AIRR: Stellar Returns, And Not Your Average ETF

The First Trust RBA American Industrial Renaissance ETF (NASDAQ:AIRR) is a truly differentiated ETF that stands out in a world with no shortage of cookie-cutter ETFs that seem like they all own the same stocks. Plus, the ETF is posting stellar long-term returns.

AIRR is an interesting ETF with a unique theme and group of holdings. I’m bullish on this smaller, off-the-beaten-path ETF based on its differentiated strategy, highly-rated group of under-the-radar holdings, and quietly outstanding performance over the long term. Let’s take a look.

What Is the AIRR ETF’s Strategy?

According to First Trust, AIRR “is designed to measure the performance of small- and mid-cap U.S. companies in the industrial and community banking sectors.”

As the fund’s name suggests, the rationale for these types of stocks is that they will be key to any American “industrial renaissance,” in which U.S. companies bring more manufacturing jobs back to the country.

The industrials are the companies that will be doing the manufacturing, and the community banks are the companies that will be lending to them. This is an interesting combination, as many ETFs either invest in a broad market or in one specific theme or sector, not two distinct sectors.

AIRR starts with the investment universe of the Russell 2500 and then removes companies that are not industrials or banks. It only selects banking stocks that are based in what it calls “traditional manufacturing hubs,” or essentially the Rust Belt states.

Additionally, companies deriving over 25% of their revenue outside the United States are excluded. To be included, companies must also have a positive mean 12-month forward consensus earnings estimate. The fund is rebalanced and reconstituted quarterly.

The Rationale for Reshoring

Why is the idea of reshoring and this potential industrial renaissance a compelling theme to invest in? The fund’s index provider, Richard Bernstein Advisors (RBA), “believes there is increasing reason to expect that the United States may regain industrial market share, based on a number of factors, including access to competitively-priced energy sources; the relative stability of the U.S. market compared to many emerging markets; and availability of bank financing for manufacturers.”

These reasons all make sense, and RBA also explains that there are additional benefits to reshoring: “…Many companies are continuing to bring their manufacturing back to the U.S. for the potential advantages of higher product quality, shorter delivery times, rising offshore wages, lower inventory, advanced technology, pro-business policies, and the ability to be more responsive to change in customer demands.”

RBA believes this trend can be a boon for smaller and community banks as “manufacturing is a capital-intensive business that requires equipment, tooling and raw materials which may provide a growth opportunity for smaller U.S. banks.” RBA says that these smaller banks can benefit from fueling this growth without having to take on “massive trading infrastructures” or “unnecessary” global risk to profit.

Further, RBA finds that reshoring brings about synergies. They state, “Some companies that have already begun to reshore have cited the benefits of having designers, engineers, and salespeople at the same facility rather than oceans apart.” They also note that there are time and cost savings to be had by avoiding international shipping. As the attacks on shipping in the Red Sea showed this past fall, there’s significant merit to this idea.

There has been plenty of discussion about onshoring and reshoring jobs to the U.S. in the wake of the COVID-era supply chain disruptions, and the theme is also sure to be a topic of discussion in the upcoming U.S. Presidential elections. Whether there ends up being a broader wave of onshoring or not, the fund is already producing excellent returns.

Excellent Long-Term Performance

AIRR’s long-term performance has been nothing short of outstanding. The ETF has made noise with a scorching gain of 47.3% over the past year (note that we last covered AIRR 10 months ago, making it a well-timed call).

Looking out over a three-year timeframe, AIRR has posted an impressive annual return of 15.7% (as of April 30). This nearly doubles the performance of the S&P 500 (SPX), as represented by the Vanguard S&P 500 ETF (NYSEARCA:VOO), which returned 8.0% over the same time horizon.

Over a five-year time horizon, AIRR has posted an excellent annualized return of 19.9%, handily beating VOO’s still-impressive return of 13.2% (as of April 30).

Over the past decade, AIRR has generated a 13.0% annualized return (as of April 30), beating VOO’s return of 12.4%.

AIRR has beaten the S&P 500 over the past three, five, and 10 years, making it one of the few funds that can say it has beaten the broader market over each time frame. This is an impressive feat, especially given that the broader market has set a high bar to clear over the past decade.

While past performance is never a guarantee of future results, this exceptional long-term performance gives me confidence in AIRR’s future prospects.

AIRR’s Holdings

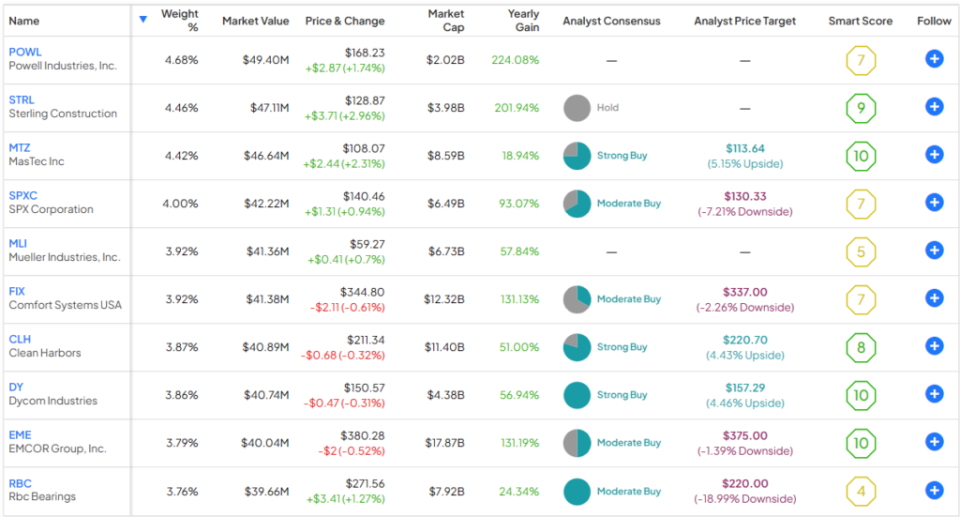

AIRR owns 45 stocks, and its top 10 holdings account for 40.5% of assets. You can check out a snapshot of AIRR’s top 10 holdings below using TipRanks’ holdings tool.

I like the fact that AIRR is going well beyond the typical “Magnificent Seven” names and turning over stones to find some real diamonds in the rough. Stocks like Powell Industries (NASDAQ:POWL), Sterling Construction (NASDAQ:STRL), and Comfort Systems USA (NYSE:FIX) are hardly household names, but they’ve accumulated massive gains of 220.0%, 191.6%, and 132.1%, respectively, over the past year.

Collectively, AIRR’s largest holdings feature some top-notch Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

An impressive seven of AIRR’s top 10 holdings feature Outperform-equivalent Smart Scores, and three, Mastec (NYSE:MTZ), DyCom (NYSE:DY), and EMCOR Group (NYSE:EME) score ‘Perfect 10’ ratings.

The One Drawback

The one blemish on AIRR’s otherwise stellar profile is its steep expense ratio of 0.70%. This means that an investor putting $10,000 into AIRR will pay $70 in fees annually, which is certainly on the high side. If the ETF keeps generating the type of outstanding results it has been, few investors will mind paying this premium, but if its performance stalls, this is a relatively high fee to stomach.

Is AIRR Stock a Buy, According to Analysts?

Turning to Wall Street, AIRR earns a Moderate Buy consensus rating based on 33 Buys, 13 Holds, and zero Sell ratings assigned in the past three months. The average AIRR stock price target of $73.83 implies 5.1% upside potential.

The Takeaway: An Outstanding ETF

AIRR is a unique, underappreciated ETF that travels well off of the beaten path for the construction of its portfolio. You won’t find these holdings in many other places. I’m bullish on the fund based on this differentiated theme and portfolio, the high Smart Scores for its underrated holdings, and its exceptional performance over the past three, five, and 10 years.

Yahoo Finance

Yahoo Finance