Altria's Juul Vaping Misadventure Is a Scorcher

(Bloomberg Opinion) -- Altria Group Inc.’s investment in Juul Labs Inc. is getting vaporized.

The tobacco giant on Thursday announced a $4.1 billion non-cash charge related to its stake in the maker of electronic cigarettes. It’s the second writedown in three months, and means Altria’s 35% stake is now valued at $4.2 billion, about a third of its original $12.8 billion investment. Altria shares more than 5% in midday trading.

The Marlboro maker’s Juul transaction, in December 2018, was part of a familiar playbook across Big Tobacco. With demand for cigarettes declining, it had little choice but to join other market leaders in the industry in pivoting toward alternatives with potentially lower health risks, but higher growth prospects.

For most players, there have been hurdles along the way. Two years ago, for example, demand for devices that heat rather than burn tobacco slowed in Japan — the biggest market for this kind of alternative — which was a problem for Philip Morris Intenational Inc. and the U.K.’s British American Tobacco Plc. Unfortunately, with Juul, Altria has encountered more challenges than most.

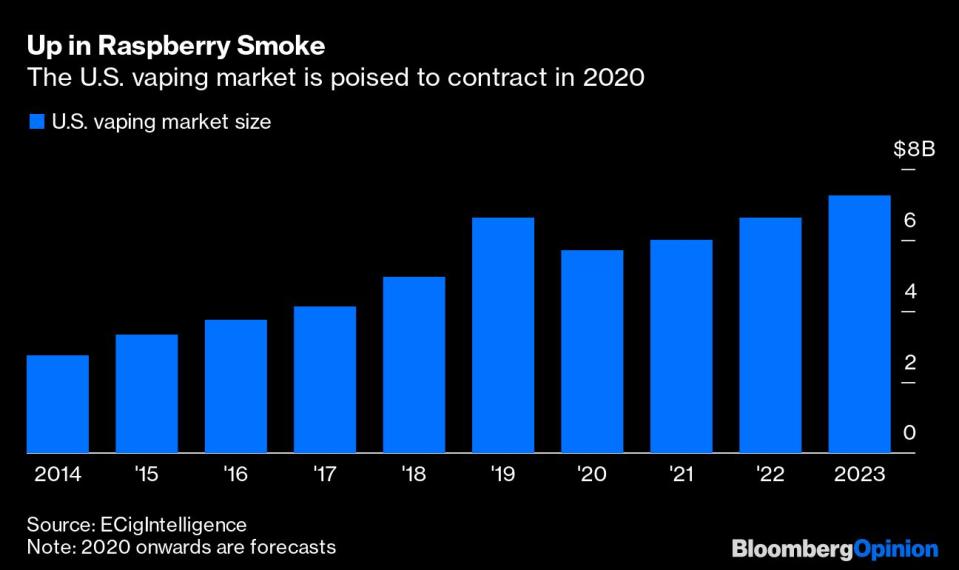

A crisis has engulfed the vaping industry after a spate of illnesses and deaths related to electronic cigarette use. Even though there is a growing consensus that these occurrences involved vaping oils carrying the psychoactive ingredient in cannabis, the events have taken their toll on the U.S. vaping market.

Juul has been at the forefront of criticism, besieged by lawsuits accusing it of using sweet fruit and candy flavors to overtly target underage users. The Food and Drug Administration recently announced a ban on flavors aside from menthol and tobacco for pod-based electronic cigarettes, such as those made by Juul, pending new rules coming into force in a few months time. Kenneth Shea, analyst at Bloomberg Intelligence, says Juul’s many challenges must include the possibility that the FDA doesn’t approve it to remain on the U.S market. All manufacturers must submit their applications to keep their products on sale by May.

Along with the Juul writedown, Altria has moved to renegotiate the terms of its agreement with Juul. It has the option to be released from a non-compete clause if Juul can’t sell electronic cigarettes in the U.S. for at least a year – acknowledging the possibility that Juul won’t get FDA approval -- or if the value of its investment falls below $1.28 billion. This paves the way for Altria to introduce its own vaping cigarettes, or, more likely, according to Bloomberg Intelligence’s Shea, a move away from electronic cigarettes to heat-not-burn. Unlike electronic cigarettes, these haven’t been drawn into the vaping crisis. Altria has the license to distribute IQOS, Philip Morris’s heat-not-burn product, in the U.S.

Given the long-term trend for declining smoking rates – Altria will no longer provide multi- year forecasts for U.S. cigarette declines -- all tobacco companies, must find alternatives to traditional cigarettes. At the time of its original investment, Juul was disrupting the industry, leaving Marlboro man trailing in its wake. By getting in on the act, it was hoping to future-proof its business.

But Altria should have been more aware of the risks, particularly those related to underage vaping, which were plain to see, after Juul axed social media accounts and pulled some flavors. And it should have factored this into the price it paid. To be fair, it couldn’t have foreseen how the environment for electronic cigarettes in the U.S. would deteriorate so dramatically over the past six months.

Altria’s new emphasis on heat-not-burn over vaping looks sensible, but it makes the Juul investment look a very expensive foray into a category it may end up moving away from. As Altria’s investment dollars go up in smoke, so do any hopes that its shift away from cigarettes will be quick or easy.

To contact the author of this story: Andrea Felsted at afelsted@bloomberg.net

To contact the editor responsible for this story: Beth Williams at bewilliams@bloomberg.net

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance