Ameriprise (AMP) Q3 Earnings Beat, Revenues Rise Marginally

Ameriprise Financial’s AMP third-quarter 2019 adjusted operating earnings per share (excluding unlocking) of $4.24 surpassed the Zacks Consensus Estimate of $3.97. Further, the figure was 8.2% higher than the year-ago quarter.

Results benefited from a marginal improvement in revenues, and growth in assets under management (AUM) and assets under administration (AUA). Moreover, the company witnessed a marginal decline in expenses.

After taking into consideration several significant items, net income was $543 million or $4.04 per share, up from $503 million or $3.43 per share reported in the prior-year quarter.

Revenues Improve, Costs Decline

Net revenues (on a GAAP basis) were $3.32 billion, up marginally year over year. Moreover, the figure beat the Zacks Consensus Estimate of $2.96 billion. On an operating basis, total adjusted net revenues were $3.30 billion, up marginally year over year.

Adjusted operating expenses were $2.65 billion, down marginally from the prior-year quarter.

AUM & AUA Improve Marginally

As of Sep 30, 2019, total AUM and AUA was $921.28 billion, up nearly 1% year over year.

Capital Deployment

In the reported quarter, Ameriprise returned $676 million to shareholders in forms of share repurchases and dividends.

Our Take

Improving AUM balance and restructuring initiatives are expected to continue supporting the company. However, despite focusing on cost management, overall costs are expected to remain elevated in the near term because of the company’s hiring and technology upgrades. Moreover, significant outflows in the Asset Management segment are expected to hamper financials.

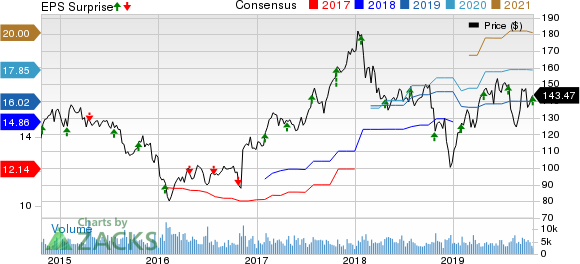

Ameriprise Financial, Inc. Price, Consensus and EPS Surprise

Ameriprise Financial, Inc. price-consensus-eps-surprise-chart | Ameriprise Financial, Inc. Quote

Ameriprise currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

BlackRock, Inc.’s BLK third-quarter 2019 adjusted earnings of $7.15 per share surpassed the Zacks Consensus Estimate of $6.95. However, the figure was 4.9% lower than the year-ago quarter’s number.

Blackstone’s BX third-quarter 2019 distributable earnings of 58 cents surpassed the Zacks Consensus Estimate of 54 cents. However, the figure declined from 63 cents earned in the prior-year quarter.

Cohen & Steers’ CNS third-quarter 2019 adjusted earnings of 65 cents per share beat the Zacks Consensus Estimate of 63 cents. Also, the bottom line was 1.6% higher than the year-ago quarter figure.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Blackstone Group Inc/The (BX) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance