Alphabet Is Undervalued in the AI Space

Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) is the second-largest holding in my portfolio. Part of the reason why is that I deem it to offer exceptional value whilst also exposing me to the high-growth field of artificial intelligence. While I consider the shares to be well-valued at this time against their intrinsic value, I think there is some opportunity for investor sentiment surrounding the stock to increase as AI becomes further commercialized and adopted around the world.

In effect, this could drive up the valuation multiples. Part of the reason I believe this is also likely to happen is that Alphabet's Google could be one of the first major beneficiaries of margin expansion based on the internal adoption of AI and robotics practices more prominently over the next decade.

In addition, one of the core reasons I hold shares is that I believe CEO Sundar Pichai manages the company very well, and I think while he operates the business with efficiency, I have noticed he is not ruthless in the name of profits like some other big tech companies. To me, this is very important, as I like to know my investments are helping to support people well both inside and outside of the companies.

Alphabet's future position in AI

The tech giant has an extremely strong position in AI at the moment, with its dedicated research division known for its cutting-edge work in machine learning, natural language processing and other AI technologies. A lot of people do not know that Google's Transformer architecture, which powers models like GPT-3, originated here.

In addition, Alphabet acquired DeepMind in 2015, which is one of the leading AI research labs globally. It is renowned for its progression in reinforcement learning, where AlphaGo (designed to play the board game Go) and AlphaFold (designed to predict protein structures) became particularly successful.

Alphabet also has an open-source machine learning framework developed by Google called TensorFlow, which is widely used by researchers and developers globally. In addition, the company's custom-built hardware accelerators, called Tensor Processing Units, or TPUs, are designed to speed up machine learning tasks, which enable more efficiency in AI.

The company has been very clever in its AI efforts in that it has integrated these developments into its products, including search and advertising, Google Assistant and Google Cloud. In my opinion, these areas are likely to evolve much further in the coming years, and I think we are going to see much more heightened use of Gemini and other AI capabilities within Google Docs, Google Calendar and all other cloud services. I also believe at some point the search engine is likely to iterate toward a heavier emphasis on AI. While Alphabet has been clear that it does not want to remove the links in search, it might need to adapt its current model more rigorously to stay competitive with the likes of OpenAI.

Pichai has also mentioned that Alphabet is reallocating a lot of its workforce, which is going to involve reskilling people because a lot of the old work functions are going to become automated. This is already happening in its advertising division, where significant layoffs have occurred. Many new roles are going to open in AI and machine learning. Therefore, the employees who are willing to start learning these skills now will be well rewarded in the future.

Fundamental and competitive analysis

Despite Alphabet's clearly strong position in AI, it should not be underestimated how much competition there is. In my opinion, there are three major competitors to the company in the field of AI models.

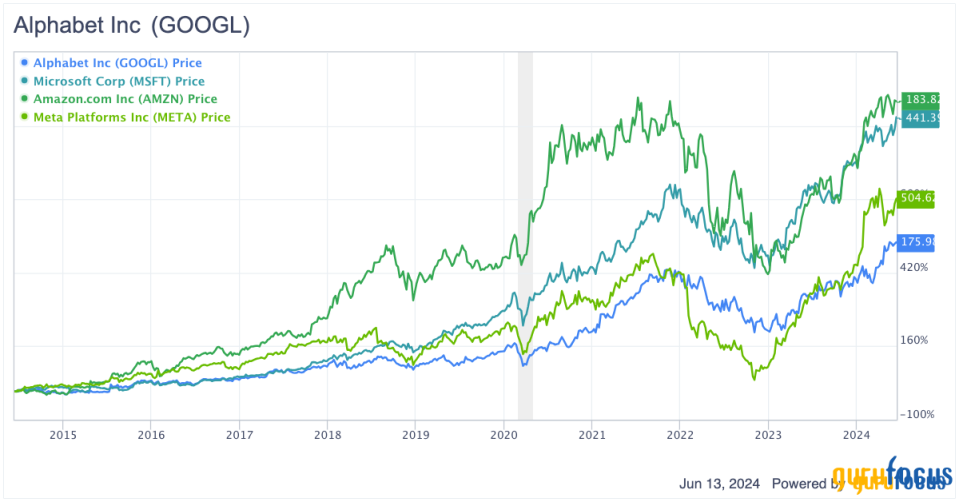

First is Microsoft (NASDAQ:MSFT), which has a strong partnership with OpenAI, the creator of ChatGPT, and is also developing AI in-house for use within its Azure cloud platform and for integration with Bing. Second is Amazon (NASDAQ:AMZN) Web Services, or AWS. It has extensive machine learning and AI services, including Amazon SageMaker, which allows developers to build, train and deploy machine learning models. It also uses AI in retail and logistics. Finally, Meta Platforms (NASDAQ:META) performs leading AI research through its Facebook AI Research, or FAIR, lab. It has helped to advanced computer vision, natural language processing and robotics. It also uses AI for content moderation and user personalization on its platforms.

AWS has much more of a focus on infrastructure for AI model development and deployment and for use internally, whereas Alphabet and Microsoft offer more of a front-end set of services. Therefore, I think Google and Microsoft may end up largely equal in their respective approaches to AI and machine learning over the coming years, with AWS potentially getting larger overall sales due to its development of an ecosystem that supports third-party AI more acutely.

Alphabet has delivered the lowest compound annual growth rate over the past decade of all four companies. However, I think it should not be underestimated how much more secure the investment is due to its more favorable valuation compared to peers.

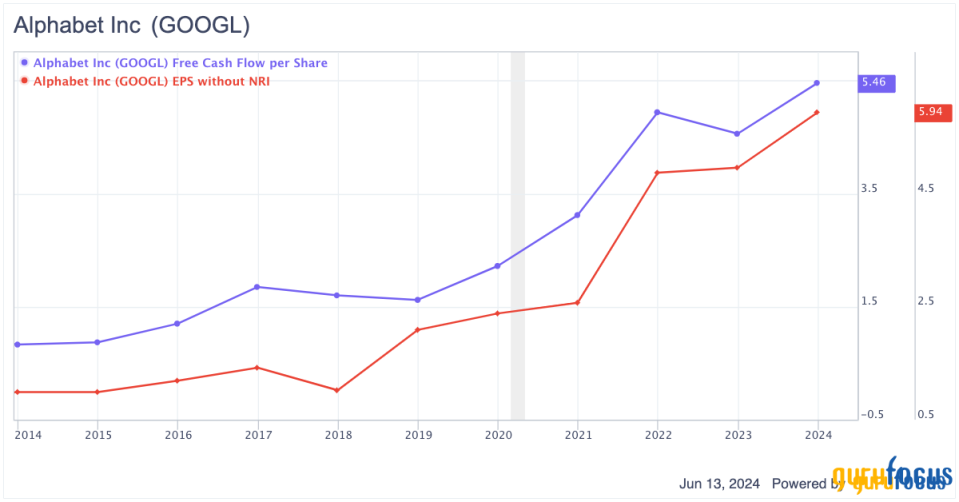

What is particularly promising about Alphabet, which is different from Amazon, is that it is not very capital-intensive. This is a result of the fact it is not an infrastructure builder or a warehouser like Amazon predominantly is. As Alphabet generates a significant portion of its revenue from software, its free cash flow growth is much more stable.

In my opinion, this stability in free cash flow and less of a need for heavy infrastructure buildouts at Alphabet is going to significantly inform its future share price stability. Amazon has had multiple moments of heavy earnings volatility, which has had a direct impact on the stock price. In my investment style, I favor the investments that offer slow, non-volatile returns over the companies that offer more rapid growth at the expense of short-term stability. Part of what allows Alphabet to command this steady growth is that it is fortunate to have consolidated such an extensive moat through its reputation in software services, primarily a result of its size, which means it also benefits from crucial economies of scale.

Alphabet has a very strong balance sheet, with an equity-to-asset ratio of 0.72 at the time of writing. Over the past decade, the ratio has been as high as 0.83 in 2016 and even higher at 0.89 in 2009. In my opinion, the company is managed extremely well financially and its structure is a careful mixture of the closed ecosystem approach of Apple (NASDAQ:AAPL) along with the diversified portfolio approach of Microsoft. This allows Alphabet to keep many of its customers for long periods of time due to them being heavily embedded in its services, but also to develop risk mitigation through other smaller, diversified bets outside of the core Google projects, like self-driving cars with Waymo and Verily Life Sciences.

Valuation analysis

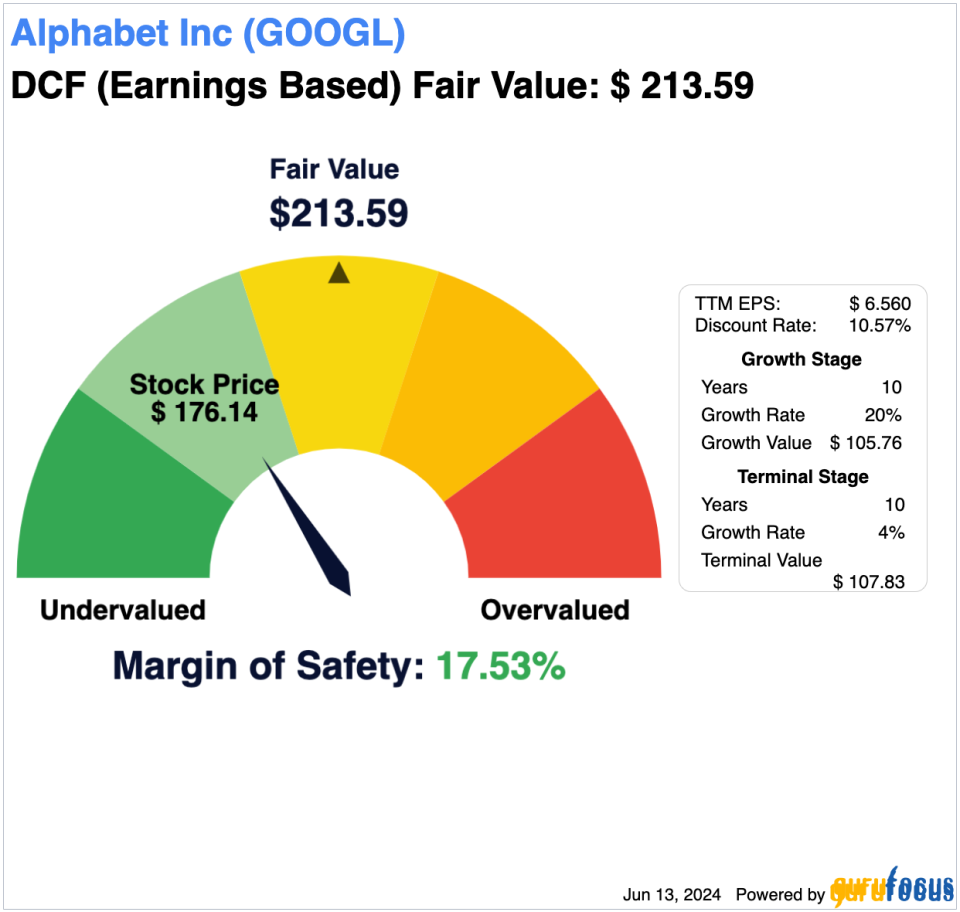

In my opinion, the most appealing part of the investment case for Alphabet right now is its valuation. It is incredibly rare for a big tech company to trade below intrinsic value. However, in this instance I believe this to be the case.

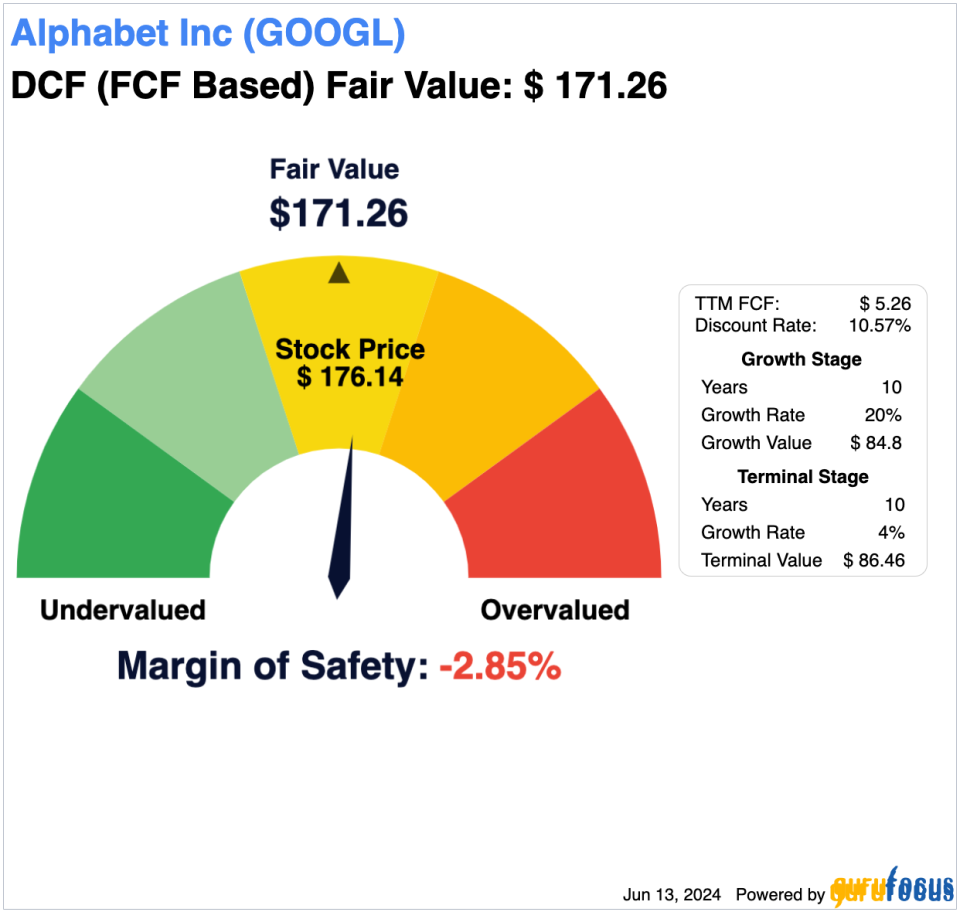

For my discounted earnings model, I used Alphabet's weighted average cost of capital, which was 10.57% at the time of writing, for the discount rate. I also estimated the company will deliver 20% annual earnings per share without non-recurring items growth from 2024 to 2034 and 4% annual earnings per share without NRI growth for the terminal stage. The result indicates the stock could be approximately 17.50% undervalued based on this conservative model.

Over the past 10 years, the annualized earnings per share growth rates for Alphabet have grown from 21.80% to 32.30%. This is a significant expansion, and due to the coming higher utilization of AI internally and the use of robotics in many projects under Alphabet, I believe its margins could expand further, which would likely continue to boost earnings growth even though the company has already well saturated its core markets.

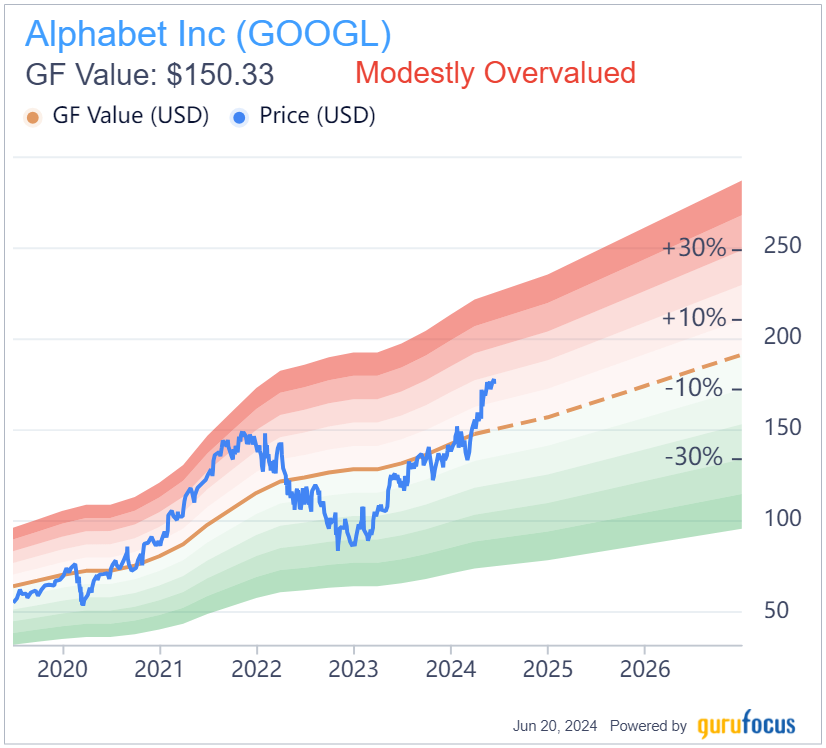

We should not forget this model is not all that counts, as increased market sentiment over the long term would also be needed to make the present investment worth the current price. The GF Value chart shows Alphabet to be modestly overvalued, and there is further evidence of this from the expansion of its price-sales multiple from the 10-year median of 6.38 to 7.22 currently and the expansion of its price-to-free cash flow ratio from 29.89 as a 10-year median to 33.51. Its earnings tell a different story, with a 10-year median price-earnings ratio without NRI being 27.28 and its current price-earnings ratio without NRI being 26.85.

This calls me to do a discounted cash flow model on Alphabet as well to ascertain whether the undervaluation estimate from my discounted earnings model may be too optimistic. In this case, Alphabet looks more fairly valued, with my estimate of 20% annual free cash flow growth from 2024 to 2034 and my estimate of 4% annual FCF growth for the terminal stage. I retained the discount rate as Alphabet's present WACC. The result is a margin of safety of -2.85%.

Therefore, I think shareholders need to ask themselves what metric the broader investing public deems as the most important for ascertaining fair value. Free cash flow is considered the best input for a discount model by professionals, but my experience tells me the broader mainstream news and public puts more emphasis on earnings beats and earnings growth.

Therefore, Alphabet may be fairly valued based on true intrinsic value using free cash flow, but perhaps undervalued when using earnings, a metric more reflective of investor sentiment. Also, the company's earnings could grow more than anticipated with heightened automation capabilities, further elucidating the opportunity here.

Risk analysis

One of the risks I believe is being overlooked slightly at the moment with companies heavily involved with AI is the negative effects of these technologies, which could become prevalent later on. While each company is doing its best to navigate privacy and security in models and infrastructures, the race toward artificial general intelligence, also known as AGI, is highly competitive. I believe some companies are prone to cut corners to stay ahead. AGI is defined as a superintelligence that can outperform almost any human at any cognitive task.

The risk of a fast-growth emphasis from Alphabet, Microsoft, Amazon, Meta and other AI players at this time is that if security and misinformation issues become widespread in dangerous ways, for example, surrounding public health, their reputations could be significantly damaged. With AI in particular, I believe the reputation of these companies is absolutely vital to cultivate and maintain with caution. As many people will use AI for jobs they depend on their incomes for, any issues arising within models that negatively affect users' personal reputations may cause extensive user defection.

Additionally, the failure to properly integrate AI within search over the long term to provide proper competitive mitigation against other chatbots taking market share from Google needs to be properly understood. If Alphabet fails to restructure its offerings accordingly, I think it is quite possible it will lose a lot of users over the long term to OpenAI.

Conclusion

Depending on how investors assess it, Alphabet's stock is either fairly valued or undervalued. However, when you factor in the likeliness of higher margins on the horizon from deeper internal implementations of AI and robotics, I think the investment is very likely undervalued at this time. The company's position in AI is formidable, and I believe it is highly unlikely that it will lose its position as one of the leaders in the field over the next few decades. There is lots of stability in the operational model, which includes stable free cash flow growth as a result of low capital expenditures, making the company more secure of an investment than some other big tech companies like Amazon, where the valuation is more largely dependent on investor sentiment to sustain it.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance