Allianz Says French Bondholders Fear a Replay of Euro Crisis

(Bloomberg) -- French officials must reassure foreign investors that the nation’s finances are in order or risk a fresh blowout in bond spreads, according to Allianz Global Investors’ multi-asset chief investment officer.

Most Read from Bloomberg

Nvidia Rout Takes Breather as Traders Scour Charts for Support

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Wikileaks’ Julian Assange to Plead Guilty, Ending Yearslong US Battle

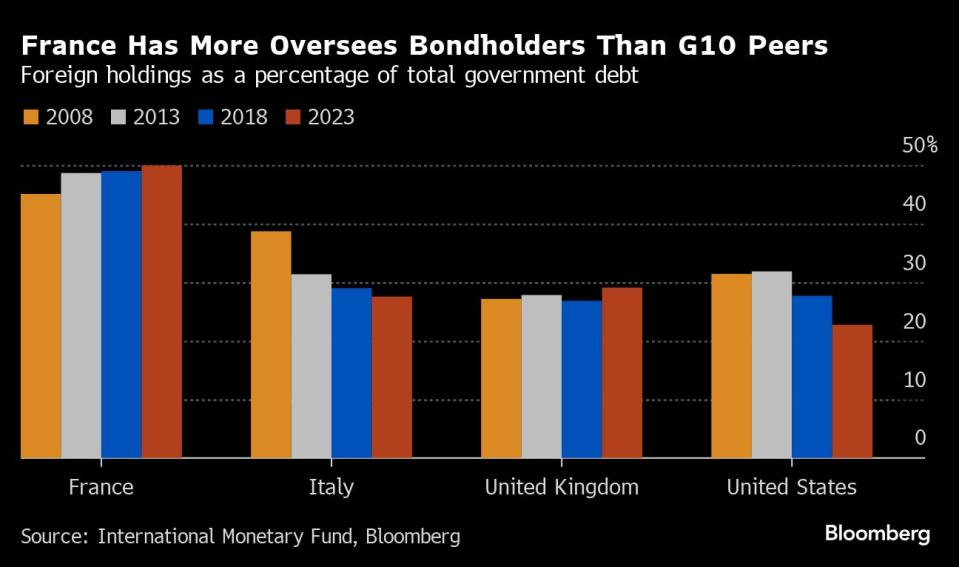

Overseas investors own a much larger share of French government debt than they do elsewhere, and some fear the current political turmoil could trigger a European debt crisis to rival the one seen over a decade ago, said Gregor Hirt, whose division has €156 billion ($168 billion) of assets under management.

“Any reminder of the European sovereign debt crisis is a red flag for many international investors,” he said.

Sign up for the Paris Edition newsletter for special coverage throughout the French election.

Fear that a win by the right or left would exacerbate France’s bloated public finances has spooked markets and triggered a selloff in French debt. The extra yield investors demand to hold the nation’s 10-year bonds instead of those of Germany hit the highest on Friday since the euro-area was in the depths of the last debt crisis.

Hirt was in Asia when French President Emmanuel Macron shocked markets by announcing the snap vote, and witnessed his clients’ reaction first hand.

“We need some action from the French government, some stabilization, so these large investors are reassured,” he said.

In 2023, foreigners accounted for around 50% of the French market, according to the International Monetary Fund. That compares with a share of about 30% in Italy, the UK and the US.

With the first round of voting kicking off this weekend, Hirt is keeping an overweight position in US dollars versus the euro, despite the recent pick up in euro-area economic data. He’s looking at gold as a shield against geopolitical turbulence.

In contrast to the French election, Hirt says the UK vote on July 4 will be a “non-event,” given the Labour party is widely expected to sweep to power. He favors UK equities, and sees Labour potentially forging closer ties with the EU if victorious.

Allianz continues to hold a long position in 10-year US Treasuries. The widening in euro-area spreads amid the French selloff doesn’t offer enough extra return to make French debt a buying opportunity, he said.

“The risk for France is that the spread on its debt could continue to widen.”

--With assistance from Alice Gledhill.

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance