AMark Precious Metals Q4 Preview: Can Shares Stay Hot?

The Zacks Consumer Discretionary Sector has been hit harder than most in 2022, down more than 30%. Even over the last month, the sector’s 1% gain has lagged behind the S&P 500 notably. Facing record-high inflation, consumers have heavily pulled back their spending on non-essential items.

A company in the sector, A-Mark Precious Metals AMRK, is slated to unveil earnings on Tuesday, August 30th, after market close.

A-Mark Precious Metals operates as a full-service precious metals trading company offering a wide array of products, including gold, silver, platinum, and palladium. Further, its services include financing, leasing, consignment, hedging, and various customized financial programs.

How does everything shape up heading into the quarterly print? Let’s take a closer look.

Share Performance & Valuation

AMRK shares have been notably strong year-to-date, increasing a stellar 20% in value and crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

A-Mark Precious Metals shares have continued their market-beating trajectory over the last month, tacking on 19% in value vs. the S&P 500’s -1.4% decline.

Image Source: Zacks Investment Research

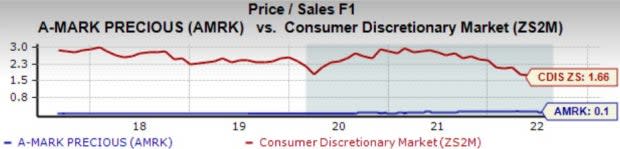

In addition to the favorable price action, AMRK shares trade at rock-solid valuation levels – the company’s 0.1X forward price-to-sales ratio is tiny, reflecting a staggering 95% discount relative to its Zacks Consumer Discretionary Sector.

AMRK carries a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

A singular analyst has upped their quarterly earnings outlook over the last 60 days, with the Consensus Estimate Trend increasing marginally. Still, the Zacks Consensus EPS Estimate of $1.41 reflects a 34% drop-off in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

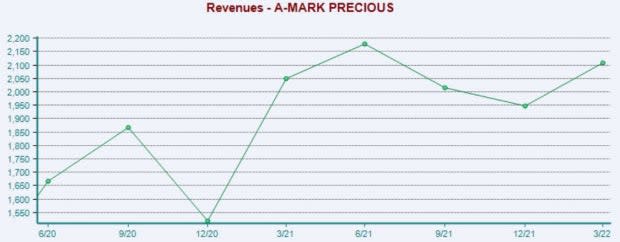

The company’s top-line appears to be undergoing some turbulence as well – the Zacks Consensus Sales Estimate for the quarter resides at $2.1 billion, penciling in a 5% year-over-year drop.

Quarterly Performance & Market Reactions

AMRK has been on an impressive earnings streak, exceeding the Zacks Consensus EPS Estimate in five consecutive quarters. Just in its latest print, the company registered a substantial 130% bottom-line beat.

Top-line results have also been strong as of late, with American Precious Metals Company exceeding quarterly revenue estimates in four of its previous five quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Expect shares to be very volatile in response to the release – over AMRK’s previous six quarterly prints, shares have climbed as high as 19% and fallen as far as 15% following the release.

Putting Everything Together

AMRK shares have posted market-beating returns YTD and over the last month, indicating that buyers have been busy.

In addition, shares trade at solid valuation levels, further displayed by its Style Score of an A for Value.

One analyst has lowered their quarterly outlook, and estimates reflect declines in both revenue and earnings.

As of late, the company has had little issue exceeding quarterly estimates. Still, expect shares to be highly volatile following the release.

Heading into the print, American Precious Metals Company AMRK carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -9.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMark Precious Metals, Inc. (AMRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance