Albertsons (ACI) Q4 Earnings Top, Identical Sales Rise 5.6%

Albertsons Companies, Inc. ACI reported fourth-quarter fiscal 2022 results, wherein the top and bottom lines not only beat the Zacks Consensus Estimate but also improved year over year. The company's focus on Own Brands and Fresh offerings, efficient in-store services, digital enhancement and operational capabilities drove the quarterly results.

Fourth-Quarter Performance in Detail

Albertsons Companies posted adjusted quarterly earnings of 79 cents a share, which comfortably surpassed the Zacks Consensus Estimate of 69 cents. The bottom line improved from the 75 cents reported in the prior-year period.

Net sales and other revenues came in at $18,265.1 million, up 5.1% year over year. The top line beat the Zacks Consensus Estimate of $18,159 million. The upside was driven by a 5.6% rise in identical sales, with retail price inflation, growth in pharmacy and increasing digital penetration contributing to the metric. Digital sales rose 16% year over year in the quarter.

The gross profit amounted to $5,084.3 million, up 2% year over year. However, the gross margin contracted 90 basis points to 27.8%.

Excluding the impact of fuel and LIFO expenses, the gross margin rate shrunk 71 basis points compared with the last year. This stemmed from higher product, shrink, supply-chain and advertising costs, an increase in picking and delivery expenses associated with digital sales and the soft pharmacy business. These were partly offset by the benefits of ongoing productivity initiatives.

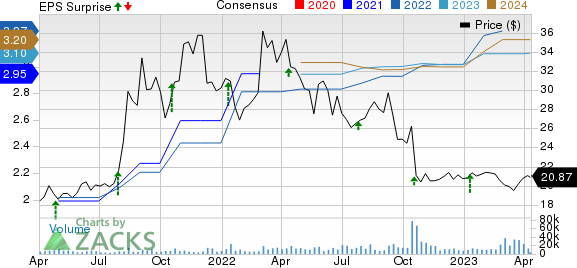

Albertsons Companies, Inc. Price, Consensus and EPS Surprise

Albertsons Companies, Inc. price-consensus-eps-surprise-chart | Albertsons Companies, Inc. Quote

Selling and administrative expenses rose 9% to $4,712 million. As a percentage of net sales and other revenues, selling and administrative expenses increased 90 basis points to 25.8%.

Excluding the impacts of fuel, withdrawal from the Combined Plan and a legal settlement in the final quarter of fiscal 2022, selling and administrative expenses, as a percentage of net sales and other revenues, remained flat.

The benefits of ongoing productivity initiatives, lower appreciation in pay and a decline in pandemic-related expenses helped offset higher employee expenses, a rise in utility costs, incremental merger-related expenses and investments related to the acceleration of digital and omnichannel capabilities.

Adjusted EBITDA decreased 2.2% to $1,050.2 million. Meanwhile, the adjusted EBITDA margin contracted 50 basis points to 5.7% on a year-over-year basis. The decline in adjusted EBITDA can be attributed to fewer COVID-19 vaccines in the quarter.

Management highlighted that the declining trend in COVID-19 vaccinations is likely to continue in fiscal 2023. This is in addition to a drop in COVID-19 at-home test kit revenues. As a result, the company foresees roughly $200 million of headwinds related to adjusted EBITDA in fiscal 2023 compared with fiscal 2022.

Other Financial Details

Albertsons Companies, which carries a Zacks Rank #2 (Buy), ended the quarter with cash and cash equivalents of $455.8 million as of Feb 25, 2023. The long-term debt and finance lease obligations totaled $7,834.4 million, while total stockholders' equity amounted to $1,610.7 million.

Merger Agreement

Last year in October, this food and drug retailer entered into an “Agreement and Plan of Merger” with The Kroger Co. KR.

Kroger will acquire all the outstanding shares of Albertsons Companies for an estimated total consideration of $34.10 per share. The combined entity will benefit from a loyal customer base, digital investments, increased purchasing power and a broader product portfolio.

Shares of Albertsons Companies have declined 2.2% in the past three months compared with the industry's fall of 10.4%.

Other Stocks Looking Red Hot

Here we have highlighted two other top-ranked stocks, namely BJ's Wholesale Club BJ and General Mills GIS.

BJ's Wholesale Club, which operates warehouse clubs, carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 9.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for BJ's Wholesale Club’s current financial-year sales and earnings suggests growth of 7.3% and 0.8% from the year-ago period. BJ has a trailing four-quarter earnings surprise of 19.6%, on average.

General Mills, which manufactures and markets branded consumer foods, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 7.5%.

The Zacks Consensus Estimate for General Mills’ current financial-year sales and earnings suggests growth of 6.3% and 7.4% from the year-ago period. GIS has a trailing four-quarter earnings surprise of 8.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance