ALLETE (NYSE:ALE) Takes On Some Risk With Its Use Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, ALLETE, Inc. (NYSE:ALE) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for ALLETE

What Is ALLETE's Debt?

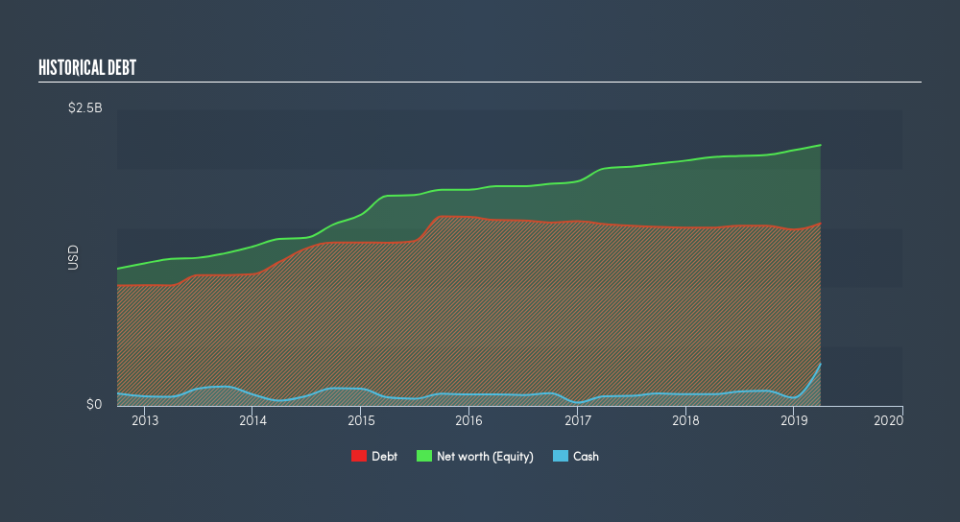

As you can see below, ALLETE had US$1.54b of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. However, it also had US$353.3m in cash, and so its net debt is US$1.19b.

How Strong Is ALLETE's Balance Sheet?

The latest balance sheet data shows that ALLETE had liabilities of US$322.4m due within a year, and liabilities of US$2.70b falling due after that. On the other hand, it had cash of US$353.3m and US$98.9m worth of receivables due within a year. So it has liabilities totalling US$2.57b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since ALLETE has a market capitalization of US$4.47b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

ALLETE has a debt to EBITDA ratio of 2.9 and its EBIT covered its interest expense 3.1 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. More concerning, ALLETE saw its EBIT drop by 3.0% in the last twelve months. If that earnings trend continues the company will face an uphill battle to pay off its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if ALLETE can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, ALLETE's free cash flow amounted to 50% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

ALLETE's interest cover was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. But on the bright side, its ability to convert EBIT to free cash flow isn't too shabby at all. It's also worth noting that ALLETE is in the Electric Utilities industry, which is often considered to be quite defensive. Taking the abovementioned factors together we do think ALLETE's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance