Amazon crosses $2,000 per share, on way to $1 trillion club

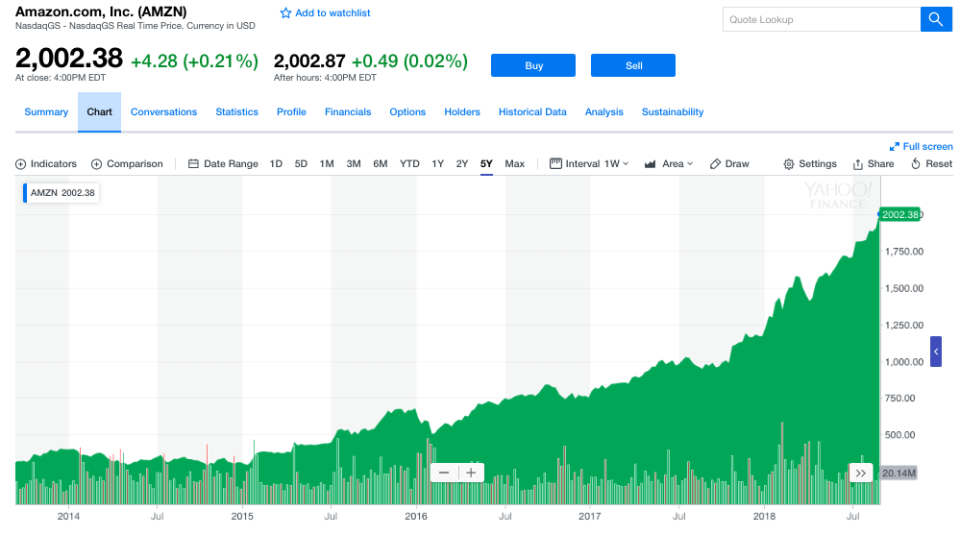

Amazon (AMZN) crossed $2,000 per share for the first time on Thursday morning as the e-commerce giant heads toward a $1 trillion market cap. The stock ended the day at $2,002.38.

If the stock reaches $2,050.27 per share, Amazon would become the second U.S.-listed company to be worth $1,000,000,000,000. Apple (APPL) crossed that threshold on August 2. Amazon’s stock is up more than 600% over the past five years.

Amazon’s stock surged more than 3% on Wednesday after Morgan Stanley analysts published a note detailing why $AMZN could reach $2,500 per share.

“We are raising our price target from $1,850 to $2,500 … as we have increasing confidence that Amazon’s rapidly growing, increasingly large, high margin revenue streams (advertising, [Amazon Web Services], subscriptions) will drive higher profitability and continued upward estimate revisions,” the note stated.

‘The growth prospects for this company seem almost unlimited’

Amazon is known for an increasingly robust ecosystem of services ranging from its Amazon Prime paid subscription service to Amazon Web Services (AWS) — which provides on-demand cloud computing platforms — to the Whole Foods Market grocery chain and live-streaming video platform Twitch.

“[Amazon CEO] Jeff Bezos doesn’t seem to see any territory that he’s not willing to get into,” Yahoo Finance’s Rick Newman says in the video above. “That’s why the growth prospects for this company seem almost unlimited, even as big as it is.”

READ MORE:

Yahoo Finance

Yahoo Finance