Akamai (AKAM) Q2 Earnings and Revenues Surpass Estimates

Akamai Technologies Inc. AKAM delivered non-GAAP second-quarter 2018 earnings of 83 cents per share beating the Zacks Consensus Estimate by 4 cents and surged 33.9% from the year-ago quarter. The figure also came ahead of the higher end of management’s revised guided range of 79-81 cents per share.

Better-than-expected year-over-year growth can be attributed to robust increase in revenues, lower tax rate and favorable impact of the cost reduction initiatives implemented in the past two quarters.

Revenues of $662.8 million outpaced the Zacks Consensus Estimate of $662 million and increased 9.4% from the year-ago quarter (up 9% adjusted for foreign exchange). Further, revenues were near the top end of management’s updated guided range of $658-$663 million.

Excluding Internet Platform Customers, revenues increased 11.5% year over year (up 10% adjusted for foreign exchange) to $618.7 million. Revenues from Internet Platform Customers were $44.1 million, down 13.9% year over year.

Shares were down 3.3% in after-hours trading following the results. This can be attributed to a tepid third-quarter outlook. Akamai has returned 7.2% year to date, against the industry’s decline of 3.8%.

Robust Cloud Security Solutions Growth

Cloud Security Solutions (23.4% of total revenues) revenues were $155.3 million, surged almost 33% year over year (up 31% adjusted for foreign exchange). Solid growth was driven by strong demand for Kona Site Defender, Bot Manager and Prolexic Solutions. The traction gained by Enterprise Application Access and Enterprise Threat Protector also aided growth.

Management remains optimistic over the growing influence of its security solutions during the reported quarter among media customers, in particular.

Akamai stated that cloud security business revenue run-rate is now $640 million per year.

Segment Details

Web Division (almost 53% of total revenues) revenues increased 10.6% year over year (up 9% adjusted for foreign exchange) to $351.1 million. Solid cloud security solutions growth as well as strong performance from Image Manager, mPulse and Digital Performance Management solutions drove growth.

Management noted that revenues from the new solutions have more than tripled on a year-over-year basis and revenue run-rate is well over $170 million per year.

Media and Carrier Division (47% of total revenues) revenues of $311.7 million increased 8.1% (up 7% adjusted for foreign exchange) from the year-ago quarter. Akamai stated that growth was primarily aided by the successful integration of Nominum and initiatives to improve traffic growth across its top 250 global media accounts.

Traffic growth was especially strong in OTT and gaming sectors.Management noted that during the World Cup season, traffic exceeded 20 terabits per second on several days. Notably, 55 broadcasters leveraged Akamai’s platform globally during the tournament.

Management also remains elated on the recent record downloads of Epic Games’ new Fortnite game registering traffic of over 22 terabits per second on the company’s platform.

U.S. revenues were $413.1 million (62.3% of total revenues), up 3.2% year over year. International revenues (37.7% of total revenues) were $249.6 million, up 21.4% year over year (up 18% adjusted for foreign exchange) primarily driven by strong growth in Asia Pacific region.

Management stated that foreign exchange volatility positively impacted revenues by $8 million from the year-ago quarter. However, the foreign exchange movement negatively impacted revenues by $5 million sequentially.

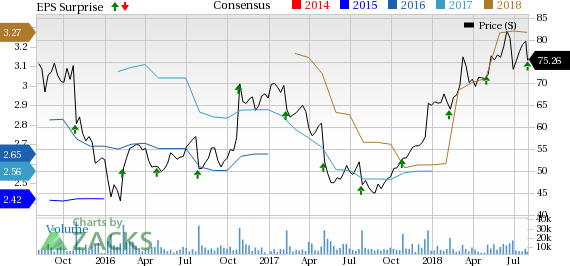

Akamai Technologies, Inc. Price, Consensus and EPS Surprise

Akamai Technologies, Inc. Price, Consensus and EPS Surprise | Akamai Technologies, Inc. Quote

Operating Details

Adjusted EBITDA margin of 39.5%, registered an expansion of 280 basis points (bps) on a year-over-year basis,almost in line with management’s guidance. This can primarily be attributed to higher revenues and improving operational efficiency.

Non-GAAP cash gross margin expanded 100 bps to 76.9%.

Non-GAAP research & development (R&D) and selling & marketing expenses (S&M) expenses increased 20 bps and 17 bps to 7.4% and 17.3% on a year-over-year basis, respectively. Meanwhile, non-GAAP general & administrative (G&A) expensesas percentage of revenues contracted 210 bps to reach 12.7%.

As a result, non-GAAP operating margin expanded 173 bps from the year-ago quarter to 25.7%, coming at the higher end of management’s guided range due to improving operating efficiency.

Balance Sheet & Cash Flow

As of Jun 30, 2018, Akamai’s cash and cash equivalents (and marketable securities) were $1.86 billion as compared with $1.32 billion recorded at the end of the previous quarter.

The company generated cash flow from operations of $219.7 million as compared with $192 million in the previous quarter.

In the quarter, Akamai repurchased around 2.2 million shares for $166 million.

Guidance

For third-quarter 2018, Akamai envisions revenues between $656 million and $668 million (mid-point at $662 million). Management stated that unfavorable foreign exchange and seasonal summer trafficare likely to impact revenues. The Zacks Consensus Estimate is currently pegged at $668.4 billion, higher than the top-end of the guidance range.

Non-GAAP operating expenses are projected between $249 million and $254 million, up sequentially due to seasonal increases in annual merit.

Adjusted EBITDA margin is anticipated in the range of 39-40%. Non-GAAP operating margin is projected in the range of 25-26% for the third quarter.

Non-GAAP earnings are envisioned in the range of 80-86 cents per share.

Akamai had updated guidance for 2018 during the second quarter citing strong dollar concerns and expanding operating margins.Owing to currency headwinds, Akamai expects full-year 2018 revenues between $2.68 billion and $2.71 billion as compared with the previous guidance in the range of $2.69-$2.72 billion. The Zacks Consensus Estimate is pegged at $2.7 billion.

However, the company has provided a revised earnings outlook. Non-GAAP earnings are now projected in the range of $3.26 per share to $3.38 per share, up from the previously updated outlook of $3.20-$3.30 per share. The Zacks Consensus Estimate is pegged at $3.28 per share. The projected increase was primarily due to anticipated expansion in the company's operating margins.

For full-year 2018, Akamai expects revenues between $2.68 billion and $2.71 billion.

Adjusted EBITDA margin is anticipated in the range of 39-40%. Non-GAAP operating margin is anticipated to range in between 25% and 26%.

Akamai anticipates further improvement in margins by the end of 2018 backed by the additional cost reduction initiatives that the company undertook in the first and second quarters.

Non-GAAP earnings are projected in the range of $3.26-$3.38 per share.

Management maintains its plans to achieve non-GAAP operating margin of 30% in 2020.

Zacks Rank & Stocks to Consider

Currently, Akamai carries a Zacks Rank #3 (Hold).

Mellanox MLNX, Microsoft MSFT and Intel INTC are a few stocks worth considering in the broader technology sector, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Mellanox, Microsoft and Intel are pegged at 15%, 12.3% and 8.4%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance