America's top fund is run by a father-son duo from the shores of Lake Minnetonka

The best performing mutual fund so far this year is not managed by a Wall Street heavy hitter or a team of wunderkind quantitative analysts. Rather, it’s run by a father-son duo, aged 87 and 63, out of Wayzata, Minnesota. And it’s crushing the market.

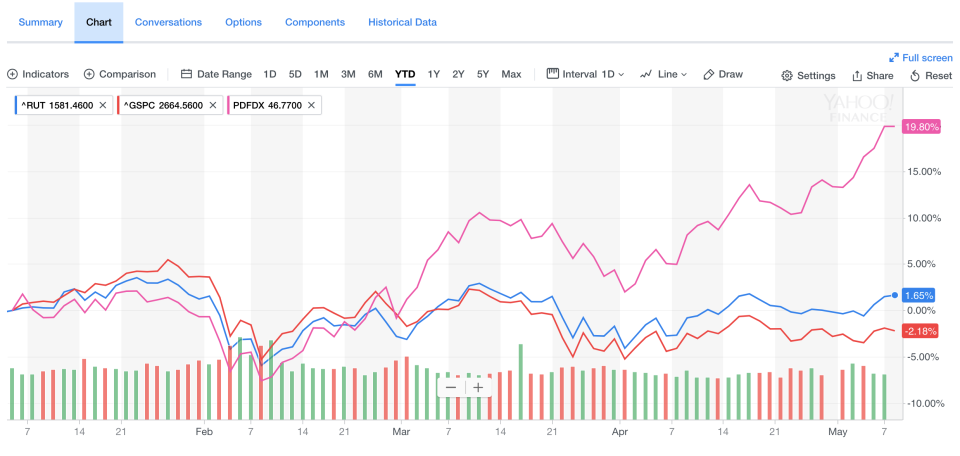

The Perkins Discovery Fund (PDFDX), a micro-cap boutique fund with less than $10 million in holdings, has gained 19.8% so far this year as the broader stock market has stumbled with the benchmark S&P 500 (^GPSC) down 2.2% year-to-date.

Perkins Capital, run since 1985 by Richard and Daniel Perkins, created the fund as a vehicle for children’s IRAs and smaller portfolios. So far this year it is providing returns well above benchmarks and outpacing even other top mutual funds by a wide margin, data from Thomson Reuters Lipper shows.

The Discovery Fund has gained nearly 4% more year-to-date than the second-highest returning equity fund and close to 10% more than the third-highest performing equity fund. The fund’s percentage gain so far this year is almost 9% higher than the average of the next 24 funds in Lipper’s calculation of 2018’s top 25 performing equity funds.

Winning in a volatile market

Since February, when stocks began a swoon that has persisted for much of the market since, the Perkins Discovery Fund has also been the top performing equity fund, returning around 20%, according to Lipper data. The S&P is down more than 3%, the Dow (^DJI) has fallen 4.5%, the Nasdaq has edged up 0.6% and the Russell 2000 (^RUT) small-cap index is up just 2.4% during that time.

Perkins Capital’s vice president and portfolio manager, Daniel Perkins, told Yahoo Finance the key to success has been picking winning companies that have generated consistent returns.

That’s hardly atypical advice. What has been unusual is the rate at which the fund’s stock picks have skied for much of this year. Top fund holdings AxoGen Corp. (AXGN), a medical device manufacturer specializing in nerve repair, is up 55% this year; BioTelemetry, Inc. (BEAT), a wireless medical technology company, has risen 35.3%; and Vericel Corp. (VCEL), a cell therapy product marketing company, is up 122.9%.

“We look at a lot of different ideas and try to find companies that have some change taking place, a new product or new management, sometimes, or a new process that we think can result in significant growth in the future,” Perkins said.

While Perkins Capital Management oversees about $150 million for various clients, the Perkins Discovery Fund is its only mutual fund.

Domestically-oriented U.S. small caps in favor amid trade tensions

The fund has benefitted from the resurgence of small cap stocks, which have jumped this year thanks in part to investor fear of trade tensions between the United States and China that have jilted confidence in many multi-national companies, as well as from U.S. tax reform legislation passed earlier this year that analysts say provides an outsized benefit to small businesses.

But it’s even stampeding over the Russell 2000, which is up 1.6% for 2018.

“A lot of funds have hundreds of holdings, so they basically perform like the market,” Perkins said. “But by having a somewhat more concentrated fund by stock picking we can perform differently than the market in general.”

He said that Perkins finds companies to invest in through a combination of road shows, financial journals and company outreach. Many of the companies, have met with Daniel and his father in Perkins Capital’s conference room in Wayzata, “on the shores of Lake Minnetonka,” Perkins said.

Recently, healthcare stocks have caught the Perkins’ eye and become a major part of the fund, currently making up 13 of the 22 holdings. However, Perkins said he doesn’t consider the Discovery Fund to be a healthcare dedicated portfolio.

However, the Perkins family has a history in the medical field, as Richard began his investing career as a portfolio manager for the Mayo Foundation at the Mayo Clinic in Rochester, Minnesota.

FAANG-less

Their fund hasn’t always been an outperformer, falling short of the Russell 2000 on a 10-year return basis, according to Perkins’ financial disclosures, and it has seen its share of outflows as big-name stocks like Facebook, Amazon and Google dominated investor conversations. A 2008 media report cited Perkins’ assets under management at $300 million, more than double the level Daniel Perkins said the company oversees now. The Discovery Fund also has seen outflows as a number of clients sought larger companies with more stable returns.

“For years, if you didn’t own the FAANG stocks, you just plain old underperformed and those were never the stocks that we owned,” Perkins said. “They’ve run up so much that now the smaller companies are doing much better.”

Still, over 15 years it has outperformed the S&P, returning an average of 9.57%, and run just below the Russell’s 10.03% return over that time frame, according to the company. If this year’s outperformance continues more investors and clients could soon be showing up on the shores of Lake Minnetonka seeking out the Perkins’ counsel.

—

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

Yahoo Finance

Yahoo Finance