American Express and Emburse Bring Integrated Expense Management Solution to Commercial Customers

Integration between American Express and Emburse makes it easier for small businesses and corporations to gain better visibility into spend, reduce errors, and save employees time

NEW YORK & DALLAS, May 21, 2024--(BUSINESS WIRE)--American Express (NYSE:AXP) and Emburse:

What it is:

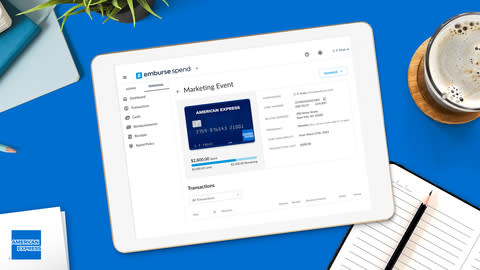

American Express, a leader in global business payments, and Emburse, a leading provider of travel and expense software, are partnering to offer end-to-end virtual card issuance, card reconciliation, and expense management in Emburse Spend1, an all-in-one expense management solution, to American Express customers.

Customers can now connect their American Express Card programs to Emburse Spend. Card Members can enroll their eligible commercial American Express Card to issue American Express virtual Cards (a dynamic payment option that replaces a physical card number with a digital card number) on demand within the platform. Expenses from Cards and virtual Cards will automatically enter the accounting system for easy reconciliation. Enrollment required and fees may apply.

Who it’s for:

Eligible American Express® Business, Corporate, or Corporate Purchasing Card customers seeking a single solution for virtual card issuance, card reconciliation, and expense management.

Why it matters:

Streamlined Processes & Approvals: The integration pre-codes every eligible American Express transaction with vital expense information (category codes, custom expense fields), making expense submissions and approvals effortless.

Added Security & Transparency: American Express virtual Cards help businesses maintain control over budgets and securely manage recurring expenses and one-off vendor payments through unique tokens that have pre-set parameters for each Card, including budget, expiration, and per-transaction limits.

Optimized Spending & Compliance: This integration brings transactions from eligible American Express Cards, virtual Cards issued from those accounts, and other payment methods into Emburse Spend, so finance leaders can better understand and optimize their spending across payment methods and minimize out-of-policy transactions.

American Express and Emburse on-the-record:

"Embedding American Express payments in Emburse Spend improves automation, strengthens controls and compliance, and boosts employee productivity. We’re seeing businesses benefit from the transparency and enhanced security of virtual cards, which are quickly becoming an integral form of business payments," said Widad Chaoui, Vice President of Corporate Solutions Product Management at American Express.

"American Express has long been a strong partner to small and medium-sized businesses, so we’re thrilled that its Commercial Card customers can now benefit from Emburse Spend’s user-friendly, integrated card and expense management capabilities," said Marne Martin, CEO at Emburse. "Emburse Spend simplifies the way employees make and expense purchases, streamlines bill payments, and reduces the need for finance teams to spend hours on manual reconciliation."

Customer testimonial:

"Emburse Spend is an extremely convenient solution that allows us to issue American Express virtual Cards and our employees to easily categorize expenses via the mobile app. This unified solution has already saved me countless hours previously spent reviewing and categorizing all employee spending on my own. The capability to map each individual employee into their respective cost centers is another incredibly useful feature. This has been pivotal in my monthly financial analysis and budgeting, as it’s a new insight that’s shown me where we are spending too much or too little," said Khory Lee, Controller, ASAP Heating & Air, Emburse and American Express customer.

Learn more:

Emburse Spend is available to eligible American Express Business, Corporate, and Corporate Purchasing Card customers today. For more information, please visit here.

1 Card enrollment required for eligible American Express Business, Corporate, and Corporate Purchasing Cards. Separate enrollment with each of Emburse and American Express is required to utilize combined product offering. To pay a supplier using an eligible American Express Business, Corporate, or Corporate Purchasing Card within the Emburse platform, the supplier must be an American Express accepting merchant. Additional upgrades, features, and payment methods may require separate activation with Emburse, and fees may apply as determined by Emburse. Please contact your American Express representative to learn more. Not all general ledger software is compatible with Emburse. Please contact American Express for information.

About American Express

American Express is a globally integrated payments company, providing customers with access to products, insights and experiences that enrich lives and build business success. Learn more at americanexpress.com and connect with us on facebook.com/americanexpress, instagram.com/americanexpress, linkedin.com/company/american-express, twitter.com/americanexpress, and youtube.com/americanexpress.

Key links to products, services and corporate responsibility information: personal cards, business cards and services, travel services, gift cards, prepaid cards, merchant services, Business Blueprint, Resy, corporate card, business travel, diversity and inclusion, corporate responsibility and Environmental, Social, and Governance reports.

About Emburse

Emburse’s expense, travel management, accounts payable, and payments solutions are trusted by more than 12 million professionals, including CFOs and finance teams, travel managers, and business travelers. More than 20,000 organizations in 120 countries, from Global 2000 corporations and small-medium businesses, to public sector agencies and nonprofits, count on us to manage expenses with ease, providing user-friendly tools and personalized support.

Our AI-based automation and mobile-first product approach eliminate manual, time-consuming expense submissions, approval and reconciliation. We deliver efficiency and time savings, increase financial visibility, enhance spend control and compliance, and improve the business travel experience. This empowers our customers and their teams to focus on what matters most in their personal and professional lives.

For more information visit emburse.com, or follow our social channels at @emburse.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240521713077/en/

Contacts

Margaret Manning

American Express

Margaret.k.manning@aexp.com

Emburse

emburse@firebrand.marketing

Yahoo Finance

Yahoo Finance