American Water Works (AWK) Tops on Q2 Earnings & Revenues

American Water Works Company AWK posted second-quarter 2022 operating earnings per share (EPS) of $1.20, which surpassed the Zacks Consensus Estimate of $1.14 by 5.3%. The bottom line improved 5.3% from the year-ago earnings of $1.14 per share.

The year-over-year increase was primarily due to the implementation of new rates in the Regulated Businesses from infrastructure investments, somewhat offset by the impacts of inflationary pressures.

Total Revenues

Total revenues of $937 million surpassed the Zacks Consensus Estimate of $924 million by 1.4%. The top line declined 6.2% from the year-ago figure of $999 million.

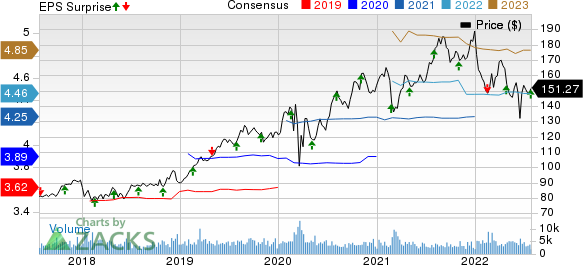

American Water Works Company, Inc. Price, Consensus and EPS Surprise

American Water Works Company, Inc. price-consensus-eps-surprise-chart | American Water Works Company, Inc. Quote

Highlights of the Release

Total operating expenses for the second quarter amounted to $610 million, down 8.8% from the year-ago quarter’s $669 million due to a decrease in operating and maintenance expenses.

The operating income was $327 million, up 0.9% from the year-ago figure of $330 million. The new rates (effective from Jan 1, 2022) will boost annual revenues by $103 million and the pending rate case, if approved without any change, will further increase the top line by $598 million.

American Water Works continues to expand operations through acquisitions and organic means. Till Jun 30, 2022, it added 51,000 customers to its base through nine closed acquisitions in four states. AWK’s pending acquisitions (as of Jun 30), when completed, will add another 29,200 customers through 30 acquisitions.

In the first half of 2022, American Water Works invested $1.25 billion in infrastructure improvements to provide quality services to its expanding customer base.

Just after the close of the second quarter, AWK received its first long-term deal to serve the U.S. Navy. American Water Works, through its Military Service Group, is currently serving 18 military installations.

Segment Details

Regulated businesses’ net income in the second quarter of 2022 was $219 million compared with $215 million in the year-ago quarter.

Market-Based businesses reported a net loss of $1 million in the second quarter of 2022 compared with $8 million in the second quarter of 2021.

Financial Highlights

Cash and cash equivalents amounted to $71 million as of Jun 30, 2022, down 38.8% from $116 million as of Dec 31, 2021.

The total long-term debt was $11,026 million as of Jun 30, 2022, up 6.6% from $10,344 million as of Dec 31, 2021.

Guidance

American Water Works affirmed the 2022 earnings guidance at $4.39-$4.49 per share. The Zacks Consensus Estimate for 2022 earnings of $4.46 per share is higher than $4.44, the mid-point of the company’s guided range. AWK reiterated long-term earnings growth of 7-9% for 2022-2026.

American Water Works aims to invest $2.5 billion across its service areas in 2022 to further strengthen its operation.

Zacks Rank

American Water Works currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

American States Water Co. AWR is slated to report second-quarter 2022 earnings on Aug 1, after market close. The Zacks Consensus Estimate for American States Water’s second-quarter EPS is pegged at 77 cents.

The Zacks Consensus Estimate for AWR’s 2022 earnings is pegged at $2.59 per share, implying year-over-year growth of 4.9%.

Global Water Resources GWRS is slated to report second-quarter 2022 earnings on Aug 11, before market open. The Zacks Consensus Estimate for Global Water Resources’ second-quarter EPS is pegged at 5 cents.

The Zacks Consensus Estimate for GWRS’ 2022 earnings is pegged at 19 cents per share, implying year-over-year growth of 18.8%.

Essential Utilities Inc. WTRG is slated to report second-quarter 2022 earnings on Aug 3, after market close. The Zacks Consensus Estimate for Essential Utilities’ second-quarter EPS is pegged at 31 cents.

The Zacks Consensus Estimate for WTRG’s 2022 earnings is pinned at $1.78 per share, implying year-over-year growth of 6.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

American States Water Company (AWR) : Free Stock Analysis Report

Global Water Resources, Inc. (GWRS) : Free Stock Analysis Report

Essential Utilities Inc. (WTRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance