Amneal (AMRX) Parkinson's Candidate Successful in Pivotal Study

Amneal Pharmaceuticals, Inc. AMRX announced positive top-line data from the pivotal phase III study — RISE-PD — evaluating its novel formulation candidate, IPX-203, in patients with Parkinson’s disease (PD) who have motor fluctuations. The company met its primary endpoint of “Good On” time as well as secondary endpoint of “Off” time.

Based on promising data from the pivotal study and other supported data, the company plans to file a new drug application seeking approval for the candidate as potential treatment for PD in mid-2022.

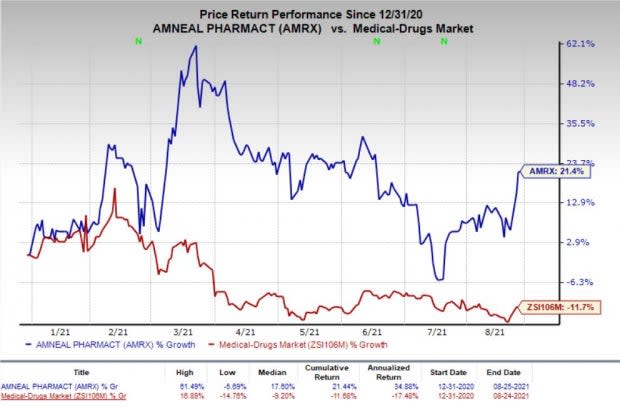

Shares of Amneal gained 14.4% during after-hours trading on Aug 25, following the study data readout. In fact, the company’s shares have increased 21.4% so far this year against the industry’s decrease of 11.7%.

Image Source: Zacks Investment Research

Please note that IPX-203 is an extended-release formulation of carbidopa/levodopa (CD/LD). The candidate’s formulation is also distinct from Amneal’s approved drug, Rytary — which is an extended-release CD/LD capsule.

The RISE-PD study evaluated IPX-203, which was dosed on average 3 times per day and immediate-release CD/LD was dosed on average 5 times per day. The study consisted of three weeks of open-label immediate-release CD/LD dose adjustment period followed by four weeks of open-label period for conversion to IPX-203, which was further followed by the 13-week double-blind treatment period.

Top-line data from study showed that IPX-203 demonstrated superior “Good On” time, measured in hours per day, from baseline compared to immediate-release CD/LD at the end of the 13-week treatment period. “Good On” time is defined by the sum of “On” time without dyskinesia and with non-troublesome dyskinesia.

The study data also showed that treatment with IPX-203 resulted in significantly less “Off” time compared with immediate-release CD/LD. The candidate also led to higher proportion of patients who were either “much improved” or “very much improved”, as measure by Patients' Global Impression of Change (PGI-C) scores. However, change in scores on Movement Disorder Society - Unified Parkinson's Disease Rating Scale from baseline were similar for IPX-203 and immediate-release CD/LD. Per data from a post-hoc analysis, IPX-203 increased “Good On” time by 1.55 hours per dose versus immediate-release CD/LD.

The company believes that despite introduction of new PD medications in past few years, there is still demand for medications with better duration of benefit. A potential approval to IPX-203 will also boost Amneal’s Specialty Pharma portfolio.

AMNEAL PHARMACEUTICALS, INC. Price

AMNEAL PHARMACEUTICALS, INC. price | AMNEAL PHARMACEUTICALS, INC. Quote

Zacks Rank & Stocks to Consider

Currently, Amneal has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the same sector include Ironwood Pharmaceuticals, Inc. IRWD, Avenue Therapeutics, Inc. ATXI and BioPath Holdings, Inc. BPTH. While Ironwood sports a Zacks Rank #1 (Strong Buy), Avenue Therapeutics and BioPath currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ironwood’s earnings per share estimates for 2021 have increased from $1.00 to $1.18 in the past 30 days while that for 2022 have increased from $1.20 to $1.72 over the same period. The stock has risen 27.2% in the year so far.

Avenue Therapeutics’ loss per share estimates for 2021 have narrowed from 27 cents to 26 cents in the past 30 days while that for 2022 have narrowed from 76 cents to 74 cents over the same period.

BioPath’s loss per share estimates for 2021 have narrowed from $1.76 to $1.36 in the past 30 days while that for 2022 have narrowed from $1.90 to $1.41 over the same period. The stock has risen 33.1% in the year so far.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ironwood Pharmaceuticals, Inc. (IRWD) : Free Stock Analysis Report

BioPath Holdings, Inc. (BPTH) : Free Stock Analysis Report

Avenue Therapeutics, Inc. (ATXI) : Free Stock Analysis Report

AMNEAL PHARMACEUTICALS, INC. (AMRX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance