Alaska Air (ALK) Rides on Rosy Air Travel Demand: Is It a Buy?

An improvement in air-travel demand bodes well for Alaska Air Group’s ALK top line. Driven by the upbeat demand, ALK exceeded the Zacks Consensus Estimate for first-quarter 2024 earnings by 15.6%. Sales beat estimates by 2.4%.

Strong Passenger Volumes Drive Upbeat Views

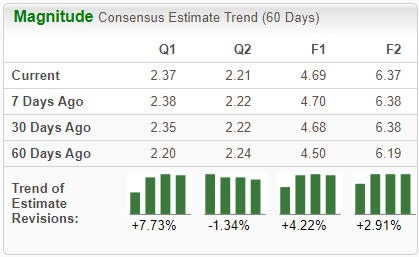

Anticipating air-travel demand to be rosier given the presence of the summer holiday period, ALK issued bullish earnings per share guidance for second-quarter 2024. ALK expects second-quarter earnings per share to be between $2.20 and $2.40. The Zacks Consensus Estimate is currently pegged at $2.37, well above the mid-point ($2.30) of the guided range.

The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $2.98 billion, suggesting an increase of 33.6% from first-quarter 2024 actuals. The consensus mark for June quarter revenues indicates 5.2% growth from the year-ago levels.

Adding to the bullishness, management lifted its 2024 earnings per share guidance. ALK now expects adjusted earnings per share in the $3.25-$5.25 band. The earlier guidance was in the band of $3-$5 per share.

The Zacks Consensus Estimate for the same is currently pegged at $4.69, well above the mid-point ($4.25) of the guided range. The guidance lift resulted in analysts revising their earnings estimates for ALK positively.

Image Source: Zacks Investment Research

Robust Price Performance

Driven by upbeat passenger volumes, ALK shares have gained 7.1% over the past three months against its industry’s 5.9% decline. ALK shares have also outperformed the broader Zacks Transportation sector, which has declined 11.2%.

Image Source: Zacks Investment Research

ALK Expands Capacity to Meet Demand Growth

Alaska Air is expanding its network by introducing new routes as it offers the largest summer schedule in its history in anticipation of the busy summer season ahead. The airline is also making other arrangements like increasing the number of daily flights in its network that fly to popular destinations.

During the peak summer months (June, July and August), ALK, currently carrying a Zacks Rank #2 (Buy), added almost one million seats to meet the demand swell. In fact, owing to the buoyant air-travel demand scenario, ALK carried in excess of 500,000 guests to their destinations over the recent Memorial Day weekend. The figure represents a 6% year-over-year increase. ALK expects that its busiest days in the summer season will be before and after Jul 4, where almost 160,000 passengers are expected to fly on ALK flights each day.

In view of the aforementioned bullishness, we believe investors should add ALK stock to their portfolios now for healthy returns. Its current Zacks Rank supports our thesis.

Other Airline Stocks to Consider

Investors interested in the airline industry may also consider some other top-ranked stocks like SkyWest SKYW and Copa Holdings CPA. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SkyWest's fleet modernization efforts are commendable. Upbeat air travel demand also supports the company. The Zacks Consensus Estimate for SKYW’s 2024 earnings has improved 5.9% in the past 60 days. The stock has risen 56% year to date.

SKYW has an expected earnings growth rate of more than 100% for 2024. The company delivered a trailing four-quarter earnings surprise of 128.09%, on average.

Latin American carrier Copa Holdings is being aided by upbeat air-travel demand. We are also encouraged by its initiatives to modernize its fleet.

Over the past 60 days, the stock has seen the Zacks Consensus Estimate for 2024 earnings being revised 3.2% upward. CPA surpassed the Zacks Consensus Estimate for earnings in each of the last four quarters by an average of 20.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance