Annaly's (NLY) Q2 Earnings Miss Estimates, NII Declines Y/Y

Annaly Capital Management, Inc. NLY reported second-quarter 2019 core earnings, excluding premium amortization adjustment (PAA), of 25 cents per share, missing the Zacks Consensus Estimate by a whisker. Moreover, the figure compares unfavorably with the year-ago tally of 30 cents.

Further, net interest income (NII) totaling roughly $177.4 million, witnessed a steep decline from the year-ago tally of $334.1 million.

Nonetheless, the company increased capital allocation to Agency from 76% to 78% during the quarter. This was driven by relative value of Agency mortgage backed securities (MBS) as compared to Credit Businesses. In addition, it managed to maintain a strong liquidity position, with unencumbered assets aggregating $7.8 billion in the June-end quarter.

Quarter in Detail

In the second quarter, average yield on interest-earning assets (excluding PAA) was 3.48%, up from the prior-year quarter’s 3.07%.

Net interest spread (excluding PAA) of 1.07% for the second quarter slid from 1.18% reported in the prior-year quarter. Net interest margin (excluding PAA) in the quarter came in at 1.28% compared with 1.56% witnessed in second-quarter 2018.

The company’s investment at fair value of Agency MBS was around $118.2 million as of Jun 30, 2019, up from $86.6 million as of Jun 30, 2018.

Moreover, Annaly’s book value per share came in at $9.33 as of Jun 30, 2019, compared with $10.35 as of Jun 30, 2018. Additionally, book value per share declined from $9.67 as of the prior-quarter end. At the end of the second quarter, the company’s capital ratio was 11.4%, down from 13.2% reported at the end of second-quarter 2018.

Leverage was 7:2:1 as of Jun 30, 2019, compared with 6:0:1 as of Jun 30, 2018. The company offered an annualized core return on an average equity of 9.94% in the April-June quarter, down from the prior-year quarter’s 11.05%.

Bottom Line

During the second quarter, Annaly made significant securitization efforts within the residential credit business by completing two residential whole loan securitizations, aggregating $772 million. Also, subsequent to the end of the quarter, it closed an additional securitization that increased aggregate issuance to $2.7 billion through seven transactions since the beginning of 2018. This apart, the company increased the number of residential whole loan origination partners by more than 25% during the April-June quarter.

Additionally, in June, the company authorized a $1.5-billion share-repurchase program, providing it additional flexibility within the company’s capital allocation framework. Hence, with balance-sheet strength, the company is well positioned to expand its portfolio efficiently.

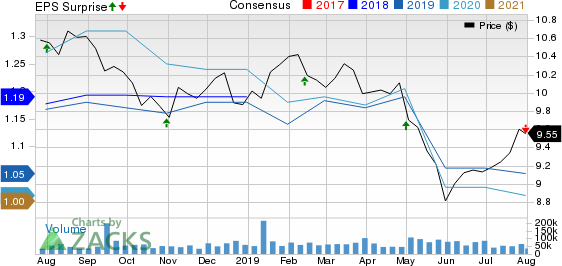

Annaly Capital Management Inc Price, Consensus and EPS Surprise

Annaly Capital Management Inc price-consensus-eps-surprise-chart | Annaly Capital Management Inc Quote

Currently, Annaly carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other REITs

AGNC Investment Corp. AGNC reported second-quarter 2019 net spread and dollar-roll income (excluding estimated catch-up premium amortization benefit) of 49 cents per share, marginally missing the Zacks Consensus Estimate of 50 cents. Moreover, it came in lower than the prior-year figure of 63 cents per share.

Cousins Properties Incorporated CUZ posted second-quarter FFO per share (before TIER transaction costs) of 71 cents, missing the Zacks Consensus Estimate by a whisker. The figure, however, came in higher than the prior-year quarter’s reported tally of 60 cents.

SL Green Realty Corp. SLG delivered second-quarter 2019 FFO of $1.82 per share, surpassing the Zacks Consensus Estimate of $1.73. The tally includes promote income from the sale of 521 Fifth Avenue of $3.4 million or 4 cents per share. Results also compared favorably with the year-ago quarter’s tally of $1.69.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGNC Investment Corp. (AGNC) : Free Stock Analysis Report

Annaly Capital Management Inc (NLY) : Free Stock Analysis Report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance