Altice's (ATUS) Q2 Earnings Beat Estimates, Revenues Up Y/Y

Altice USA, Inc. ATUS reported relatively modest second-quarter 2021 results. The bottom line surpassed the Zacks Consensus Estimate and the top line matched the same. Despite several pandemic-related regulatory programs, the company recorded higher broadband revenues and solid customer additions. Accretive fiber buildouts, network upgrades and strategic acquisitions on the back of a resilient business model are likely to drive Altice’s growth momentum in 2021.

Bottom Line

Net income attributable to shareholders in the June quarter was $197.7 million or 43 cents per share compared with $111.3 million or 19 cents per share in the prior-year quarter. The year-over-year improvement was primarily due to loss on extinguishment of debt and write-off of deferred financing costs along with lower operating expenses in the reported quarter. Adjusted earnings per share came in at 52 cents. The bottom line surpassed the Zacks Consensus Estimate by 5 cents.

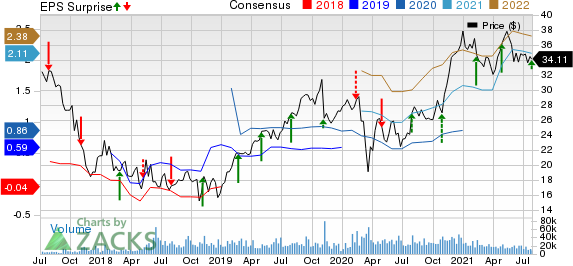

Altice USA, Inc. Price, Consensus and EPS Surprise

Altice USA, Inc. price-consensus-eps-surprise-chart | Altice USA, Inc. Quote

Revenues

Second-quarter total revenues increased 1.7% year over year to $2,516 million, primarily on higher Broadband revenues (up 7.8%), accompanied by growing subscriber base. Despite several pandemic-related regulatory programs, factors such as the Morris Broadband buyout, customer wins, accelerated pace of footprint expansion, Optimum fiber upgrades and segment cable network upgrades were major tailwinds. Further, the top line matched the Zacks Consensus Estimate.

The company witnessed solid demand for its broadband service with more than 50% of customer sticking to plans with download speeds of 200 Mbps or less. In the reported quarter, broadband-only customer usage averaged 558 GB per month. The company has accelerated the deployment of 1-gig services with 11.3% of the total customer base currently availing Gigabit speeds. This represents a significant growth opportunity for the company. Residential revenue per customer relationship declined 1.5% year over year to $142.24.

Business services and wholesale revenues increased 1.8% to $372 million as a result of Lightpath’s healthy momentum. During the second quarter, Lightpath extended its network into Boston, MA, and Queens, NY. Moreover, Lightpath is making investments to strengthen its market penetration in Boston through three acquisitions and new organic fiber build.

The upside was further driven by higher average recurring broadband revenue per SMB customer. With businesses picking up pace post the COVID-19 lockdown, bolstered vaccination efforts and moderate operational constraints supported SMB customer quarterly net additions in the last four years. News and Advertising revenues surged 36.4% to $131.8 million from $96.6 million in the prior-year quarter, primarily fueled by strength across local, regional and national advertising, along with additional political advertising revenues.

The company covered nearly 1.1 million households with FTTH (fiber-to-the-home) technology at the end of the reported quarter. With an optimistic outlook, Altice USA is committed to accelerating its future FTTH deployment initiatives and enhancing both CAPEX and OPEX efficiencies following the completion of its FTTH build, supported by improved customer experience.

Other Details

Operating income improved to $626.8 million from $508.7 million in the year-ago quarter. Adjusted EBITDA was $1,104.6 million compared with $1,105.8 million in the prior-year quarter. In the second quarter, Altice repurchased 5.8 million shares for an aggregate price of about $202.8 million, at an average price of $34.84.

Cash Flow & Liquidity

In the first six months of 2021, Altice generated $1,479.2 million of net cash from operating activities compared with $1,529.5 million in the prior-year period. Free cash flow for the same period came in at $943.3 million compared with $1,001.7 million in the prior-year quarter. As of Jun 30, 2021, cash and cash equivalents totaled $221.3 million with net debt of $24,839 million.

2021 Outlook Reaffirmed

Despite adversities stemming from the COVID-19 pandemic, Altice remains confident of its ability to deliver revenue and adjusted EBITDA growth in 2021 while maintaining leverage and share repurchase targets. The company currently anticipates capital expenditures for 2021 to be $1.3 billion to $1.4 billion with a year-end leverage target of less than 5.3x net debt.

Zacks Rank & Stocks to Consider

Altice currently has a Zacks Rank #4 (Sell).

Few better-ranked stocks in the broader industry are Clearfield, Inc. CLFD, Cogent Communications Holdings, Inc. CCOI and SeaChange International, Inc. SEAC. While Clearfield and Cogent sport a Zacks Rank #1 (Strong Buy), SeaChange International carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered a trailing four-quarter earnings surprise of 49%, on average.

Cogent delivered a trailing four-quarter earnings surprise of 29%, on average.

SeaChange International delivered a trailing four-quarter earnings surprise of 12.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

Altice USA, Inc. (ATUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance