Allison (ALSN) Q1 Earnings & Revenues Surpass Expectations

Allison Transmission Holdings ALSN delivered first-quarter 2024 earnings of $1.90 per share, which rose 2.7% year over year and beat the Zacks Consensus Estimate of $1.88. Record quarterly revenues of $789 million grew 6.5% from the year-ago period's level and outpaced the Zacks Consensus Estimate of $759 million.

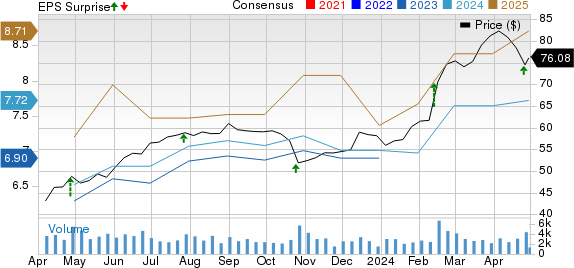

Allison Transmission Holdings, Inc. Price, Consensus and EPS Surprise

Allison Transmission Holdings, Inc. price-consensus-eps-surprise-chart | Allison Transmission Holdings, Inc. Quote

Segmental Performance

Allison segregates revenues in terms of end markets served, which are as follows:

In the reported quarter, net sales in the North America On-Highway end market rose 11.7% year over year to $420 million. High demand for Class 8 vocational and medium-duty trucks and price increases on certain products resulted in sales growth.

Net sales in the North America Off-Highway end market surged 83.3% to $4 million from the year-ago period.

In the reported quarter, net sales in the Defense end market rallied 77.7% year over year to $48 million, driven by higher demand for Tracked vehicle applications.

The Outside North America On-Highway end market’s net sales of $115 million increased from $108 million generated in the corresponding quarter of 2023, primarily due to robust demand from energy, mining and construction sectors.

Net sales in the Outside North America Off-Highway end market surged 82.6% year over year to $42 million, thanks to high demand in Asia and better pricing.

Net sales in the Service Parts, Support Equipment & Other end markets fell 12.5% year over year to $160 million in the quarter.

Financial Position

Allison saw a gross profit of $366 million, which increased from $361 million reported in the year-ago quarter, mainly driven by higher net sales and price increases in certain products.

Adjusted EBITDA in the quarter came in at $289 million, which rose from $276 million reported a year ago. The growth was led by higher net sales and price increases in certain products.

Selling, general and administrative expenses in the quarter decreased to $86 million from $87 million reported in the prior-year quarter. Engineering – research and development expenses totaled $46 million compared with $44 million recorded in the corresponding quarter of 2023.

Allison had cash and cash equivalents of $551 million as of Mar 31, 2024, down from $555 million recorded as of Dec 31, 2023. Long-term debt amounted to $2.4 billion compared with $2.5 billion as of Dec 31, 2023.

Net cash provided by operating activities totaled $173 million. Adjusted free cash flow in the reported quarter totaled $162 million, down from $169 million generated in the year-ago period.

During the first quarter, the company increased its quarterly dividend by 9% to 25 cents per share, marking the fifth consecutive annual increase to its quarterly dividend.

Updated 2024 Outlook

Allison’s full-year 2024 net sales are estimated in the band of $3.05-$3.15 billion. Net income is expected in the band of $635-$685 million. Adjusted EBITDA is estimated in the range of $1.07-$1.13 billion. It expects net cash provided by operating activities between $700 million and $760 million. Capex is expected in the band of $125-$135 million. Adjusted free cash flow is estimated between $575 million and $625 million.

Zacks Rank & Key Picks

ALSN currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Geely Automobile Holdings Limited GELYY, Volvo VLVLY and Canoo Inc. GOEV, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GELYY’s 2024 sales suggests year-over-year growth of 36.6%. The EPS estimates for 2024 and 2025 have moved up 34 cents and 54 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for VLVLY’s 2024 earnings suggests year-over-year growth of 0.43%. The EPS estimates for 2024 and 2025 have improved 5 cents and 11 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for GOEV’s 2024 sales and earnings suggests year-over-year growth of 7,722.3% and 68.24%, respectively. The EPS estimates for 2024 and 2025 have improved $4.27 and $4.71, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Geely Automobile Holdings Ltd. (GELYY) : Free Stock Analysis Report

AB Volvo (VLVLY) : Free Stock Analysis Report

Canoo Inc. (GOEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance