Amazon shares could surge to $3,000 in two years, Jefferies says

Amazon's (AMZN) stock price could hit $3,000 in just two years, a 65% upside from present levels, according to equity analysts at investment bank Jefferies.

In a new note, the Jefferies team led by Brent Thill reiterated their current price target of $2,300, about 27% above current levels. Shares of Amazon were last trading around $1,828.

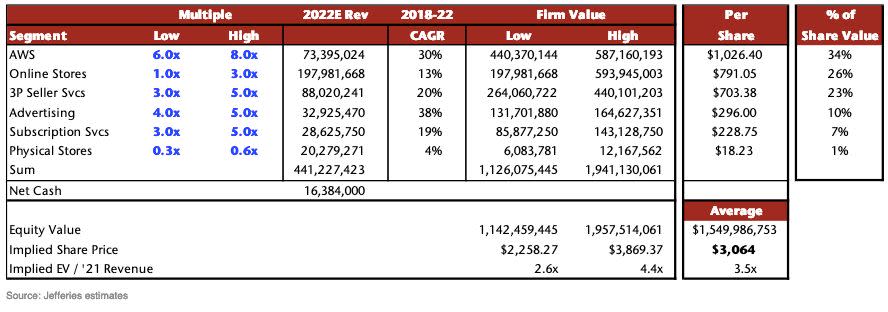

In an updated sum-of-the-parts analysis using 2022 revenue estimates, they laid out a roadmap to $3,000. They argued that Amazon’s growth opportunities in several areas are underappreciated.

"Amazon has just scratched the surface in many of its existing markets and we do not believe they need to open new storefronts to achieve our valuation," Thill wrote. "We examined 6 of Amazon’s core businesses (AWS, core retail, [third party] seller services, advertising, grocery, and subscription) and applied mostly conservative / discounted multiples to each business."

Jefferies noted that AWS, advertising, and third-party seller services are all growing faster than the core retail business and are also more profitable.

"We estimate conservatively these businesses will be on a combined ~$194B run rate by 2022 (vs. cons at $220B+), accounting for ~44% of total revenue, but 66% of Amazon’s value. We have high confidence these high-recurring revenue / high-margin businesses warrant higher multiples than the core business and expect investors to recognize their embedded value."

What's more, the Jefferies analysis doesn't take into consideration the potential upside from new businesses such as healthcare, which is a $3 trillion industry ripe for disruption.

Shares of Amazon are up 21% year-to-date.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Yahoo Finance

Yahoo Finance