcing: NantHealth (NASDAQ:NH) Stock Increased An Energizing 234% In The Last Year

Some NantHealth, Inc. (NASDAQ:NH) shareholders are probably rather concerned to see the share price fall 39% over the last three months. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 234% in that time. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

See our latest analysis for NantHealth

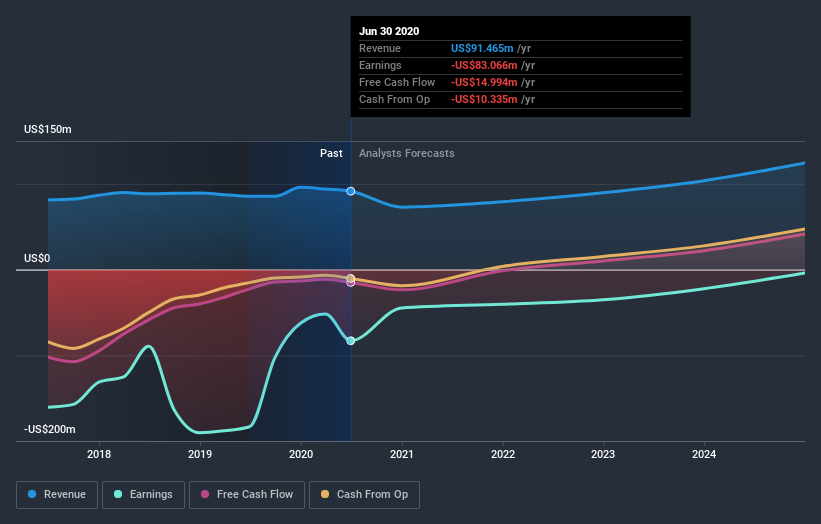

NantHealth isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

NantHealth grew its revenue by 7.1% last year. That's not a very high growth rate considering it doesn't make profits. In contrast, the share price took off during the year, gaining 234%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that NantHealth rewarded shareholders with a total shareholder return of 234% over the last year. What is absolutely clear is that is far preferable to the dismal 10% average annual loss suffered over the last three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that NantHealth is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance