American Tower (AMT) Q1 AFFO & Revenues Top, '23 View Revised

Shares of American Tower Corporation AMT are up 1.44% in the pre-market session after it reported first-quarter 2023 adjusted funds from operations (AFFO) per share, attributable to AMT common stockholders, of $2.54, beating the Zacks Consensus Estimate of $2.38. The figure also surpassed our estimate of $2.44.

Results reflect improving revenues across its Property segment. American Tower recorded healthy year-over-year organic tenant billings growth of 6.4% and total tenant billings growth of 7.3%. It also revised its 2023 outlook.

The company has clocked in total revenues of $2.77 billion, outpacing the Zacks Consensus Estimate of $2.74 billion. We estimated the same to be $2.69 billion.

On a year-over-year basis, while total revenues improved 4%, AFFO per share was lower than the prior-year quarter’s tally by a penny.

Quarter in Detail

Adjusted EBITDA was $1.76 billion, up 8.6% from the prior-year period. The adjusted EBITDA margin was 63.7% in the quarter.

In the reported quarter, AMT spent roughly $61 million on acquisitions. Of this, $10 million was spent for the purchase of eight communications sites and other communications infrastructure assets in the United States, Canada, Poland and Spain. The remaining amount reflects cash paid in association with the sites acquired in 2022.

Property Operations

Revenues were $2.71 billion, up 4.4% on a year-over-year basis. Our estimate for the same stands at $2.63 billion. The operating profit was $1.79 billion, and the operating profit margin was 66%.

In the Property segment, revenues from the United States and Canada totaled $1.29 billion, up 4.5% year over year. Total international revenues amounted to $1.22 billion, rising 3.4%. Newly formed Data Centers added $203 million to Property revenues, up 10.3% from $184 million in the prior-year period.

Service Operations

Revenues totaled $53 million in the reported quarter, down from $60 million in the prior-year quarter. We expected the same to be $60.6 million. The operating profit was $28 million and the operating profit margin was 53% in the January-March quarter.

Cash Flow & Liquidity

In the first quarter, American Tower generated $1.07 billion of cash from operating activities, jumping 61.3% year over year. Free cash flow in the period was $598 million, significantly rising from the year-ago quarter.

As of Mar 31, 2023, the company had $7.7 billion in total liquidity. This comprised $1.8 billion in cash and cash equivalents, and availability of $5.9 billion under its revolving credit facilities (net of any outstanding letters of credit).

Revised 2023 Guidance

American Tower anticipates total property revenues of $10,665-$10,845 million, suggesting a year-over-year improvement of 2.7% at the mid-point. The earlier guided range was $10,685-$10,865 million.

The adjusted EBITDA was maintained at $6,860-$6,970 million. This indicates a mid-point increase of 4.1%.

The consolidated AFFO is now projected in the band of $4,450-$4,560 million, implying a year-over-year mid-point decline of 0.3%. The company’s prior expectations ranged from $4,675 million to $4,785 million.

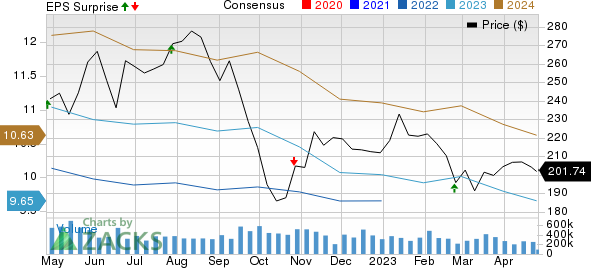

AFFO per share is now expected to be $9.53-$ 9.76, indicating a fall at the mid-point of 1.1%. The prior projected range was $9.49-$9.72. The Zacks Consensus Estimate for the same is pegged at $9.65, which lies within the company’s guided range.

The company retained its guidance for capital expenditure between $1,650 million and $1,760 million.

Currently, AMT carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Tower Corporation Price, Consensus and EPS Surprise

American Tower Corporation price-consensus-eps-surprise-chart | American Tower Corporation Quote

Performance of Other REITs

SL Green Realty Corp. SLG reported first-quarter 2023 FFO per share of $1.53, surpassing the Zacks Consensus Estimate of $1.42. It also beat our estimate of $1.39. The reported figure, however, fell 7.3% from the year-ago quarter’s $1.65.

SLG’s results reflected better-than-anticipated revenues. However, a fall in occupancy in Manhattan’s same-store office portfolio was a deterrent for the company in the first quarter.

Crown Castle Inc. CCI reported first-quarter 2023 AFFO per share of $1.91, lagging the Zacks Consensus Estimate of $1.94. The figure, however, compared favorably with the year-ago period’s $1.87. Our estimate for the same was pegged at $1.98.

Higher operating expenses in the quarter were a deterrent. Nonetheless, the rise in site-rental revenues amid elevated tower space demand aided CCI’s year-over-year top-line growth. The company maintained its outlook for 2023.

Alexandria Real Estate Equities, Inc. ARE reported first-quarter 2023 AFFO per share of $2.19, surpassing the Zacks Consensus Estimate of $2.15. The reported figure climbed 6.8% from the year-ago quarter’s tally. We estimated AFFO per share for the quarter to be $2.14.

ARE’s results reflected better-than-anticipated revenues on healthy leasing activity and solid rental rate growth.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT) : Free Stock Analysis Report

Crown Castle Inc. (CCI) : Free Stock Analysis Report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance