American Public (APEI) Q1 Earnings & Revenues Lag Estimates

American Public Education, Inc. APEI reported lower-than-expected results in first-quarter 2022. Quarterly earnings and revenues missed the Zacks Consensus Estimate. Although revenues increased owing to higher enrollment, earnings declined on a year-over-year basis due to increased costs and expenses.

Notably, APEI completed the acquisitions of Rasmussen University ("RU") and GSUSA on Sep 1, 2021, and Jan 1, 2022, respectively. However, prior-year results did not include the results of operations of RU and GSUSA. Also, they were not directly comparable to the current period.

Delving Deeper

The company reported adjusted earnings per share of 12 cents, which missed the consensus mark of 19 cents by 36.8% and decreased from 49 cents a year ago.

Total revenues of $154.7 million also came in below the consensus mark of $157 million by 1.5% but increased 75% from the year-ago period’s level. The upside was backed by the acquisitions and higher enrollment.

Total costs and expenses increased nearly 92% year over year to $149.5 million due to the inclusion of RU. Adjusted EBITDA increased 8.8% year over year to $17.4 million.

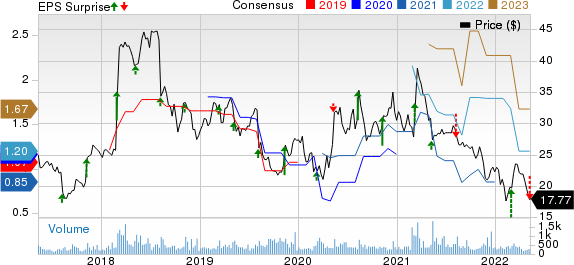

American Public Education, Inc. Price, Consensus and EPS Surprise

American Public Education, Inc. price-consensus-eps-surprise-chart | American Public Education, Inc. Quote

Segment Discussion

The company now operates within three segments, namely, American Public University System (“APUS”), RU and Hondros College of Nursing (“HCN”).

APUS: Revenues declined 5.7% from the year-ago period to $73.1 million. Enrollments grew 1.2% but revenues declined owing to the timing of registrations during the quarter. Also, lower revenue per net course registrations led to the decline, given a change in mix to military registrations, which generate lower revenue per registration than non-military registrations.

APUS’s total net course registration increased 1.2% from the year-ago period to 94,000 in the first quarter.

RU: The segment reported revenues of $67.1 million for the quarter. RU’s total student enrollment also fell 6.4% from the prior-year quarter’s figure to 16,200.

HCN: This segment’s revenues rose 3.7% year over year to $11.5 million, owing to improved enrollment. Total student enrollment at HCN increased 8.1% from the prior-year quarter’s level to 2,500.

Meanwhile, GSUSA contributed $3.1 million to total revenues in the quarter.

Financials

At March 2022-end, American Public had total cash and cash equivalents of $170.9 million compared with $149.6 million at 2021-end.

Higher cash provided by operating activities and net cash received as a result of the GSUSA acquisition led to the upside. However, increases in capital expenditures and payments of principal and interest on debt obligations partly offset the positives.

Q2 Guidance

The company expects total revenues to increase 92-97% year over year. The Zacks Consensus Estimate for the metric is pegged at $153.5 million, indicating growth of 96.7% year over year.

APEI expects earnings within break-even at seven cents per share, indicating a decline of 100-133% year over year. However, the consensus mark for second-quarter earnings is currently pegged at 22 cents, suggesting growth of 633.3% from the prior-year quarter.

Adjusted EBITDA is anticipated within $14.3-$16.2 million, suggesting a rise of 44-63% year over year.

At APUS, total net course registrations are likely to fall 2-1% year over year to 80,900-83,400. HCN’s total student enrollment is expected to increase by 3% from the prior year’s tally to 2,400. RU’s student enrollment is likely to fall 6% from the year-ago quarter’s figure to 15,900 (due to a 2% decline in Nursing and a 10% decline in Non-Nursing).

Zacks Rank

APEI currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Look at Some Recent Consumer Discretionary Releases

Adtalem Global Education Inc. ATGE reported mixed third-quarter fiscal 2022 results. The company’s earnings lagged the Zacks Consensus Estimate due to the pandemic-related challenges, but revenues beat the same.

On a year-over-year basis, ATGE’s quarterly revenue and earnings increased on the back of the Walden acquisition.

Strategic Education, Inc. or SEI STRA reported lackluster results for first-quarter 2022.

STRA’s quarterly earnings and revenue missed the Zacks Consensus Estimate and declined on a year-over-year basis due to lower contributions from all three segments.

Mohawk Industries, Inc. MHK reported impressive results for first-quarter 2022. Earnings and sales surpassed their respective Zacks Consensus Estimate and improved on a year-over-year basis.

The uptrend in MHK’s first-quarter results was backed by record sales, higher pricing, growth in ceramic businesses, improving commercial sector and benefits from small buyouts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance