Allscripts (MDRX) Q3 Earnings Surpass Estimates, Margins Up

Allscripts Healthcare Solutions, Inc. MDRX delivered adjusted earnings per share (EPS) of 23 cents in the third quarter of 2022, up 9.5% year over year. The figure topped the Zacks Consensus Estimate by 21.1%.

GAAP EPS for the quarter was 12 cents, flat year over year.

Revenues in Detail

Allscripts registered revenues of $151.9 million in the third quarter, up 4.9% year over year. The figure, however, missed the Zacks Consensus Estimate by 0.7%.

For third-quarter 2022, Veradigm revenues were $145.4 million, up 5.9% from the prior-year period.

Segment Details

In the quarter under review, revenues at the Provider segment amounted to $122.8 million on a reported basis, up 3.9% from the year-ago quarter's tally.

The Payer & Life Sciences segment’s revenues totaled $29.1 million, up 9.8% from the year-ago quarter's figure.

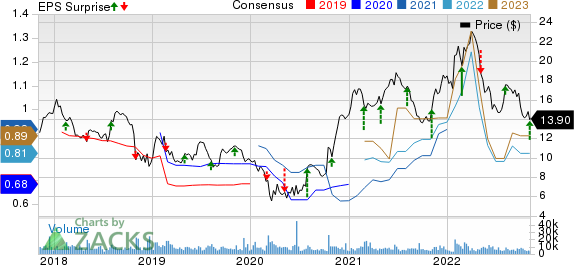

Allscripts Healthcare Solutions, Inc. Price, Consensus and EPS Surprise

Allscripts Healthcare Solutions, Inc. price-consensus-eps-surprise-chart | Allscripts Healthcare Solutions, Inc. Quote

Margin Trend

In the quarter under review, Allscripts’ gross profit rose 19.8% to $83.4 million. Gross margin expanded 681 basis points (bps) to 54.9%.

Selling, general & administrative expenses rose 18.6% to $32.5 million. Research and development expenses climbed 12.4% year over year to $23.6 million. Adjusted operating expenses of $56.1 million increased 15.9% year over year.

Adjusted operating profit totaled $27.3 million, reflecting a 28.8% uptick from the prior-year quarter. The adjusted operating margin in the third quarter expanded 332 bps to 17.9%.

Financial Position

Allscripts exited third-quarter 2022 with cash and cash equivalents of $492.6 million compared with $500.2 million at the end of the second quarter. Long-term debt at the end of third-quarter 2022 was $200.3 million compared with $199.9 million at the end of the second quarter.

Cumulative net cash provided by operating activities - continuing operations at the end of third-quarter 2022 was $119 million compared with net cash provided by operating activities - continuing operations of $98.5 million a year ago.

Allscripts repurchased stocks worth $34 million in the third quarter of 2022.

2022 Guidance

Allscripts has reiterated its consolidated revenue growth projection for full-year 2022, which is likely to be up 1-2% from the comparable 2021 figures. The Zacks Consensus Estimate for revenues currently stands at $615.2 million.

The company continues to expect to register year-over-year growth of 6-7% in its Veradigm revenue.

Our Take

Allscripts exited the third quarter of 2022 with better-than-expected earnings. The year-over-year uptick in both the top and bottom lines, along with robust Veradigm revenues, during the reported quarter is impressive. Revenues from both segments also rose during the quarter, which is encouraging. In September, Veradigm announced a new agreement with Vytalize Health to integrate the latter’s solutions and services directly into the Practice Fusion EHR (electronic health records), a Veradigm Network solution. This raises our optimism about the stock. The expansion of both margins is another positive.

Yet, Allscripts’ lower-than-expected revenues in the third quarter are disappointing. The company’s exposure to integration risks is worrying. Intense competition in the niche space is also a concern.

Zacks Rank and Key Picks

Allscripts currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are AMN Healthcare Services, Inc. AMN, Medpace Holdings, Inc. MEDP and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy), reported third-quarter 2022 adjusted EPS of $2.57, which beat the Zacks Consensus Estimate by 10.3%. Revenues of $1.14 billion outpaced the consensus mark by 3.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has an estimated long-term growth rate of 3.2%. AMN’s earnings surpassed estimates in all the trailing four quarters, the average being 10.9%.

Medpace Holdings, sporting a Zacks Rank #1, reported third-quarter 2022 EPS of $2.05, which beat the Zacks Consensus Estimate by 39.5%. Revenues of $383.7 million outpaced the consensus mark by 8.1%.

Medpace Holdings has an estimated growth rate of 44.9% for the full-year 2022. MEDP’s earnings surpassed estimates in all the trailing four quarters, the average being 22%.

Merit Medical, carrying a Zacks Rank #2, reported third-quarter 2022 adjusted EPS of 64 cents, which beat the Zacks Consensus Estimate by 20.8%. Revenues of $287.2 million outpaced the consensus mark by 5.2%.

Merit Medical has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average being 25.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allscripts Healthcare Solutions, Inc. (MDRX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance