Analog Devices Appoints Anantha Chandrakasan to its Board

Analog Devices, Inc. ADI appoints Anantha Chandrakasan as the new independent director to its board. Chandrakasan will commence his operations from Jan 1, 2019. Previously, he was the dean of MIT’s School of Engineering, and the Vannevar Bush Professor of Electrical Engineering and Computer Science.

This latest move is expected to be beneficial for the company, courtesy of Chandrakasan’s solid technical background.

Prior to joining Analog Devices, he also co-chaired the MIT–IBM Watson AI Lab and chairs the MIT-SenseTime Alliance on Artificial Intelligence and J-Clinic, the Abdul Latif Jameel Clinic for Machine Learning in Health at MIT.

A glimpse of the company’s price trend shows that Analog Devices has outperformed the industry on a year-to-date basis. The stock has lost 1.1% compared with the industry’s 16.5% decline.

Factors at Play

Analog Devices increased focus on innovation and operational execution is expected to bode well in the near term. Also, the company continues to benefit from rising demand for semiconductor content in the Automotive, Communications and Industrial markets.

Per Statista, the semiconductor industry is expected to grow by 12.4% in 2018, with total sales reaching $463.41 billion worldwide.

During the last reported fourth-quarter 2018, the company witnessed 10%, 2% and 29% increase in revenues year over year in the Industrial, Automotive and Communications markets, respectively.

Analog Devices boasts of a well-functioning communications business as well. The buildout of TD-LTE in China, 4G network densification activities in the United States, and expected deployments in Europe and emerging regions should benefit the communications segment in the near term, increasing the chances of market share gains.

However, declining usage of the company’s products in portable consumer applications is a major headwind. In the last reported quarter, the company witnessed a 33% decline in consumer revenues year over year. Macro uncertainty and geopolitical fears are added concerns, which might hurt the company’s top line.

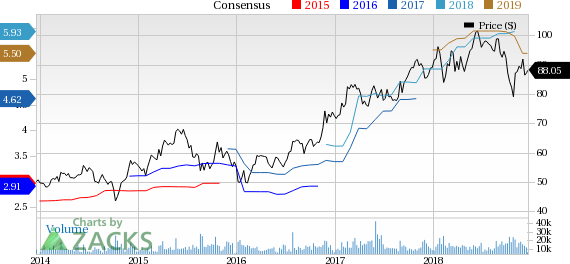

Analog Devices, Inc. Price and Consensus

Analog Devices, Inc. Price and Consensus | Analog Devices, Inc. Quote

Zacks Rank & Stocks to Consider

Currently, Analog Devices has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader computer and technology sector include Generac Holdings Inc. GNRC, SS&C Technologies Holdings, Inc. SSNC and Symantec Corporation SYMC. All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Generac, SS&C and Symantec’s long-term earnings growth rate is projected at 6.5%, 13.5% and 7.9%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Symantec Corporation (SYMC) : Free Stock Analysis Report

SS&C Technologies Holdings, Inc. (SSNC) : Free Stock Analysis Report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Generac Holdlings Inc. (GNRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance