ALLETE's (ALE) Arm Minnesota Power Plans HVDC Upgrades

ALLETE, Inc’s ALE operating division, Minnesota Power announced planned improvements to its high-voltage direct-current (“HVDC”) transmission system that transports renewable wind energy from its Bison Wind Energy Center in North Dakota to customers in Minnesota. This will help ensure a dependable and resilient grid that can grow in the future.

On Jun 1, 2023, the operating division filed a Certificate of Need and Route Permit with the Minnesota Public Utilities Commission. It submitted a request to replace the aging critical infrastructure and modernize the terminal stations of its 465-mile HVDC transmission line that runs from Center, ND to Hermantown, MN.

The new system is expected to cost between $800 million and $900 million. Construction related to this project is expected to start in Minnesota and North Dakota as early as 2024, subject to regulatory permissions. The system is projected to go into operation between 2028 and 2030.

Benefits of the Upgrade Project

As Minnesota Power gets ready to fulfill the state of Minnesota's target of supplying carbon-free electricity by 2040, maintaining and enhancing the reliable delivery of essential energy becomes a crucial part of its EnergyForward plan.

This operating division of ALE ensures a robust grid with cost-effective utilization of its existing assets. The current project will help improve reliability and reduce transmission congestion on its electric grid. It will also enable a safe and reliable supply of power, and help meet the state's carbon reduction goals.

The project also includes the construction of three transmission lines (of less than a mile each) to connect the new converter station to the existing electric system. The converter facilities at the Square Butte East Substation in Center, ND, are slated for similar upgrades.

Utilities' Focus on Infrastructure Upgrades

Renewable energy requires more complex storage and management infrastructure. In order to make the Upper Midwest's grid more reliable and resilient, transmission investments and the replacement of outdated infrastructure with contemporary systems are essential. This is especially true as the region experiences extreme weather events and the energy source continues to change.

Along with ALLETE, some other electric power companies like FirstEnergy Corporation FE, Duke Energy DUK and AVANGRID AGR are adopting measures to strengthen their existing infrastructure.

In 2022, FirstEnergy invested $1.4 billion to modernize and improve the reliability and resiliency of its transmission system. The company filed the new four-year Grid Modernization II program with the Ohio commission, proposing a $626-million capital investment to expand the deployment of Grid Modernization technologies and help reduce the frequency of power outages. The first phase of the Grid Modernization program is nearly complete.

FE’s long-term (three- to five-year) earnings growth rate is 6.45%. The Zacks Consensus Estimate for 2023 earnings per share (EPS) indicates a year-over-year increase of 4.15%.

Duke Energy remains focused on expanding its scale of operations and implementing modern technologies at its facilities. It invests heavily in infrastructure and expansion projects. Almost 85% of the planned investment will fund the company's generation fleet transition and grid modernization. This includes approximately $75 billion to modernize and strengthen its transmission and distribution infrastructure.

DUK’s long-term earnings growth rate is 6.18%. The Zacks Consensus Estimate for 2023 EPS implies a year-over-year improvement of 6.64%.

AVANGRID aims to invest $21.5 billion through 2025 to maintain and upgrade its infrastructure and facilities.

AGR’s long-term earnings growth rate is 4.43%. It delivered an average earnings surprise of 5.12% in the last four quarters.

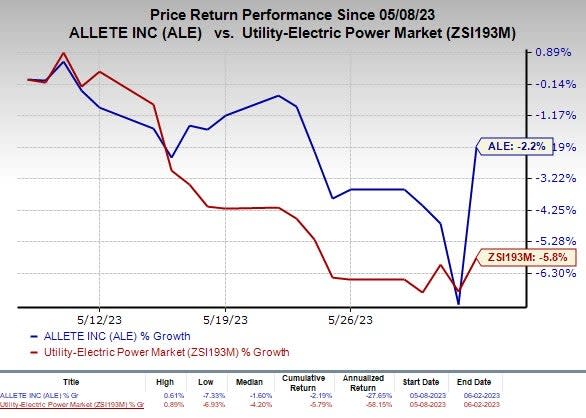

Price Performance

In the past month, shares of ALLETE have lost 2.2% compared with the industry’s 5.8% decline.

Image Source: Zacks Investment Research

Zacks Rank

ALLETE currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

Avangrid, Inc. (AGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance